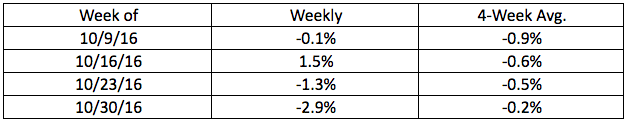

Appraisal volume didn’t waver from its downward trend at the end of October, posting a 2.9% drop for the week of October 30, according to the latest National Appraisal Volume Index from a la mode, which is provided exclusively to HousingWire.

The drop is slightly greater than the 1.3% decline recorded last week. However, despite the larger drop, the four-week average still increased due to the 4.1% decline at the start of the month dropping off.

The news isn’t anything alarming though. The report noted that this is consistent with the fourth quarter doldrums the industry experiences each year.

Check the chart below to see appraisal volume over the past four weeks.

Click to enlarge

(Source: a la mode)

As a reminder, appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

Although, recent mortgage application reports from the Mortgage Bankers Association follow similar trends as appraisal volume, posting little change over the past several weeks.

These slow weeks won’t last forever though. After the market moves through its typical lows, it’s projected to take off in 2017.

Reflecting the continued low interest rate environment and a rebound in the purchase mortgage market to more normalized levels, FBR & Co. predicted that the mortgage originations industry would reach $1.8 trillion in 2017.