The 30-year fixed-rate mortgage finally moved above the 4% threshold as mortgage rates keep increasing alongside treasury yields, the latest Freddie Mac Primary Mortgage Market Survey reported.

This is the first time the average 30-year fixed-rate mortgage has topped 4% since 2015.

The 10-year Treasury yield started increasing after the election, a sign that mortgage rates would likely follow suit.

“In a short week leading up to the Thanksgiving holiday, the 10-year Treasury yield rose 8 basis points. The 30-year mortgage rate followed suit, rising 9 basis points to 4.03%,” said Sean Becketti, chief economist with Freddie Mac.

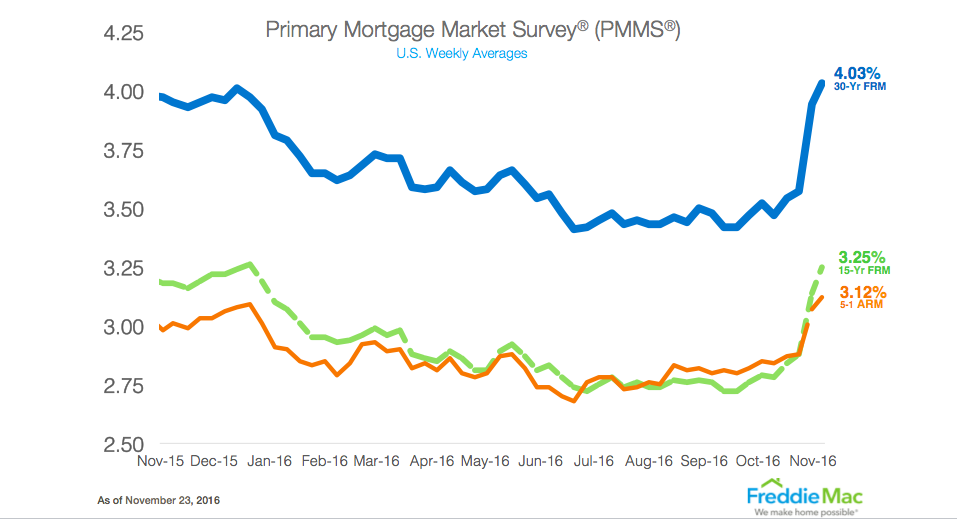

According to the latest rate report from Freddie, the 30-year fixed-rate mortgage averaged 4.03% for the week ending Nov. 23, up from last week’s average of 3.94%. A year ago at this time, the 30-year FRM averaged 3.95%.

Also increasing, the 15-year FRM this week averaged 3.25%, up from last week when it averaged 3.14%. In 2015, the 15-year FRM came in at 3.18%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.12% this week, increasing from last week’s 3.07%. A year ago, the 5-year ARM averaged 3.01%.

The chart below shows the changes in these three products since November 2015.

Click to enlarge

(Source: Freddie Mac)

The Freddie Mac report echoes the most recent Mortgage Bankers Association’s Weekly Mortgage Applications Survey, which posted that the 30-year mortgage rate recorded its highest weekly average since the beginning of 2016. It is important to note that the MBA survey timeline is slightly different and is for the week ending Nov. 18.

The MBA report posted that the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since January 2016, 4.16%, from 3.95%.