As one of the largest sectors of the U.S. economy, the total value of the housing market now sits at a level not seen since the early 2000s.

According to the latest monthly housing report from the Urban Institute, the total value of the housing market comes in at a whopping $23.9 trillion.

Broken up, total debt and mortgages increased to $10.2 trillion, and household equity increased to $13.7 trillion, making the total value of the housing market $23.9 trillion.

The report cited that the Federal Reserve's Flow of Funds report has consistently indicated an increasing total value of the housing market driven by growing household equity since 2012.

The most recent home price report from CoreLogic not only posted that home prices continued their upward trend in October, but they are forecasted to continue rising into next month and next year.

Frank Nothaft, CoreLogic senior vice president and chief economist, predicts that the market will see an increase of about 5% in home prices in 2017.

The chart below shows that the last time housing was worth this much was roughly from 2004-2006.

Click to enlarge

Looking at next year, 2017 is not forecasted to surpass any records in housing due to a likely drop in refinance applications.

And the decline in refinance applications is already happening now, as the Mortgage Bankers Association’s latest application report revealed that the refinance share of mortgage activity sits at 57.2% of total applications.

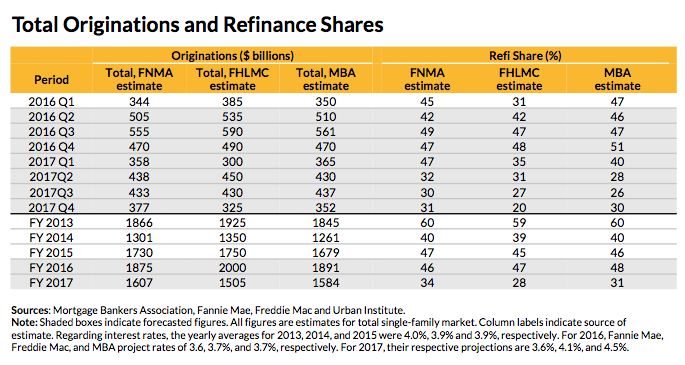

This year is estimated to finish with close to $2 trillion in origination volume, with slightly varying forecasts from different housing organizations. The chart below presents the different forecasts from Fannie Mae, Freddie Mac and the MBA.

But while the forecasts didn’t align when it comes to 2016, all three organizations expect origination for 2017 to be in the $1.5-$1.6 trillion range due to a sharp decline in refinance activity as a result of rising interest rates.

Click to enlarge

Kroll Bond Rating Agency’s report for 2016 and 2017 echoed this, noting that 2016 will likely be the peak year for mortgage originations for “years to come,” as a fall in origination volume will occur in 2017 and beyond.