Despite the current lack of inventory in the housing market, homebuyers can still successfully close on a house with a low down payment, according to a survey this month of more than 800 Redfin real estate agents.

The survey found half of agents reported that the typical down payment for successful buyers in their market was less than 20%, even though competition is extremely fierce.

As it stands, the inventory shortage has become so bad that it spans across nearly all markets.

However various agents explained why low down payments aren’t a disadvantage in this environment. It’s noteworthy given the growing prominence of low down payment options. Most recently, lenders started to roll out mortgage options with as little as 1% down.

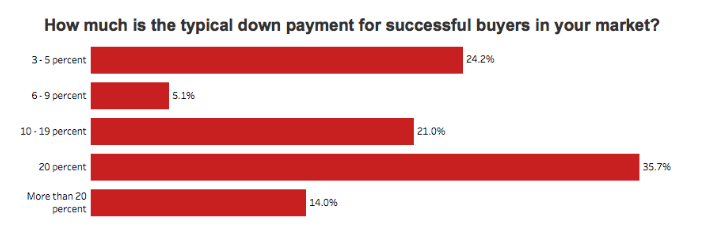

The chart below shows that although a 20% down still ranks as the typical down payment, 3% to 5% down payments are the second top option for successful buyers.

Click to enlarge

(Source: Redfin)

“I’ve had successful negotiations where my clients put down less than 20%. Most sellers aren’t really fixated on that as much as on the overall quality of the offer,” said Redfin real estate agent Rano Khudayberdieva, who works in the Chicago suburbs.

Khudayberdieva further explained that in low down payment situations they typically reach out to the lender to find out how confident they are that the loan will be approved. “If it’s a lender I know and trust, and they assure me they can approve it quickly, then we consider it a solid offer,” said Khudayberdieva.

Khudayberdieva cautioned that it’s not guaranteed though. “If the price is escalating higher than I think the home can appraise, I advise my seller against accepting an offer with a down payment of 5% or less, which indicates the buyer might not be able to come up with additional cash to cover the appraisal deficiency,” said Khudayberdieva. “Generally, though, 10% down or more is good.”

Redfin once again reaffirmed the key benefits that having a cover letter brings.

“Cover letters do make a difference – you’d rather have a committed buyer who put a little less down than a buyer with 20 percent% who may back out,” said Khudayberdieva.

For an example of how to write one, here’s a sample cover letter to help secure your dream home.