It may take homebuilders up to six months to feel the financial impact of the Trump administration’s recently announced tariff on Canadian softwood lumber imported into the U.S.

Canadian lumber producers, however, don’t share the same timeline and will feel an impact immediately, but since many U.S. homebuilders lock in lumber prices months in advance, they will only have to reckon with higher prices when these forward contracts expire, according to a report from Moody’s Investors Service.

The new anti-subsidy tariffs, averaging 20%, on Canadian softwood lumber imports were announced to address a long-standing issue between the U.S. and Canada on lumber.

“The U.S. lumber industry alleges Canadian wood is heavily subsidized and that imports are harming American mills and workers. Canadians argue the U.S. depends on its lumber for home construction and won’t be able to meet demand without its neighbor to the north. It’s a rift that goes back decades,” Jen Skerritt explained in an informative Q&A on the issue.

The issue reached a boiling point when the quotas and taxes on Canadian lumber exported into the U.S. expired in last 2015.

Since the beginning of the year, the Moody’s report explained that people have been anticipating some sort of action by the Trump administration. But as a side effect of this, the report stated that western Canadian softwood lumber prices (the type of lumber frequently used in home building) have already risen 29% since the start of the year.

Now more than a quarter into 2017, homebuilders have already felt, or will soon feel, the impact of higher softwood lumber prices, and the additional cost impact of a 20% tariff may range from negligible (in accordance with the old Wall Street adage of ‘buy on the rumor; sell on the news’) to as high as 20%, Moody’s stated.

Also, the report noted that larger homebuilders, such as Toll Brothers and The New Home Company, are like more likely to be adversely affected than other homebuilders since they need more lumber.

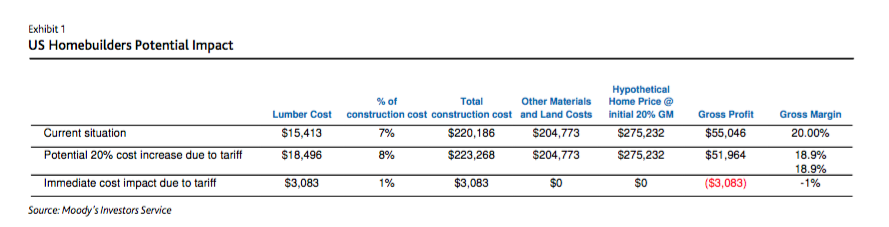

Moody’s did the math on the potential financial impact this tariff will have on homebuilders, as seen in the chart below.

Click to enlarge

(Source: Moody’s Investors Service)