Nearly seven years ago, financial institutions, specificallyWashington Mutual and Bank of America (BAC), issued the first U.S. covered bonds.

Despite the success with covered bonds, it became clear that the existing structure for issuing U.S. covered bonds was too expensive to replicate and too complicated for investors — investors disfavored the unusual securitization-type structure.

To try and break the structure of the covered bond market, proposed legislation was introduced in the Senate and assigned to the Committee on Housing, Banking and Urban Affairs, but no hearings were held on the bill and, consequently, no further action was taken.

With the start of 2013, a new Congress began and any bills unfinished by the old Congress must be reintroduced into the new council. However, the legislative agenda is crowded this year with spending limitations and bills out there designed to wind down Fannie Mae and Freddie Mac.

Perhaps, it’s time to try an alternative to try and restart covered bond issuance by banks in the absence of a statute, suggested Anna Pinedo and Jerry Marlatt of Morrison & Foerester.

"The housing market is clearly recovering strongly and the need for private sector funding of residential mortgages is growing," both attorneys explained.

They added, "Covered bonds provide a more policy-friendly means of residential mortgage finance. Because mortgages remain on the bank’s books, the bank’s interests are better aligned with those of investors."

From an investor perspective, covered bonds create additional confidence because they are dual recourse instruments, providing recourse both to the issuing bank and to a pool of collateral in the event of a bank failure or default.

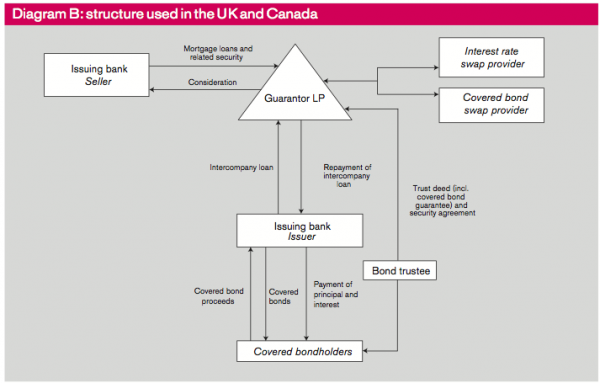

It may seem worth attempting to obtain approval for issuing covered bonds under the structure used by Canadian and English banks prior to the passage of statutes in those countries and still used today.

The structure is simple. The issuing bank establishes a subsidiary to which it sells the loans that will make up the cover pool. The bank then issues covered bonds to investors, guaranteed by the subsidiary. The guarantee is secured by the pledge of the loans owned by the subsidiary.

If the bank fails, the Federal Deposit Insurance Corp will take it into receivership and the subsidiary then becomes obligated under its guarantee to continue making scheduled payments on the covered bonds using proceeds from the loans.

However, whether regulators would approve this structure is an open question.

"Such regulatory approval may be conditioned on the bank not issuing covered bonds in excess of any specific percentage of it liabilities to address any FDIC concern about excessive encumbrance of assets," the Morrison & Foerester attorneys stated.

In the aftermath of the financial crisis, the regulatory response may be different today.

Covered bonds could simplify the regulators’ assessment of a bank because of improved transparency; foster a better environment for borrowers and improved bank underwriting standards, Morrison & Foerester suggested.

"At a time when it would be beneficial to restore a high level of private sector funding for residential mortgage loans without the risks presented by securitization, maybe we should look at this alternative to enacting a covered bond statute, and get on with the business of financing residential housing," Morrison & Foerester concluded.