Detroit has long been known as one of the housing markets that was hardest hit during the crisis. Even recently, RealtyTrac deemed the city the best place to find a fixer-upper based solely on the number of homes available for under $100,000.

However, after filing for bankruptcy last week, many are left wondering what this means for the distressed market in Detroit. Will the bankruptcy have any impact on foreclosure activity?

According to RealtyTrac Vice President Daren Blomquist, foreclosure activity may not be affected by the filed bankruptcy at all.

"We have seen foreclosure activity in the city trending down for the last several years, with 32 consecutive months of annual decreases in foreclosure activity in Wayne County, through June (when foreclosure activity was down 51% from a year ago)," Blomquist told HousingWire.

Blomquist believes that the bankruptcy could very well mean more vacant, abandoned foreclosures that are not maintained and contribute to blight throughout many of the city’s neighborhoods.

"With limited resources, the city may not be able to perform adequate code enforcement and needed maintenance on these homes," Blomquist added.

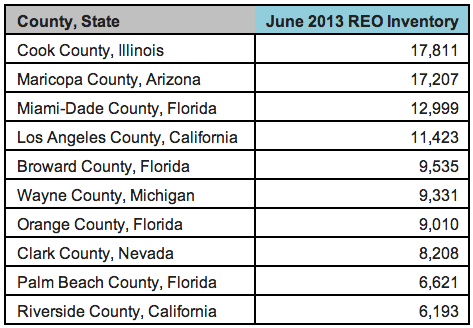

Data from RealtyTrac shows 9,331 foreclosed homes in Wayne County, the sixth highest total of any county nationwide. Additionally, 30% of the homes in Wayne County that are in the foreclosure process, meaning they are in foreclosure but not yet repossessed by the bank, are vacant. This is significantly above the national average of 20% of homes in foreclosure that are vacant.

Ken VanNorwick, supervising bankruptcy attorney atPotestivo & Associates, thinks the city’s bankruptcy may lead to significant delays in the foreclosure process moving forward.

"The challenges raised by Detroit’s Chapter 9 filing are hard to pin down. However, there are numerous potential issues that could be problematic," said VanNorwick. "The first issue is a foreclosure action, which cannot take place, due to the imposition of the automatic stay under 11 U.S.C. 922. Lenders will not be able to foreclose on properties where the City of Detroit has an interest in the property," he added.

According to VanNorwick, Detroit’s hardest hit neighborhoods actually have the possibility of improving with this Chapter 9, as it successfully addresses the debt and other structural problems that the city faces.

"In the short-term, the foreclosure process can proceed, so long as Detroit is not a lienholder or otherwise interested party in the foreclosure," said VanNorwick.

For the foreclosures stayed by the Chapter 9 filing, it will delay the potential return of that property to an interested and committed owner, who wishes to either operate the property as a rental or live in as their principle residence, according to VanNorwick. "This will necessarily delay the neighborhood’s improvement."

"This case is unprecedented in its scale and complexity. It will be quite some time before all of the issues are dealt with," he added.