A widening supply of homes in Southern California caused the market to see a surge in home sales, rising to an eight-year high for that month as buyers were able to find more available homes for sale, a report from California-based DataQuick revealed.

A Realtor.com report out Tuesday revealed that California has been replaced by a new set of market leaders in regards to inventory decline.

The median sales price for a home in SoCal remained nearly unchanged from the month before, but increased 26% year-over-year, marking the seventh consecutive month with an annual gain of more than 20%.

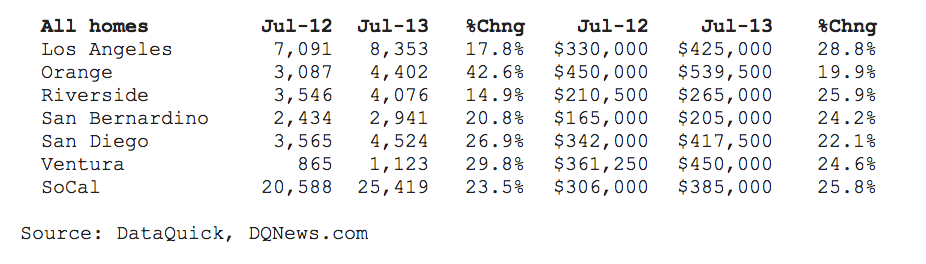

In the Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties, a total of 25,419 new and resale houses and condos sold last month. This was a 17.6% increase from 21,608 sales in June, and up 23.5% from 20,588 sales in July 2012.

July’s sales came close to historic norms, falling just 0.5% below the average number of sales — reaching 25,541 units — in the month of July. It’s been more than seven years since Southland sales have been above average for any particular month.

All new and resale houses and condos sold in the six-county region had a median price of $385,000, unchanged from June. However, this figure was up 25.8% from $306,000 in July 2012. The June and July median prices represent the highest number for any month since April 2008, which had a median price of $385,000 also.

On a year-over-year basis, July marks the 16th consecutive month of gains, which range between 10.8% and 28.3%, respectively, over the past 12 months.

The July median is still 23.8% lower than the peak of $505,000 median in the spring and summer o2007.

SoCal homebuyers seem to be confident in the current housing market, as they continue to put near-record amounts of their money into residential real estate. In July, these homebuyers put a shocking $5.39 billion of their own money into downpayments or cash purchases, up from $5.25 billion and June and up from $3.61 billion a year ago.

“July home sales came in very strong, and we think a lot of the increase in activity can be chalked up to a rising inventory of homes for sale," said John Walsh, president of DataQuick. "The jump in mortgage rates a couple of months back might have spurred more buying, too."

"The market continues its rebalancing act, with more and more people who’ve been ‘underwater’ now able to sell their homes at a profit, or at least break even. As the mismatch between supply and demand eases, it will be more difficult for home prices to rise as steeply as we’ve seen over the past year," Walsh added.

The majority of July’s 25.8% year-over-year gain in the Southland median sale price is a result of rising home prices, while a small portion — approximately one-fifth — is reflective of a market mix that involves both an increase in mid- to high-end sales and a decline in sales of lower-cost distressed properties.

The number of homes that sold in July from $300,000 through $800,000 — a range that would typically include many move-up buyers — jumped 51.7% year-over-year. Homes selling for $500,000 or more spiked 73.5% from one year earlier, and $800,000-plus sales rose 77.5%.

Year-over-year the number of Southland homes that sold for less than $200,000 dropped 26.4%, while sales below $300,000 fell 17.6%. An inadequate supply of available homes for sale coupled with a fussy mortgage market has resulted in relatively weak low-end sales.

Many homeowners still owe more than their homes are worth and can’t afford to sell their homes. Also, lenders aren’t foreclosing on as many properties, which is another reason supply is limited.

After peaking earlier this year, the number of homes being flipped has started trending a bit lower. In July, 6.0% of all Southland homes sold on the open market had previously sold in the last six months, up from a flipping rate of 5.6% in June and up from a 4.5% rate a year ago.

Cash buyers made up 29.4% of July’s home sales, a decline from 30.5% in June and down from 31.8% a year earlier. Cash purchases peaked this February at 36.9%.

Overall, indicators of market distress continue to decline. Foreclosure activity is still well below year-ago levels and remains well below peaks established in the wake of the housing bust, DataQuick intelligence shows.