The now ubiquitous term “housing economy” isn’t just another industry buzzword: it’s a phrase whose coinage is claimed by HousingWire. And it also happens to be a term that helps capture and frame our raison d’être as a publishing house covering the sprawling housing finance space.

"These are heady times in the mortgage industry, regardless of the segment you play in," wrote HW Publisher and Founder Paul Jackson in the editor’s letter of our maiden issue five years ago this month, "it’s my opinion that we’re in the midst of the reinvention of an industry that is critical to the U.S. economy, and the decisions we make now will largely determine what the industry looks like for at least a decade to come. All of which sets up why we’ve launched the magazine you’re now holding."

HW Magazine arrived on the scene at a time when the gravity of the crisis in the U.S. mortgage market and wider economy was becoming painfully clear. During the shelf life of our maiden issue, September/October 2008, a number of major events occurred. A few examples: Freddie Mac and Fannie Mae were placed into federal receivership by the Treasury; the Dow Jones Industrial Average fell 777.68 points, the largest one-day point drop in U.S. history; the U.S. Senate passed HR 1424, its version of the $700 billion bailout bill, forcing the House of Representatives to reconsider the measure, which it duly did and passed; AIG got an additional $37.8 billion loan from the Federal Reserve.

To the creation of the term housing economy, you can add such phrases as “robosigning” and “high-touch servicing” — HW claims credit for these and others.

Every step of the way over the last five years, our media company has been there: The subprime collapse, the conservatorship of Freddie and Fannie, too-big-to-fail, the foreclosure crisis, the Home Affordable Modification Program, quantitative easing, the slow return of private-label securitization, the lauded housing recovery, claims of bubble 2.0.

Along the way we’ve picked up a slew of awards, both national and international. Our latest, bestowed just this summer, came from Trade Association and Business Publications International, or TABPI. We collected the awards in July, including two gold Tabbies, as the awards themselves are known: one for best business-to-business website and another for best feature for an article titled “Creative Destruction,” the April 2012 HW cover story about how municipalities were dealing with urban blight. Those were joined by two bronze awards and two honorable mentions, covering both editorial and design categories.

As much as we are marking HW Magazine’s 5th anniversary, HW as an entity has a slightly more storied history.

The roots of the economic troubles, of course, go back to the early days of 2007. HousingWire almost mirrors this timeline, starting out in the online sphere as a blog produced entirely by Jackson, the publisher, in September 2006. After experiencing ferocious popularity and growth, it fully formed into a media company in April 2008.

There is another side to the backstory of HW. It involves the company’s other figurehead and helps illuminate not only the company’s evolution but also the seeds of the crisis. And it is equal parts personal tale and contextual overview.

In a former life, HW President and Associate Publisher Richard Bitner was a subprime lender. He was on the frontlines of the most talked-about section of the lending space before it began to collapse. He came to national prominence in large part thanks to his critically acclaimed book “Confessions of a Subprime Lender: An Insider’s Tale of Greed, Fraud, and Ignorance,” before joining Jackson at the reins of HW.

In his forthright work, Bitner describes his personal trials with the dawning realization that many in subprime had misplaced their moral compass, an awakening that led him to depart the space. And he makes clear in some detail how the seeds of destruction were sown much earlier.

“I don’t know exactly when it happened, but a few years after we opened, the business started to change,” Bitner, who opened his Kellner Mortgage

Investments business in September 2000, wrote in his book. “Wall Street’s appetite for these loans increased at about the same time new subprime lenders entered the business.”

In the early years of HW Magazine, he put his knowledge of the industry to use by penning a number of viewpoint articles, helping get the ball rolling on the kind of coverage HousingWire has become known for: that which moves markets forward and away from the doldrums he left behind in the subprime space.

It marks a fairly poignant stopping at which to recount some of HW’s best coverage as the U.S. travels down the road to economic recovery.

In a manner of words, these touch on both the meat and the potatoes of what we have written about over the last half decade — part history of HW, part history of the crisis.

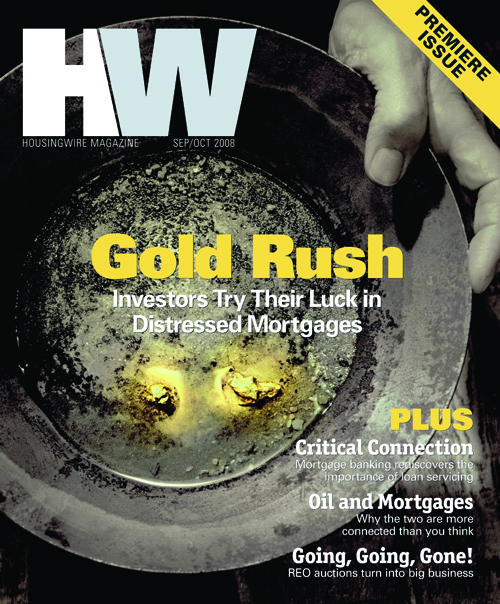

MAIDEN ISSUE (SEPT./OCT. 2008)

MAIDEN ISSUE (SEPT./OCT. 2008)

The first-ever issue of HW Magazine focused on investors diving in to distressed mortgage notes. Titled “Gold Rush,” it outlined how hedge funds and vulture investors were streaming into the market for distressed mortgages, bringing with them big money and an eye for even bigger returns.

“Billions of dollars have streamed into hedge and private equity funds that hope to cash in on distressed mortgages,” wrote the piece’s author, Darrell Delamaide, a financial journalist who wrote for, among others, Bloomberg and the International Herald Tribune. “But while the vultures are circling, there are no easy pickings — at least not yet. In fact, the only hedge funds making real money on distressed loans right now are making it the old-fashioned way: They’re earning it.”

In the same issue, Bitner, HW president, reflected on the motivations behind “Confessions of a Subprime Lender.” The story of the title appeared in our still-existing “Buy the Book” section. Not quite the book review that now dominates the page, he detailed the process by which the title saw the light of day. “After thinking about my motivations, I finally realized the book had to be more than discussing what happened — it had to be about the future of the industry and what needed to be done to fix it,” he wrote.

This debut magazine issue had a rippling effect in the industry, with response broadly enthusiastic. Jackson, the publisher, would later remark that it “was the first broad industry publication that readers felt compelled to read cover to cover.”

FHA TIME BOMB (MAY 2009)

FHA TIME BOMB (MAY 2009)

The May 2009 edition of HousingWire won in the best front magazine cover, digital imagery category from the Trade Association Business Publications International.

It was first of many awards earned by HousingWire’s dedicated editorial and creative team.

Furthermore, it stands as the most prophetic of all HousingWire issues, beating all other media outlets by more than a year in covering what would grow to be widespread problems at the Federal Housing Administration.

HousingWire reporter Diana Golobay wrote, “the question remains whether FHA has become the second home for subprime- lending era behavior.”

Text such as that earned sharp treatment at the hands of those who seek to criticize HousingWire. Our fortitude clearly won out when it came time to preside at the awards table. In its critique of the cover: “The Next Ticking Time Bomb?” TABPI judges said: “The cover cleverly updates the image of a ticking timebomb for a hard hitting illustration.”

“The cover demands attention with realistic illustration style combined with customized bright color.,” they said. “It achieves a balance of instilling alarm yet is safe and calm. Clean, sophisticated image and type treatment solidify a striking cover.”

We couldn’t agree more.

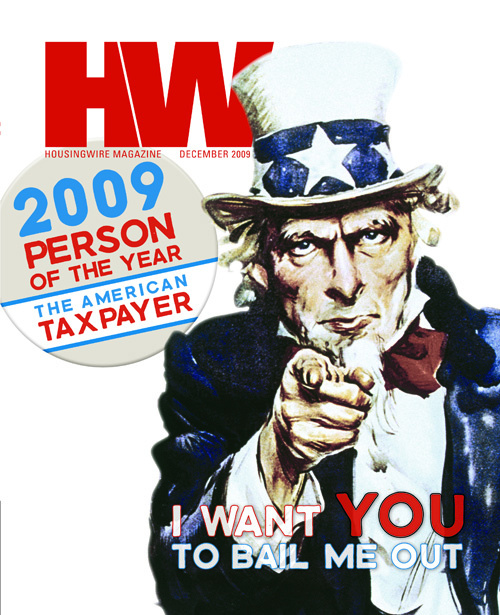

PERSON OF THE YEAR (DEC. 2009)

PERSON OF THE YEAR (DEC. 2009)

By the time December 2009 rolled around, HW Magazine had migrated from bi-monthly title to monthly. And in this issue, we featured our first “Person of the Year.” That accolade went to the collective: the American taxpayer.

In a piece penned by Publisher Jackson and then-Managing Editor, now-Executive Editor Jacob Gaffney, the masses were declared “the single largest purchaser and insurer of loans the world has ever seen.” In something close to a soliloquy, Jackson and Gaffney wrote directly to readers: “Your hard-earned tax dollars have gone to fund a dizzying array of bailout programs, from the near-nationalization of two housing finance giants to a full-scale insurance bailout, to liquidity programs designed to replace whatever absence is felt by the flight of investors away from our nation’s financial products.”

The piece marked a bold statement at a critical time in the nation’s nascent recovery, as Gaffney noted in his editor’s note.

Writing that the unfolding crisis was "not all doom and gloom," he went on to concede that as he put pen to paper on the letter “Société Générale is telling its clients in Europe to ditch the dollar and basically run for the door.” For those editorial efforts, we claimed an award-winning cover.

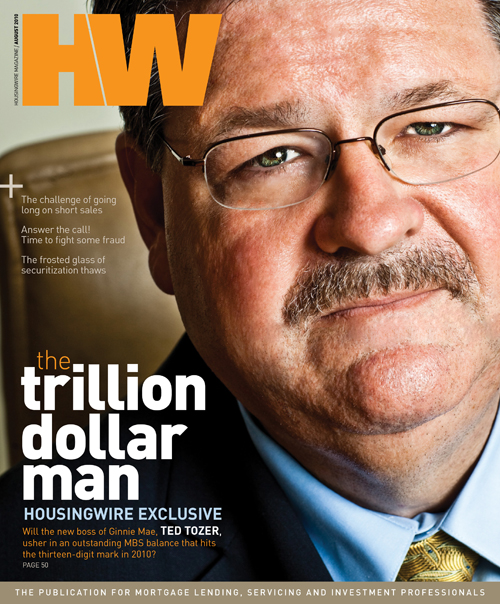

FIRST INDIVIDUAL (AUGUST 2010)

FIRST INDIVIDUAL (AUGUST 2010)

Ginnie Mae boss Ted Tozer was the first individual to grace the HW Magazine cover. The piece by Gaffney and Diana Golobay, a former HW associate editor, featured an exclusive photo shoot of the government-backed mortgage securities issuer’s president.

The story posed the question: “Will Ginnie Mae top $1 trillion in total MBS outstanding?”

Tozer had been sworn in to his role after being nominated by U.S. President Barack Obama just over five months before. “Getting Ted on the cover set in motion a series of wonderful developments for HousingWire,” recalls Gaffney. “Not only did we have the industry’s attention, we had the attention of the government. After Ginnie Mae, Freddie Mac and Fannie Mae followed — then the Federal Housing Finance Agency. To my knowledge, no other trade publication is able to produce so many quality cover stories.”

WOMEN IN HOUSING (SEPT. 2011)

WOMEN IN HOUSING (SEPT. 2011)

No trade publication in housing finance had the foresight to focus on the powerful women making valuable contributions to every point across the housing economy spectrum. At least, until HW Magazine in our September 2011 issue.

As former HW Executive Editor Kerry Curry noted in her unveiling of the inaugural Women in Housing special edition, we put that to bed. “Women bring a unique perspective and valuable insight to the space,” she wrote in her editor’s note. “Yet mortgage finance trade publications too often only quote men in the C-suite, as they bring forth news about the space. We are guilty as charged. In fact, our readership is skewed toward men. It’s important to note we have nothing against male executives. But in a male-dominated profession (with the exception of residential real estate sales), we thought it worthy to take a closer look at the many contributions made by women in our space.”

And with that, we blazed a new trail for publications in the mortgage finance space. Among our first group of featured women were Laurie Goodman, a sterling mortgage-backed securities strategist at broker-dealer Amherst Securities; Amy Brandt, the then-CEO of Vantium Capital in Irving, Texas; Donna Miller, who was heading up the JPMorgan Chase emerging markets and affordable lending group; and regulators Elizabeth Warren, Mary Schapiro and Janet Yellen. The next Women in Housing, our third annual, is slated to run in the November 2013 issue of HW Magazine.

BREAKING COVER (AUGUST 2012)

BREAKING COVER (AUGUST 2012)

For some time, Carrington Mortgage Services was a moving target, a bead firmly fixed in its direction. CEO Bruce Rose was thus a reluctant interview subject. So it was a coup when HW managed to snag a one-on-one with Carrington’s front man.

Our feature produced a profile of both the company and Rose from a different angle than the ones popularly pilloried.

“For a while now,” wrote Jacob Gaffney in the August issue editor’s letter, “the press viewed Carrington Mortgage Services as a soft target; one of many multifaceted mortgage firms that could be attacked on any day that a strong headline was needed to draw readers.”

What emerged, realized Gaffney, who also wrote the profile, was a gentler picture. Rose was a committed philanthropist. And the man himself presented a kinder visage of Carrington. “Our company has done everything that it can do for the best benefit of the borrowerinvestor longer term,” Rose said.

“Where we think it’s somewhere between ironic and amusing, is while we were working as hard as possible to keep borrowers in the houses and keep the assets cash flowing, right outside our doors and right outside my home we were being picketed by the ACORNs and the NACAs of the world, and then simultaneously in the press we were crucified by Declaration, Magnetar and analysts like Amherst for not foreclosing fast enough.”

REO-TO-RENTAL (DECEMBER 2012)

REO-TO-RENTAL (DECEMBER 2012)

“Secondary market interest in distressed single-family homes converted to rentals continues to attract a lot of interest,” wrote Amy Macintosh, a freelance writer, in our critical look at REO-to-rental’s emergence as an asset class late last year. “But figuring out how this up-and-coming asset class will best fit the capital markets is a problem. The overstock of housing is one of the biggest impediments to a sustained housing price recovery.”

In the end, our look at the REO-to-rental space as an emerging asset class proved somewhat prophetic. An example of the evidence: In late July, Morgan Stanley predicted a buy-to-rent boom, claiming it was only a fraction of what it could be in a research report.

“We believe today’s ~$17B institutional BTR industry can continue growing and perhaps reach over $100B over the next several years,” it said in a recent housing research report. And how about this for leading the pack: On July 30, The Economist used talks between private equity giant Blackstone and Deutsche Bank over securitizing home-rental payments to virtually declare the single-family rental market an industry.

FIRST-EVER RETECH:50 (JUNE 2013)

FIRST-EVER RETECH:50 (JUNE 2013)

Earlier this year, we pioneered our first list of the top technology offerings on the real estate side of the housing market.

The inaugural RETech:50 awards detailed companies such as Benutech, RESAAS and Equator. Tech innovations given treatment included a social networking service for real estate agents and brokers (RESAAS) and a trailblazing lead generation tool that drills down to the homeowners most desperate to flog their home (ReboGateway from Benutech).

The nomination and selection process was painstaking. Publisher Jackson and Executive Editor Gaffney spent many a candlelit hour needling out the winners. We’ll close with the futuristic, as that’s where we’re headed: On the design side, HW Art Director Rosangel de Moreira pushed out the boat for our first-ever 3-D cover.

And so, thank you, dear readers for FIVE wonderful years!