Since the Federal Housing Finance Agency outlined its goals for 2013, which included the divestiture of higher risk assets, both Fannie Mae and Freddie Mac have put several bids wanted in competition lists into the market.

Another one of the FHFA’s priorities for the year is to bring private capital back into mortgage credit through risk-sharing transactions. The conservator laid out a goal to target $30 billion of credit risk-sharing deals for both enterprises.

In July, Freddie Mac moved toward the FHFA’s goal to contract its risk profile by pricing a $500 million risk transfer deal linked to mortgages it guarantees.

The securities, called Structured Agency Credit Risk, or STACR, notes, defend the government- sponsored enterprise against mortgage credit default risk by transferring a portion of the risk to the private sector. This helps to protect taxpayers, with private capital taking on some of the risk of the underlying exposure.

Amherst Securities Group Senior Managing Director Laurie Goodman examined the GSE note offering, investigating whether this was an effective risk transfer for Freddie Mac.

“Our view is that it is generally very effective, but provides insufficient protection in high prepayment/high default environments,” she explained.

Deciphering the deal

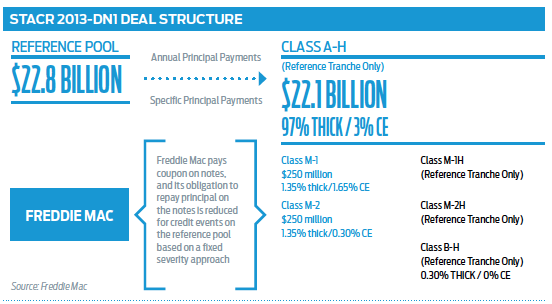

The STACR 2013-DN1 debt notes are unsecured general obligations of Freddie Mac, and the enterprise is entitled to reduce the principal balance of the notes at a tiered severity percentage when the loans in the pool become 180 days or more delinquent, or another credit event occurs.

The securities are synthetic mezzanine floating notes, with yields tied to the performance of a $22.8 billion reference pool of loans acquired by Freddie Mac between June 2012 and September 2012. This means that these vintages carry enough yield and attractive risk for investors.

The deal is structured such that the Class BH tranche takes the first loss, then the M-2 and M-1 tranches take losses sequentially.

The deal pays down scheduled and unscheduled principal pro rata between the senior and subordinate tranches, as long as the triggers pass. If the triggers fail, the unscheduled principal is diverted to the senior reference tranche, but the scheduled principal continues to pay pro rata.

In order to allow investors to determine the performance on loans with similar characteristics, Freddie Mac released loan level credit information in March and similar data in April.

In all cases, loans are taken out of the dataset at six-months delinquency.

The reference pool will consist of fully amortizing, 30-year fixed rate, first lien mortgages that cannot be covered under any mortgage or pool insurance policies, and must have a loan-to-value ratio between 60 and 80.

The notes will amortize over time based on principal payments from the reference obligations. Additionally, the notes have a final maturity of 10 years, at which time Freddie Mac will pay 100% of any remaining class principal balance.

“The sale of these notes provides further insights into the risk-based pricing of the agency guarantees and their g-fees,” explained Chris Flanagan and other analysts for Bank of America Merrill Lynch.

“This also helps to start the GSEs on their way to bringing private capital back into the mortgage market, distributing mortgage credit risk away from the GSEs.”

Analysts for Amherst estimate that default rates will be 66 basis points over 10 years on the high cohort for this risk-sharing deal, which is considerably higher than the 20-basis-point default rate for average FICO scores of 750 and 70-80 loan-to-value ratios from the 2001 vintage tranches.

This is due to two reasons: There are a few risk-layered loans with considerably higher default rates and the 2001 vintage benefited from a huge drop in interest rates in the 2002-2003 period, resulting in very fast prepayment speeds, according to Amherst Securities Group.

Investor impact

Amherst compared the risk Freddie Mac would retain if there were no risk sharing, versus a risk-sharing arrangement in which Freddie sells the M-1 and M-2 tranches. If the enterprise collected the 40 basis points guarantee fee, but had not transferred the risk, it would lose about two basis points in yield due to losses, resulting in a loss-adjusted yield of 38 basis points on an annualized basis.

But since Freddie transferred the risk, and neither the M-1 nor the M-2 tranches took a loss, the estimated loss-adjusted yield is 27 basis points per annum.

This 11-basis-point lower yield is due to the interest expenses to the M-1 and M-2 tranches sold.

In contrast, when considering a down 35% home price appreciation scenario, without risk sharing, Freddie Mac ends up with a loss adjusted yield of 16 basis points, compared to 10 basis points with risk sharing.

Overall, with fast speeds the structure potentially provides less valuable protection, compared to the interest the GSE has to pay on the M-1 and M-2 tranches.

“It is interesting to note that, at slow speeds, the residual risk to Freddie Mac after 10 years is substantial; at fast speeds, the risk is that the M-1 and M-2 tranches are prepaid before the losses roll in,” Goodman explained.

Growing g-fee fears

As the housing market becomes rosier and the mortgage credit outlook continues to influence private sector appetite, many agency investors are left wondering if Freddie Mac’s pricing will ultimately impact future g-fee hikes.

Amherst Securities’ analysis seemed to indicate that g-fees have risen to the point where — without laying off risk — even in high credit loss scenarios, the “net g-fee no risk transfer” returns are positive.

Put simply, g-fees are priced high for this pristine collateral.

Since the loans in this deal are all 60-80 loan-to-value ratios and an average 766 FICO, it is clear that current g-fees are high relative to expected losses. That is, the g-fee is higher than the losses that incur.

Many agency investors are expecting additional g-fee hikes, arguing that the current levels are crowding out private sector participation in the market. As a result, Freddie Mac’s notes pricing suggest that there’s strong private demand for mortgage credit.

But the deal does not offer enough clarity on all the necessary g-fee components.

There are concerns about the risk-sharing structure: It does not provide enough protection in a scenario in which initial speeds are fast and the subordinate tranches are paid off quickly, but then home prices decline and losses accumulate for Freddie at the back end.

“This is the inevitable result of the fact that the structure has a 10-year term (and losses will theoretically accumulate for 30 years); and the subordinate tranches are permitted to amortize unless the deal triggers (cumulative default or credit enhancement) fail,” according to Amherst Securities.

Overall, a high prepayment/high default scenario is unlikely to occur — particularly for this pool of high quality loans — in a housing recovery and rising interest rate environment.

However, actions to better protect Freddie Mac against such a low-probability event should be contemplated in future deals.

“In future deals, the GSEs may want to weigh the cost and benefit of including more protection against this type of adverse scenario,” Goodman explained.

“A shifting interest structure locking out the mezzanine bonds for a period of time or a hard subordination floor are two possibilities. The private-label securities market has already adopted these protections for the senior tranche in Securitization 2.0.”