They were hot, and hot for quite awhile, but short sales show signs of cooling, an indication of a mending housing market and shifting priorities.

Distressed property sales, including short sales, accounted for 21.6% of national sales in the fall of 2013, according to a recent four-month rolling quarter report from Clear Capital — a far cry from the peak of 41% in 2011. Short sales began their descent in 2012 after peaking at 12% to 15% of the market.

The reasons for declining short sales are varied. They include rising home prices, shifting priorities on the part of mortgage bond investors and a wind-down of the national mortgage settlement, which incentivized creditors who did short sales.

“Prices going up is a good thing for just about everybody,” said Alex Villacorta, vice president of research and analytics at Clear Capital. “What is more important is the stability and confidence that it is instilling in the consumer and in lenders.”

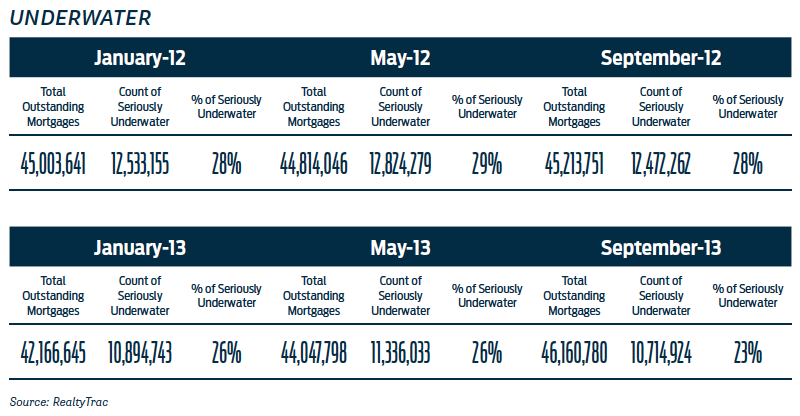

With rising home prices, more borrowers have emerged from negative equity — and have incentive to retain their homes. The share of homeowners with a mortgage who are in negative equity dropped from a peak of 26% in the fourth quarter of 2009 to half of that — 12.98% in the third quarter of 2013, according to CoreLogic. Even those still underwater have greater incentive to hang on to their homes as their loan-to-value ratio improves.

Home prices enjoyed sizable double-digit gains in many places last year. Indeed, some in the industry started to whisper rather loudly about the prospects of another housing bubble as the market heated up, with cities like Las Vegas and San Francisco posting gains of more than 25% year-over-year on the S&P/Case-Shiller Home Price Indices.

But industry experts expect those double-digit gains to temper. The prospect of slower growth should help quell uncertainty about the market’s stability, Villacorta said.

CHANGING MOTIVATIONS

Short sales accounted for 15.2% of home sales in February 2012, their highest point, according to RealtyTrac data. By October 2013, they only accounted for 5.3% of home sales, RealtyTrac said. For the full year 2013, Clear Capital said 9.8% of sales were short sales.

Daren Blomquist, vice president at RealtyTrac, believes the decline is due, in part, to shifting priorities of industry players seeking to dispose of distressed property.

“The total number of distressed sales are coming down, but we are noticing that short sales are coming down even more dramatically,” he said.

“The favored disposition method for distressed properties is shifting back toward the more traditional foreclosure auction and bank-owned sales,” Blomquist said. “Rising home prices — along with strong demand from institutional investors and other cash buyers able to buy at the public foreclosure auction or an as-is REO home — means short sales are becoming less favorable for lenders,” he said.

In October, RealtyTrac adjusted its methodology in tracking short sales to separate out short-sale classified properties that sell at public foreclosure auctions for less than the loan balance. It added a new category in its reporting, “third-party foreclosure auction sales,” which represent sales at public foreclosure auctions to parties other than the foreclosing lender. RealtyTrac retroactively tracked the data back to January 2011 after hearing anecdotal evidence that lenders — at least in some markets — were headed back toward REO sales and away from short sales.

In October, RealtyTrac adjusted its methodology in tracking short sales to separate out short-sale classified properties that sell at public foreclosure auctions for less than the loan balance. It added a new category in its reporting, “third-party foreclosure auction sales,” which represent sales at public foreclosure auctions to parties other than the foreclosing lender. RealtyTrac retroactively tracked the data back to January 2011 after hearing anecdotal evidence that lenders — at least in some markets — were headed back toward REO sales and away from short sales.

Foreclosure auction sales to third parties represented 2.5% of all sales in October, nearly twice the 1.3% in the year-ago period, according to RealtyTrac.

LOAN MODIFICATIONS

Servicers caution that various reasons exist for the declines in short sales and that taking a house through foreclosure still remains, in most cases, a servicer’s last resort.

The best outcome for the note holder is still a loan modification, not a short sale or a foreclosure, said Christopher Whalen, executive vice president and managing director for Carrington Holding Co.

“Short sales, let’s be fair, were just a way of dealing with situations where you couldn’t modify the borrower,” Whalen said. But in a stronger jobs market, a loan modification now becomes a realistic outcome over what might have been a short sale a year ago.

Short sales face other challenges as well. As institutional investor appetite for distressed property wanes, finding short-sale buyers could become more challenging, he said.

“It was much different two years ago when you were doing a short sale and you had a line around the block of investors wanting to buy that house,” Whalen said.

“The sellers were primarily financial institutions and they were looking to unload properties they had marked down. Now they are looking at a potential gain from mark to market. It’s a generalization, but the reason short-sales activity has slowed is because the market has improved.”

JUDICIAL VS. NONJUDICIAL

The short-sale equation, it should be noted, can look vastly different depending on where one lives and how a particular state processes foreclosures.

“In the judicial states, delinquent borrowers have figured out they can stay in the house three to four years without paying,” Whalen said. “If they do a short sale, they have to find another place to live, and they have to pay for it.”

Lenders, he said, are loathe to evict nonpaying homeowners in judicial states because a house that sits vacant during the foreclosure process will deteriorate faster than an occupied one.

While there remains a willingness to do short sales in judicial states, the long timelines, lack of buyers and lack of cooperation from borrowers have impeded the process, he said. Institutional investors haven’t targeted the Northeast judicial states — New York, New Jersey, Connecticut, Massachusetts — because prices there never dropped substantially. Nonperforming loan sales in those states tend to trade at a discount because it’s hard for the servicer to gain control of the asset, Whalen said.

In nonjudicial states, the foreclosure process moves much faster. Moving a property through foreclosure to auction in a multiple-bid environment might hold greater appeal than a short sale, said Desiree Patno, president and CEO of Desiree Patno Enterprises and founder of The National Association of Women REO Brokerages (NAWRB). Patno does short sales in Southern California.

Even if a short sale gets approved by the servicer, real estate agents are losing buyers because by the time the appraisal comes back in the current rising price environment it is significantly above the offer price and the buyer can’t close, Patno said. Mortgage bond investors are choosing to go the foreclosure auction route in select markets because of strong competition for a limited REO supply.

“That is not true across the board, but in L.A. County (real estate investors) are still overbidding the properties because there are so few properties going to REO, and hedge funds need to put their money somewhere.”

Patno last fall had a short sale accepted — subject to appraisal — for an owner-occupant at $114,500 in Victorville, Calif. But the mortgage investor came back after the appraisal and asked for $155,000. “To make them whole was $159,000,” Patno said.

Three months passed from the time the original $114,500 short sale offer went in and the $155,000 demand came back. Patno later sold the property for $145,000 in a cash deal to an investor.

HERE TO STAY

While a number of big banks recently slashed employees, those cuts generally came from lending divisions, not the distressed divisions that oversee short sales. Patno believes that is indication that short sales will remain a viable option, at least for now.

Equator’s short-sale platform has seen only slight declines to date on the number of short sales initiated on its platform, said John Vella, Equator COO. The platform handles roughly 40% of the nation’s short sales, he estimated.

The declines began to emerge in mid-2013. Still, Equator notes improvement in the transition rate — those short sales initiated that make it to closing. The reasons could be that real estate agents and servicers now have significant experience in handling short sales, unlike the early days of the housing crisis, he said.

Elsa Lewis, executive vice president of default solutions at Williams & Williams, said the Tulsa, Okla.-based auction house remains bullish on short sales and has seen a rise in short sales in the Northeast.

“The ones we just did on Long Island had huge crowds,” she said. The auction house sold five houses via short-sale auctions there. Under its process, the deals must go to the servicer after the auctions for final approval of the winning bids.

Lewis believes short-sale auctions will remain strong this year and noted that she just met with a large servicer that indicated short sales would be a major emphasis in the months ahead.

Gagan Sharma, CEO of BSI Financial, also said the special servicing shop has seen no declines in short sales despite a drop in the national figures by analytics firms tracking the sales.

“Short sales are still going very, very strong,” he said. “It has been one of our top loan resolutions and it is continuing to be that way. From a servicer side, the short sale is still a much preferable result than letting something go to foreclosure sale.”