All over the country this weekend parents will wonder which button you push to make the camera work, grandparents will beam with pride and probably brag too, while kids will try to figure out just how to keep that pointy hat from falling off of their heads.

It’s graduation weekend at many colleges across the nation. It’s a time of celebration and joy. But the real world is about to smack many of these graduates square in the face.

That’s because they’ll soon realize the impact of their student loans and just how hard it’s about to be to make their monthly loan payments, pay for their daily lives and if there’s any money left, save some of it for their future.

More and more, students have to take out loans to pay for their education. According to the newly released Federal Reserve Bank of New York’s Household Debt and Credit Report, student loan debt rose $31 billion from the fourth quarter of 2013 to the first quarter of 2014.

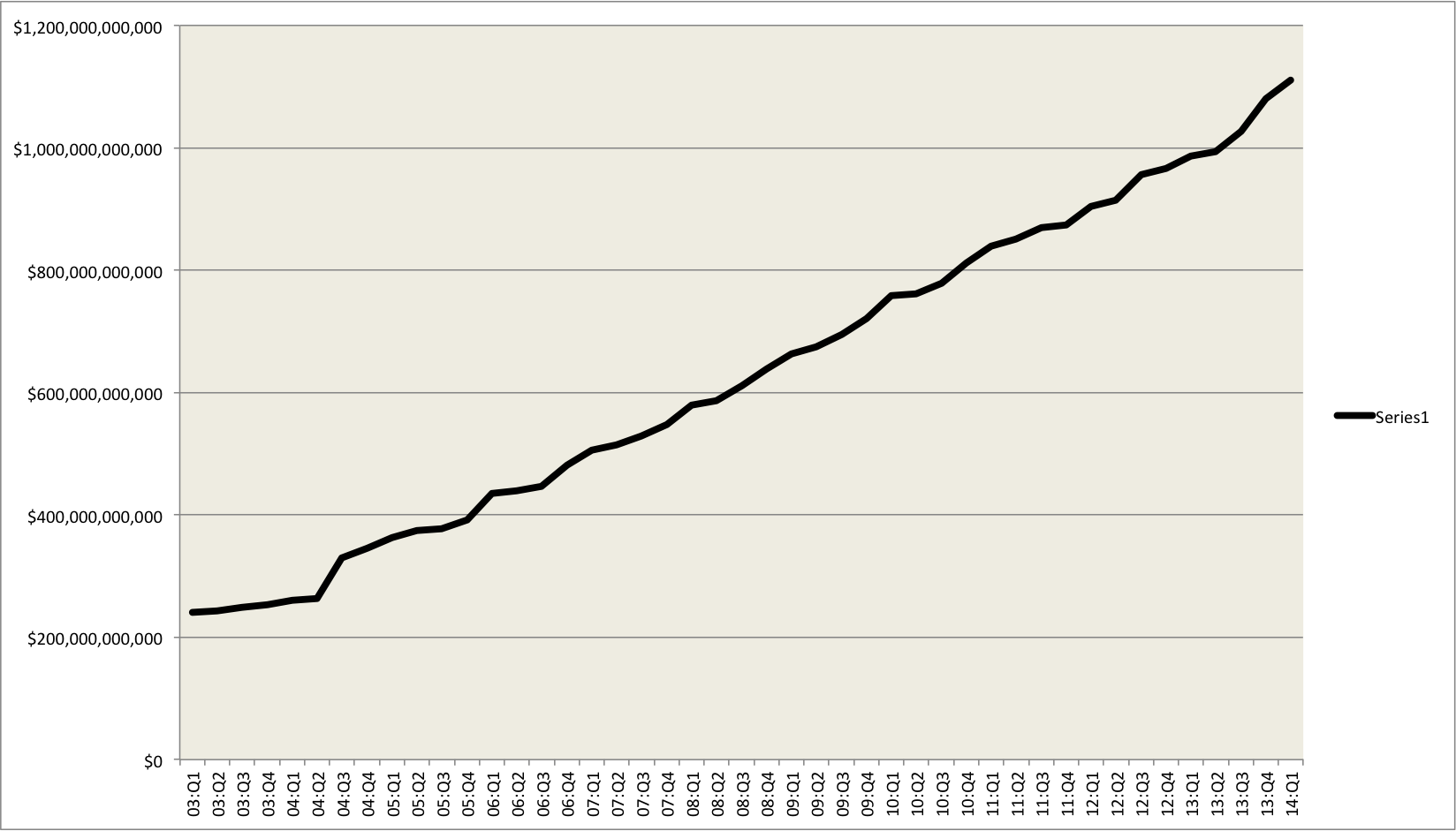

Students now have $125 billion more in loan debt than they did in the first quarter of last year. The total student loan debt has risen from $241 billion in 2003 to $1.11 trillion. That’s trillion, with a T. It’s an increase of nearly 362%.

According to the Fed data, student loan debt has grown in every single quarter since 2003. Take a look at the chart below. That’s a bit of a disturbing trend, don’t you think?

All of that mounting debt is keeping younger buyers out of the market too. Just what the industry needs now, right?

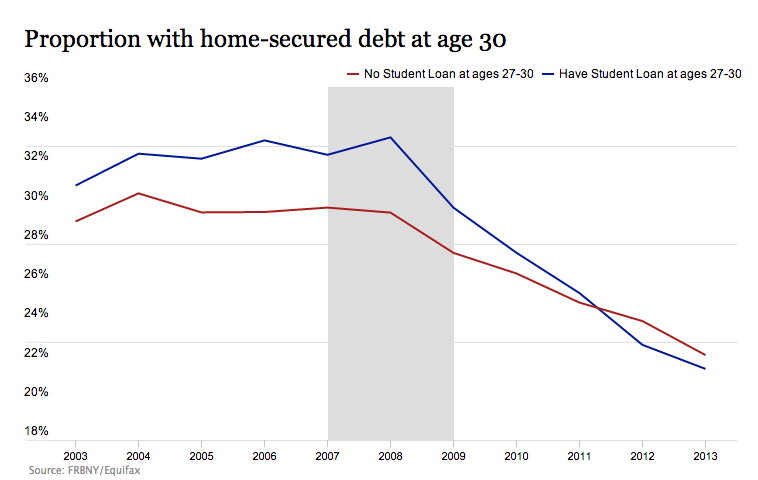

Over the last ten years, the percentage of 30-year-olds with a home loan has decreased by roughly 10%. The graph below shows the declining rate of 30-year-olds with a home loan.

According to analysts with the New York Fed, 30-year-olds with and without debt are continuing to retreat for the housing market. Here’s what the Fed analysts wrote this week:

Prior to the most recent recession, homeownership rates were substantially higher for 30-year-olds with a history of student debt than for those without. This pre-recession pattern is typically explained by the fact that student debt holders have higher levels of education on average, and hence, higher income potential. Simply put, these more educated, often higher-earning, consumers were more likely to buy homes by the age of 30.

However, the recession brought a sudden reversal in this relationship. As house prices fell, homeownership rates declined for all types of borrowers, and declined most for those 30-year-olds with histories of student loan debt.

Did student borrowers regain their homeownership advantage in the course of the broader recovery? They did not. Surprisingly, student loan holders were still less likely to invest in houses than non-holders in 2013, despite the marked improvements in the aggregate housing market.

So the news isn’t exactly promising for the housing market. And it’s not new news either. In October, the student loan ombudsman for the Consumer Financial Protection Bureau, Rohit Chopra said, “"The fact is student indebtness impacts the credit profile of first-time homebuyer. Three-fourths of the fall in household formation can be directly correlated to student debt."

Yes, college graduates usually earn higher salaries than non-graduates, but with rising rental costs engendering quotes like “This is the worst rental affordability crisis this country has ever known,” from people like Shaun Donovan, the Secretary of the United States Department of Housing and Urban Development, it’s becoming harder for students to save at all. Let alone, save enough for a down payment.

“Based on median home prices across the country, research shows that it takes the average first time home buyer 14 years to save a 20% down payment for a home,” Bradley Shuster, president and CEO of NMI Holdings, told investors this week.

Even if the prospective buyer elects to purchase mortgage insurance, it still takes an average of six years to save up for a down payment.

So students can’t save up enough money to buy a home, plus their credit is weighed down by high debt-to-income ratios. That doesn't look like a creditworthy borrower, does it? Especially with increasingly tight credit standards. Doesn’t exactly make for a promising future for the younger segment of homebuyers.

So, you may want put off those plans to turn your kid’s bedroom into a yoga studio for a while…because they’re moving back in with you ASAP. And they’re probably going to be there for a while.