According to the Federal Housing Finance Agency, the volume of mortgage refinance under the Home Affordable Refinance Program is continuing to decline. And in an environment of rising mortgage rates, this is a trend unlikely to reverse.

HARP, which started in 2009 and is scheduled to end after 2015, will likely close far short of its envisioned potential. HARP was revised once to allow for higher loan-to-value homeowners. The president later asked for more — much more.

In his 2012 State of the Union address, President Barack Obama hinted at expanding HARP to include non-Freddie Mac and Fannie Mae loans. The plan, which became referred to as HARP 3.0, could help more than 11.4 million borrowers refinance and save an average $3,000 a year on mortgage payments.

"That's a big deal," the president said in a follow-up press conference. "That $3,000 can strengthen equity in the home. Or that's $3,000 they can spend for a new computer for their kid to go back to school."

Several bills were introduced to try to make this, and other mortgage programs, a reality. They all failed.

In the first quarter of 2014 the number of mortgages refinanced through HARP was 76,930. In total, only 3.1 million mortgages have been refinanced through HARP — 8 million less than the potential number of refinances.

HARP only represents 21% of all refinances, the FHFA notes.

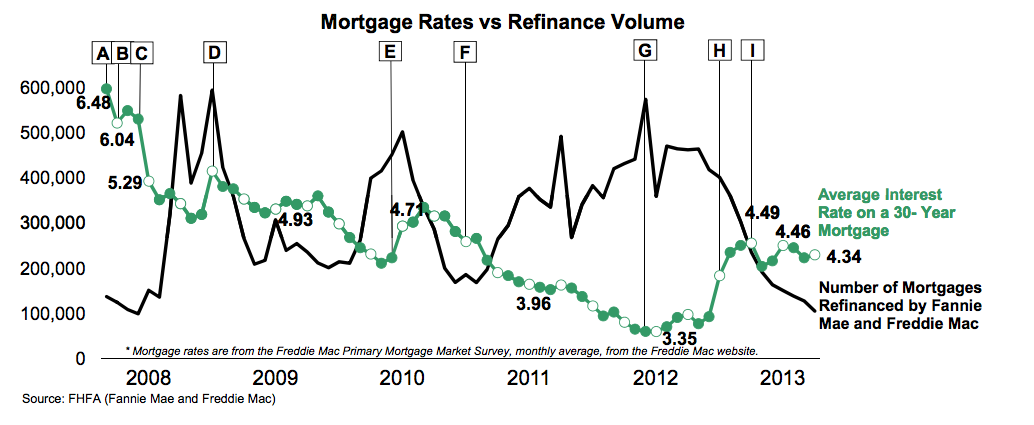

In total, the level of refinance activity is now closer to 2008 levels.

Two states in particular make up a disproportionate amount of HARP refis.

"In the first quarter of 2014, HARP refinances represented 41% of total refinances in Georgia and 38% in Florida, nearly double the 21% of total refinances nationwide over the same period," the report states.

Here is a chart following the decline of the refinance volume, click to expand: