Any time a bevy of home price data is released, as it was on Tuesday, analysis comes from all sides, with everyone trying to interpret the data and predict what’s next.

Tuesday’s data from various sources showed that home price growth has slowed either to a slow pace or to a complete halt.

According to the Federal Housing Finance Agency, home prices were unchanged in April after growing by 0.7% in March. Expectations were for a growth of 0.5%.

The slowing pace of home price growth was echoed in Tuesday’s S&P/Case-Shiller Home Price Indices report, which showed that 19 of the 20 cities witnessed lower annual gains in April than in March, with California seeing its returns worsen by approximately three percentage points.

Earlier this month, Trulia’s chief economist Jed Kolko wrote that home prices may be leveling out, but that’s a good thing for the economy. “Extreme price increases create unrealistic expectations, encourage flipping, and might discourage some owners from selling if they expect big increases to continue,” Kolko said.

Kolko said that slow, sustained growth is an indicator of the health of the housing market.

Those sentiments were echoed by Quicken Loans Vice President Bill Banfield, who said Tuesday, “Slow and steady is the reoccurring theme for these past few months of home price data. “While the year-over-year growth fell below expectations, the rise should instill confidence in a sustained and significant recovery in the housing market.”

In Trulia’s new Bubble Report, Kolko said that despite the growth, home prices are still undervalued nationally by 3%.

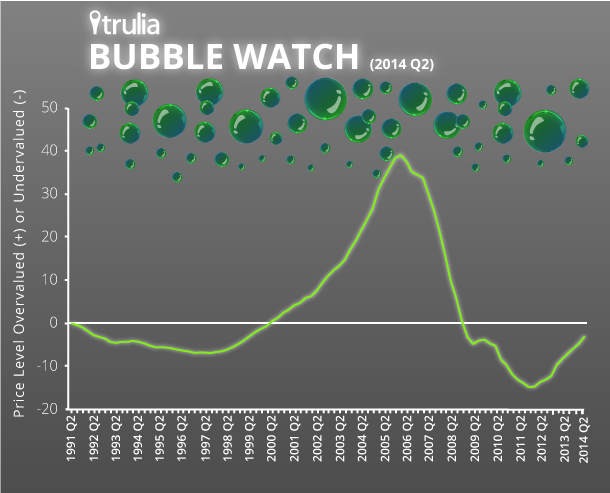

Trulia’s Bubble Report tracks the price level of homes to determine if the prices are overvalued or undervalued. Just before the housing crisis, home prices “soared to a level that was 39% overvalued” in the first quarter of 2006.

After an extreme course correction saw home prices drop to 15% undervalued in the fourth quarter of 2011, home prices have been on the rise for the last few years.

Click the image below to see Trulia's look at where the home prices stood from 1991 through 2014.

Kolko predicts that home prices should be “in line with long-term fundamentals – i.e., neither over- or undervalued” by the last quarter of 2014 or the first quarter of 2015.

But Kolko said that the modest rate of growth means that we’re not headed toward another bubble. “We’d be at greater risk of heading toward a bubble if price gains were still accelerating, but they’re not,” Kolko said. “Even in the bubbliest markets, it’s not 2006 all over again.”

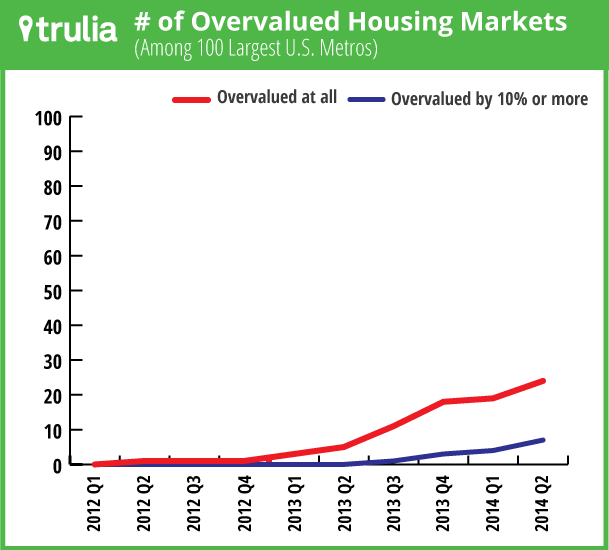

Kolko notes that home prices in 76 of the 100 largest metros are still undervalued. But the number of markets where home prices are overvalued is rising. That number has climbed from five in 2013’s second quarter to 19 in 2014’s first quarter and then to 24 in the second quarter of 2014.

Click on the picture belwo to see a larger look at the number of overvalued markets in the U.S.

“While the number of overvalued markets is rising, there remains little reason to worry about a new, widespread bubble forming,” Kolko said. “The last two years of strong price gains have been from a relatively low level and still haven’t pushed home prices nationally above our best guess of their long-term fundamental value.”