When Arthur Nelson, a professor at the University of Arizona, went shopping for a home in Tucson recently, he found plenty of senior citizens trying to sell their homes — but at prices far more than what they were worth.

"I was amazed at the number of homes that were overpriced by about 25% where the owners were seniors," he said. These seniors would barely counteroffer, taking so little off the asking price that it wasn’t worth negotiating, Nelson said.

It was an early sign of what might eventually become the nation’s next housing crisis: aging baby boomers who seek to sell their homes but can’t, or who will be forced to age in place because they can’t recoup the equity they put into the house.

Throughout their lives, this demographic of people born between 1946 and 1964 has had a major impact on all aspects of U.S. society, from the labor market to the music scene.

Now demographers, academics and housing analysts are trying to figure out how the nation’s largest generation will affect the future of housing. Will they all want to sell their homes after turning 65, 75, or 80? With so many of them, will there be enough buyers?

“My argument is that when you look at the historical propensity for seniors who own their homes to sell their homes, we will find — beginning at the later part of this decade and going on until 2040 — there will be more seniors who want to sell their homes who cannot because there aren’t buyers,” Nelson said.

Tim Flynn believes the imbalance of sellers to buyers will be severe.

Flynn is the founder and CEO of National Value Assurance, a boutique housing market research firm. He wrote about the “boomer overhang” theory in the February 2013 issue of HousingWire Magazine. It’s a phrase he coined about seven years ago to describe an emerging buyer-seller imbalance he predicts will persist in the nation’s housing market for decades to come.

“I think this is the biggest financial story of the next couple of decades,” he said. “Who is out there to buy these houses? You tell me.”

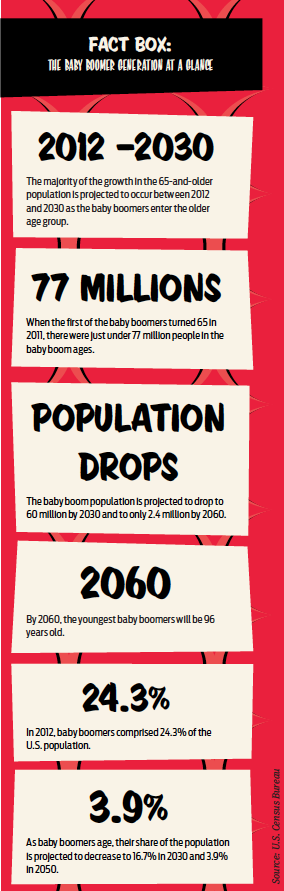

The nation’s 65-and-older population is projected to reach 83.7 million in the year 2050, almost double in size from the 2012 level of 43.1 million, according to the U.S. Census Bureau. This is due in large part to aging baby boomers. The earliest born boomers began turning 65 in 2011.

The nation’s 65-and-older population is projected to reach 83.7 million in the year 2050, almost double in size from the 2012 level of 43.1 million, according to the U.S. Census Bureau. This is due in large part to aging baby boomers. The earliest born boomers began turning 65 in 2011.

Flynn uses Census mortality data, homeownership rates and population data to estimate that about 937,000 homes are being sold annually due solely to mortality — up from slightly more than 700,000 five years ago. He predicts this number of mortality-related sales will rise to 1.5 million homes in 2030, which he forecasts as the peak year for such sales. That is roughly 18% to 23% of the market, depending on what happens to existing home sales.

Flynn’s number doesn’t take into account those baby boomers who will seek to sell for other reasons — downsizing or moving to a rental, retirement community or nursing home.

“I’ve become frustrated because no one wants to hear my message and I’m not an extremist,” Flynn said. “It’s hard to resonate a message with anyone who has a vested stake in supporting the (housing) industry.”

Flynn believes the metrics don’t bode well for the future. The U.S. birth rate is at a record low and tight credit and a weak economy are holding back buyers. Negative equity or near negative equity is keeping others on the sidelines.

For about 120 years, the housing market was made up of organic buyers and natural sellers, but the market is different now, with institutional investors and cash buyers making up a significant portion of the demand in some markets.

“Sometime within the next 40 years, the baby boomers and the homeowners older than the baby boomers will sell 95% of their homes,” Flynn said. “The millennials, the X’s and the Y’s don’t even become a driving force in the economy for 15 years. Something has got to give.”

DIFFICULT TO PREDICT

Not everyone thinks the situation is as dire as Flynn predicts.

Doug Duncan is the chief economist at Fannie Mae and has done research on the baby boomer generation.

“The boomer generation is healthier and has longer life expectancy than previous generations so I wouldn’t expect this to be something that happens soon,” he said.

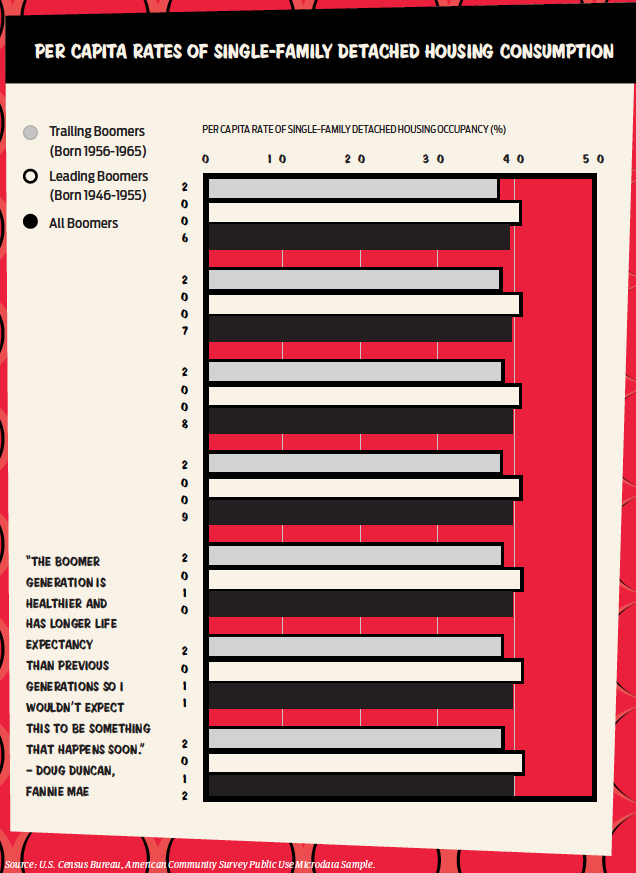

The proportion of the boomer population residing in single-family detached homes has yet to decline, according to recent Fannie Mae research. Contrary to the downsizing perception, the percent of boomers residing in single-family detached homes was at least as high in 2012 as at any time since the onset of the housing crisis. Even the oldest members of the generation, who have begun to retire in large numbers, show no major shifts away from single-family residency.

“It maybe another decade, possibly another two decades before we will see the bulk of that population having to make a decision (on their home), due to health or aging,” he said.

“While baby boomers are reaching retirement age on something of the order of 10,000 a month, and their rate of labor force participation has fallen, these changes don’t yet seem to be affecting their propensity to live in the traditional single-family home,” Duncan said. “Among those who are remaining eligible for the workforce, their workforce participation has risen post-crisis.”

“While baby boomers are reaching retirement age on something of the order of 10,000 a month, and their rate of labor force participation has fallen, these changes don’t yet seem to be affecting their propensity to live in the traditional single-family home,” Duncan said. “Among those who are remaining eligible for the workforce, their workforce participation has risen post-crisis.”

Duncan also speculates that a divide may emerge between baby boomers who have children and grandchildren and those who don’t. Anecdotal information suggests that boomers without children will want to sell their homes when they reach retirement age and move to a location with more amenities and less maintenance. Builders are catering to this group, creating “active adult communities” for the over-55 crowd. Some boomer empty nesters may also decide to downsize after their children grow up and leave the family home.

“That is the ‘boomers move to the city’ theory,” Duncan said. “Family sizes have been falling so there is some logic for that and we are much more urban as a society than we were 30 or 40 years ago. We have an affinity for urban settings.”

Boomers with children and grandchildren, however, may be more likely to keep their single-family home in the suburbs with its extra bedrooms for visits from their children and grandchildren.

As boomers age, disabilities will also play a greater role in what they do with their housing. The rate of disability doubles between the 65-74 and the 75-and-over age groups, according to Fannie Mae.

WHO WILL BUY BOOMER HOMES?

But the central question remains: When baby boomers are ready to sell, will the next generation step up to buy?

The Great Recession delayed home buying for millennials/echo boomers. These people, aged 18-34, are burdened with student loan debt and anemic incomes. Many became independent adults or college graduates during the housing crisis, and — unlike the boomers — they view housing as a risky investment. They also like the flexibility of renting, which allows them to move quickly if a better job comes along.

The older members of the millennial generation should be buying their first starter homes now, so that 10 or 15 years down the road they’ll have the equity and financial wherewithal to move into a boomer move-up home.

At least for now, few millennials are buying. Nor are many boomers selling and moving out.

Between 2006 and 2012, the percent of boomer householders who moved during the preceding year dropped from 10.2% to 7.9%, according to Fannie Mae. Most of that decline occurred during the first half of that period when the housing market was deteriorating rapidly.

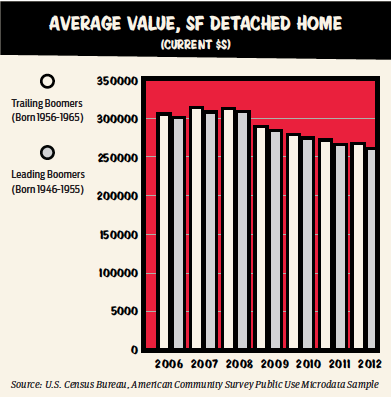

Boomers might be staying put even if they would prefer to move because of the substantial decline in home values they suffered during the housing bust. Between 2006 and 2012, the average value of an owner-occupied single-family detached home with a boomer householder declined by 13%, according to Fannie Mae analysis of data from the U.S. Census Bureau.

For some boomers, the decline in home value translated into a negative equity position on their mortgage, making it difficult to sell. Even if that’s not the case, boomers might postpone moving in hopes of recouping more of their home’s former value.

PREPARING FOR THE SELLOFF

Even if it is delayed, a boomer selloff will happen.

Boomers will swell the number of homes released into the housing market over the next four decades, according to a 2012 research report, “Demographic Challenges and Opportunities for U.S. Housing Markets,” from the Bipartisan Policy Center.

Boomers will swell the number of homes released into the housing market over the next four decades, according to a 2012 research report, “Demographic Challenges and Opportunities for U.S. Housing Markets,” from the Bipartisan Policy Center.

“The volume of housing demand over the next 20 years, especially for owner-occupied housing, will depend heavily on the economic and housing policy environment that confronts echo boomers as they mature from young adulthood into middle age,” the Bipartisan Policy Center report said.

One potential problem, notes Dowell Myers, is that the homes that boomers will want to sell won’t align with future demand from the millennial/echo boom generation. Myers is a professor of policy, planning and demography at the University of Southern California. He first forecasted the baby boomer sell-off in 2007 and 2008 and was one of the authors of the more recent Bipartisan Policy Center report.

A lot has changed since Myers’ initial forecasts, though, thanks in part to the Great Recession. Myers has been recalculating his data and plans to release new research this fall.

“My basic new findings are that the problem of baby boomer over-supply still stands but that its release is being delayed for a number of reasons,” he said, citing lower mobility rates and later retirements among those reasons.

“They will still all get rid of their houses, but it will happen more gradually so we’ll be able to respond to it better,” he said.

Millennials, however, aren’t in a position to buy up the supply. If they aren’t buying houses today, they won’t be prepared to move up to a higher-end boomer home in 10 years. The millennial generation needs to be elevated to higher economic capacity if they are to eventually step into the boomers’ shoes, Myers said. Gen X’ers, the generation now in their late 30s and 40s, are simply not large enough to absorb the boomer housing stock, although they can certainly help.

Congress should consider policy to help get millennials on the right track to become future homeowners by reducing by addressing spiraling student debt along with new barriers to homeownership post-crisis.

As an example, Myers notes that lenders want W-2’s for two years at the same job — now a standard mortgage requirement but something millennials might not possess because they are trying to improve their economic situation by changing jobs more often.

“We need to cultivate the younger generation, not punish them,” he said. “It wasn’t their fault that we had this big financial crisis. They didn’t do it.”

Myers said baby boomers need to get educated about the ramifications of current governmental housing and mortgage finance policies that are holding back the younger generation because the millennials’ current woes will eventually affect them.

“The baby boomer sellers are going to need all the demand that can be mustered,” Myers said. “The public hasn’t figured out that this is a crisis for the young people and if we don’t get them on board, it’s a crisis for the old people too,” he said.

“The older people are especially important in all this because they are the voters, and they are the ones who will be selling their houses. We need to grow a mature base of homebuyers. Our current policies are chasing them away, not trying to grow them.”

While most states and metropolitan areas have significant numbers of boomers, the distribution of young adults is more uneven so pockets of the country might be affected differently as boomers attempt to sell, according to the Bipartisan Policy Center. Problems may be more acute in the Midwest and Northeast where fewer young people reside and less noticeable in places like Texas, Arizona and Nevada, where more jobs and higher birth rates have resulted in higher numbers of younger populations.

Nelson said states and Congress might need to consider legislation that will help baby boomers age in their homes — since many won’t be able to sell them.

For example, an aging boomer might be able to stay in their home longer if there weren’t restrictions against allowing a nonrelated caregiver to live in the home. State or federal laws may need to supersede strict homeowner’s association rules, which are common throughout the country, and which prohibit some of the amenities that might help seniors age in place, such as accessory dwelling units, Nelson said.

WHAT THE FUTURE PORTENDS

Predicting the future of housing and the actions of entire generations is beyond difficult.

“It’s the most uncertain time that we’ve seen in regard to housing and home buying and home building since World War II,” said Myers. “It’s uncertain economically, and it’s uncertain demographically. And it’s never been so uncertain politically.”

Nelson agreed. “We still have the time bomb,” he said. “The ultimate issue will still hit us.”