Online real estate is so hot right now. 2013’s hottest stock — out of ALL OF THEM — was Zillow (Z). And it’s a run that has continued unabated into 2014, too, with Zillow’s common shares moving from the low $80/share range in January to above $140/share and a market capitalization north of $5 billion. (HW analyzed investment prospects for Zillow in the February 2014 issue.)

Trulia (TRLA), the Pepsi to Zillow’s Coke in terms of market share, has seen its common shares pop in 2014 as well — though not nearly to the same extent.

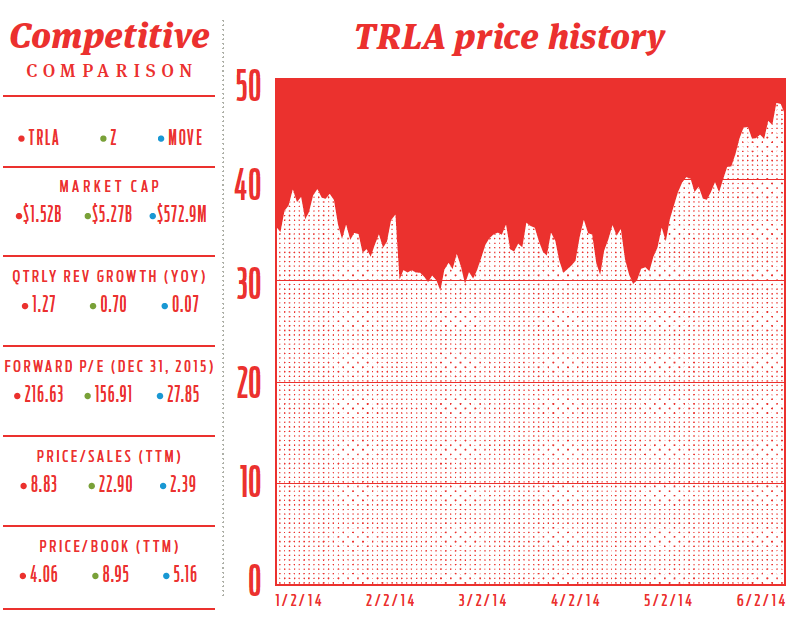

Shares started 2014 trading north of $35/share before falling briefly below $30/share in late February, before soaring in late May and into July to above $45/share.

Is now the time to invest in the emergence of online real estate search and transactions, and is now the time to back Trulia? We look at both the bull and bear cases.

THE BEAR CASE

RBC Capital Markets downgraded Trulia in mid-June, saying the company’s stock was overvalued relative to peers.

Per RBC analyst Mark Mahaney, the risk/reward payoff is missing for Trulia after a solid run to start 2014 — meaning it may not have much room to grow this year.

“[Year to date], TRLA shares have significantly outperformed the market, up 28%, vs. the S&P 500 which is up 6%, and the company has managed to fare well through the Internet Sector’s turbulent past few months,” said Mahaney in his research note.

“TRLA’s solid fundamentals have made this relative outperformance justified. However, with the stock now trading at 39x ‘15 EV/EBITDA and 6.8x ‘15 P/S, we don’t see room for material upside.”

In plain English, the relative value isn’t there, even as Trulia remains a viable No. 2 long-term in the burgeoning online real estate market.

Here’s why: even after a pullback in shares in July, Trulia’s forward price/earnings through the end of 2015 are rich compared to the company’s competitors:

- Zillow forward P/E (fye Dec 31, 2015): 156.91

- Move Inc. forward P/E (fye Dec 31, 2015): 27.85

- Trulia forward P/E (fye Dec 31, 2014): 216.63

So Trulia’s multiple is 38% above that of Zillow.

Plain and simple, this sort of top-level, rich relative valuation is usually reserved for a strong market leader expected to expand its leading run — not for a strong second-place contender. While Trulia is many good things, a company widely expected to displace Zillow anytime soon isn’t one of them.

After all, Trulia loaded itself up with debt in its acquisition of Market Leader last year — restricting the company’s ability to make additional strategic moves, for now — while Zillow remains unencumbered by any debt at all and is sitting on over $300 million in cash, giving it strong room to maneuver in the medium term.

Rumors have swirled that competitor Move Inc. (MOVE) may be up for a merger in 2014, and Zillow would be the firm in the best position to execute such a move to consolidate market players.

THE BULL CASE

The bears are missing the bigger picture here, as usual. They’re focusing on forward P/E estimates, which rely on forecasted earnings that have yet to materialize and can change dramatically between now and the end of next year.

Yet the current performance metrics capturing what’s going on right now in many ways favor Trulia versus its competitors.

Try looking at the price-to-sales ratio, where Trulia runs at an efficient 8.83 to Zillow’s 22.90. Or try the price-to-book ratio, where Trulia sits at just 4.06 to Zillow’s 8.95 — more than double the valuation via book value.

And it’s Trulia’s stock that’s supposed to be overvalued here?

There’s more. It’s Trulia that saw first-quarter revenue growth year-over-year more than double, jumping 127% — not Zillow, who saw revenue jump 70% in the same time frame.

In the Internet world, it’s revenue growth that’s rewarded by investors most often, and by that measure it’s Trulia that’s the champion of growth here. Which means investors are rewarding the company’s management accordingly.

Even better, Trulia’s audience traffic is soaring as well. The company said traffic in May 2014 was a new record, with more than 51 million unique visitors — up 47% from one year earlier. While Market Leader helped, Trulia’s stand-alone growth in May 2014 grew by 29%, as well.

Which means Trulia is growing. And online real estate is a huge market that will support more than one winner — nobody is questioning Trulia’s fundamentals, but plenty seem to want to favor Zillow.

If what matters most is revenue growth and valuation multiples based on what’s already taken place — instead of what might take place — then the track record suggests that Trulia is ripe for additional growth and a strong buy from investors who believe the past is the best predictor of the future.

Editor’s note: Bull vs Bear is a non-positional column designed to present both “bull” and “bear” cases surrounding a publicly traded stock representative of the U.S. housing economy. Analysis focuses primarily on macro-economic factors, and the column is designed to allow investors to choose for themselves which case presented makes the most sense for their own investment objectives. HousingWire does not recommend any specific investments.