As of the second quarter of 2014, one-third of counties surveyed by RealtyTrac have surpassed their historical averages for income-to-price home affordability percentages since 2000 — making residential properties less affordable now than they have been on average over the last 14 years.

The survey analyzed the affordability for buying a residential property in more than 1,000 counties nationwide.

It is important to note that none of the nearly 1,200 counties analyzed have regressed to the dangerously low affordability levels reached during the housing price bubble, and even if interest rates increased 1 percentage point, only 59 counties representing 2% of the U.S. population would be at or above bubble levels in terms of affordability.

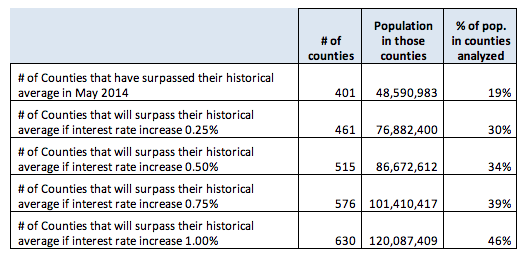

“But the scales are beginning to tip away from the extremely favorable affordability climate we’ve seen over the last two years, with one-third of the counties analyzed — representing 19 percent of the total population in those counties — now less affordable than their long-term averages,” said Daren Blomquist, vice president at RealtyTrac.

(source RealtyTrac; click to enlarge)

Additionally, counties still more affordable than their long-term averages in the second quarter included Los Angeles County (by less than a half a percentage point), Cook County, Illinois, Maricopa County, Arizona, San Diego and Orange counties in Southern California, Miami-Dade County in South Florida and the New York City boroughs of Kings County and Queens County.

Counties less affordable than their long-term averages included San Francisco County, California, Multnomah County, Oregon, Travis County, Texas, Bexar County, Texas, Harris County, Texas and Fulton County, Georgia.