Interest rates remain at historic lows and the housing market continues to steadily recover, creating a strong environment for buying a home.

This doesn't mean the timing is right for everyone, but you may already be doing these five things that show you could be ready to move toward homeownership. And, unless you have significant amounts of cash on hand, that means you'll need to get a mortgage.

And so, this article in The Globe and Mail outlines the five signs you are ready for a mortgage.

1. You are making the right financial strides

“If they have already started saving toward a down payment, that is a great sign,” said Jeffrey Baker, a real estate agent with Sutton Group in Montreal. “They have either been saving aggressively over a certain length of time and given themselves a target for the amount that will be their down payment. Or they will have had a meeting with a financial adviser or bank, who has shown them the amount they can realistically spend.”

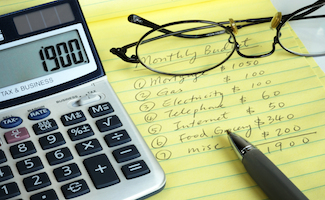

2. You are creating a firm budget

“A well-educated first-time buyer needs to know their budgets to know where they stand,” said Russell Westcott, vice-president of Vancouver-based Real Estate Investment Network.

3. You are realizing what you want

“The buyer should ideally know what community they want to be in,” said Austin Keitner of Keller Williams Realty in Toronto, who has on occasion been asked by clients whether they can lease a property for a year, instead of buying it outright, to see whether it’s the right fit for them.

4. You are willing to focus on what you need

From Westcott, the fourth sign that new home buyers are ready to make a serious commitment is when they have “put the focus on what they need, not what they want. Three bedrooms, two bathrooms and an attached garage – those are needs,” he said. “A want would be high-end fixtures, granite countertops or a wine cellar.”

5. And last, you are toning down your expectations

The final sign you are ready to take the big step is when you realize that, as Mr. Keitner put it, “there is no such thing as a perfect house. I’ve never really seen a eureka moment where it’s, ‘Oh my God, this is the place where I need to live.’” Rather, he said, the home you buy and make your own becomes the home you love.

Bonus: If these five conditions describe you but you're still not convinced to buy a mortgage, it's important to nots that unless you are living rent free with your parents, you are paying a mortgage, whether it is yours or your landlord’s, according to an article in Keeping Current Matters.