The world is awash in inaccurate sound bites related to mortgage credit. We spoke with numerous industry executives and identified three truths that need to be clarified:

1. Low income buyers actually have it easy. Buyers with poor credit and low income are finding it quite easy to buy a home below the FHA limit.

2. Many affluent buyers find it very difficult. Automated underwriting prevents many highly qualified borrowers, especially affluent retirees, self-employed, or commissioned salespeople from getting a mortgage because their income situation does not fit squarely in the credit box.

3. Industry executives are unintentionally preventing a recovery. Mortgage industry executives lobbying for the good old days where FHA limits were higher, fees were lower, and documentation was easier need to stop whining because they look very unreasonable to regulators and politicians who are not sympathetic.

Our purpose here is to shed some light on what is actually happening—- because if there were clarity around this, we would have:

1. More entry-level home buyers. Many qualified people are not even shopping for a home because they presume they cannot get a mortgage. We provide several examples of easy qualification below.

2. More affluent home buyers. More good loans to very qualified buyers would be made if underwriters were allowed to use good business sense rather than fill in automated forms. As we did our research, we heard many stories of buyers reluctantly paying cash or deciding not to move at all and telling their friends who then also elect not to move. These include business owners, retirees, and commissioned salespeople.

3. More relocating home buyers. Many relocating employees are renting simply because they cannot provide historical pay stubs at their new employer. Given their track record of steady employment and desirability to multiple employers, does that make any sense?

In the aftermath of the housing crisis, the reality is that we are lending aggressively to the poor and conservatively to the rich. While the Dodd-Frank rules were written with good intent, let the truth be known, so more first-time buyers can take advantage of current programs to buy homes. Let the bankers use good judgment again, so more affluent buyers can get a mortgage.

Easy Money through FHA

FHA federally insures 95%+ loan-to-value (LTV) mortgage loans made to people with poor credit and low incomes.

Here are three recently approved loans, all through FHA or VA:

1. Recent foreclosure. 96.5% loan on a $170,000 house, coupled with $36,000 in income, a foreclosure three years ago contributing to their 620 FICO score, and debt service equal to 55% of their gross income

2. 57% of income needed to pay debts. 96.5% loan on a $165,000 home, coupled with $38,000 in income, a 642 FICO score, and debt service equal to 57% of their gross income

3. Fixed income and disabled. 100% loan on a $160,000 home to someone permanently disabled with a 601 FICO score and a $34,000 fixed income

Tight Money above FHA Limits

Affluent commissioned salespeople, self-employed, newly employed, and retirees who don't have steady paychecks have tremendous difficulty getting a mortgage because they either:

1. Report inconsistent income to the IRS

2. Cannot provide extended income history from a new employer, or

3. Do not have sufficient current income to qualify but are trying to keep some cash in the bank or delay paying taxes on an IRA distribution.

Here are six borrowers who were denied a mortgage:

1. 27% LTV. A couple with a 780 FICO score who wanted a $300K loan on a $1.1 million house and would have $300K in reserves after closing, but whose verifiable income was only 30% above the proposed mortgage payment.

2. 801 credit score. Newly retired couple with fantastic 801 credit score, $1 million in retirement accounts, and $400,000 in savings after they were going to put down $350,000 on a $550,000 home purchase, but whose Social Security income was less than double the proposed mortgage payment.

3. Affluent business owner. Owners of a small retail business who were turning the business over to their children to manage, with the intent of collecting dividend income; who had $500K in cash savings and wanted a 50% LTV.

4. Relocating borrower. A US citizen who has been working overseas takes a job in the US, has a 700 FICO, 20% down payment, and plenty of reserves, but cannot produce a W-2 because he do not exist in the country in which he was working and hasn't started his new job yet.

5. New employee. A prospective borrower qualified in every way except she had only been in her current job for five months and had worked in the family business previously where she did not get a W-2.

6. Loan = 15% of applicant's assets. A retiree who wanted a 50% LTV and had assets six times the proposed loan amount was turned down and eventually paid cash.

Mortgage Industry Vets Tell It Like It Is

We expect the borrowers and outcomes profiled above will be surprising to many. We also want to share the following sound bites from mortgage industry veterans to offer surprising clarity on other areas of debate:

1. Loans today are easier than the 1990s. "For the average borrower, I believe it was more difficult to qualify for a mortgage in the 1990s."

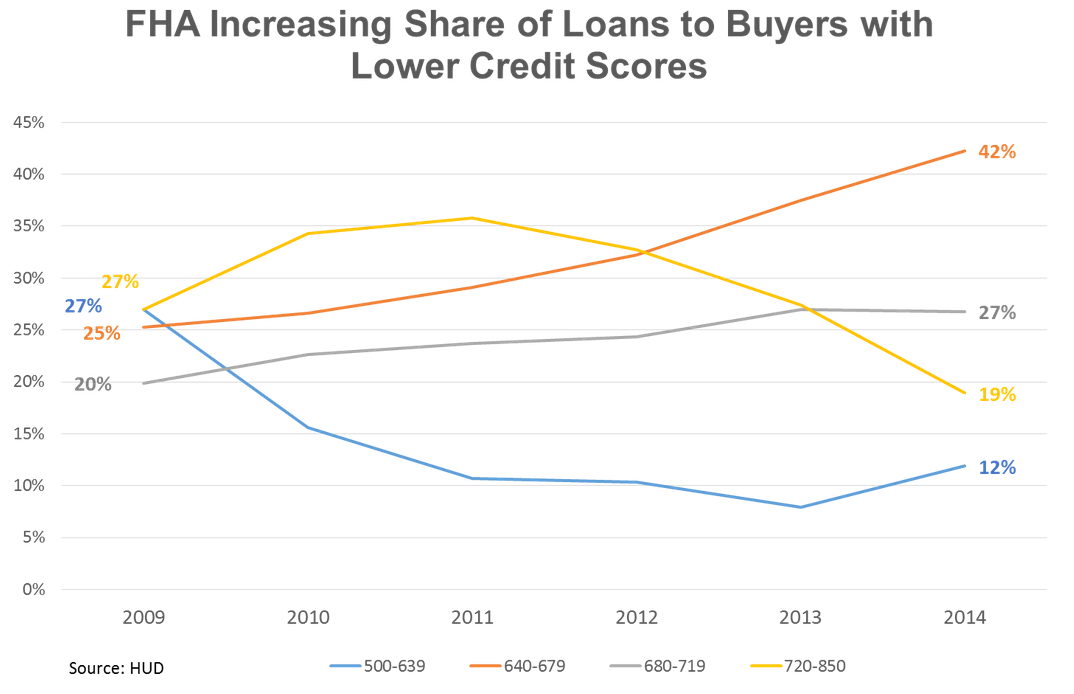

2. Huge improvements are being made in conforming loans. "For a while, if you didn't have a credit score over 720 and you wanted a loan with less than 20% down, you were pretty much looking at an FHA loan. During this period, it's fair to say that sales were being seriously impacted by 20%+. Slowly at first, and now more rapidly, things are changing. Credit requirements for 95% conventional financing are as low as 620, and MI companies have lowered premiums and relaxed guidelines. Banks have been peeling back overlays. You aren't likely to get a conventional loan with a ratio above 45% anymore, but nor could you really get that back in the 90s either."

3. Disposable income is more important than gross income. "Our industry needs to focus more on disposable income versus debt-to-income ratios, meaning a borrower who makes $2,200 a month with a 40% debt-to-income ratio is more risky than someone who makes $12,000 a month with a 50% debt to income ratio. The first borrower has very little cushion after income taxes, utilities, car insurance, food, etc. for emergencies. But the person making $12,000 a month would have much more left over after all of these other debts."

4. Stated income should have its place. "There is a time and a place for Stated Income, not "No Doc" loans, but Stated Income loans. They were a great tool back in the 2000s that rarely went bad if they were used properly because the borrower had a lot of their own capital invested in the home."

5. Income is the problem. "The challenge is not credit based, it's income based. Home valuations have increased at a steeper trajectory than income. Also, the new buyer pool is saddled with student loans and other debt, which has really created the (disposable) income issue. I believe credit is much more accessible than the media/public portrays (in terms of credit scores, LTV's, etc.) My opinion will remain our immediate challenge is income/debt/DTI."

When Lobbying Hurts the Industry More than It Helps

This analysis would not be complete without addressing the many frustrations we heard from people wishing the good old days would come back. We believe those who share these complaints are hurting the mortgage recovery because they provide ammunition for the interest groups that do not want to see large levels of default ever again. Here are a few common complaints that we believe need to stop, at least until we fix the major problems. In reality, most regulators and decision makers do not agree that federally insured institutions should:

1. Help tax cheats. Affluent people who report low incomes to the IRS are not going to get a lot of sympathy in today's regulatory or political environment. They will need to make large down payments.

2. Lower FHA limits. FHA dramatically increased their loan limits in 2008 to help stem the housing crisis and then dropped them to more normal limits this year. While that has hit a few home builders in a few markets particularly hard (and it has slowed economic growth in those markets), FHA is now back to historical normal limits. Given all the assistance FHA is already providing and the housing recovery that is taking place, it is unlikely Congress will decide to revert to another loan limit increase.

3. Stop or reverse FHA fee increases. FHA has increased their insurance costs, particularly on high LTV / low FICO loans. All in, a borrower with poor credit and low savings is still paying the equivalent of less than a 5.5% interest rate, so there is little sympathy here as well. If fees were 75 basis points lower, and rates were 75 basis points higher, the borrower would be in the same place. While underwriters may not like it, many folks in DC believe that now is the time in the recovery for the FHA to shore up their reserves.

4. Bring back seller-funded down payment assistance and closing costs. The government determined these programs resulted in risky loans that may have even been above 100% LTV on day one. Now is not the time to lobby for these programs.

5. Loosen documentation. Several industry veterans said that today's documentation is not too much more difficult than it was in the 1980s before automated underwriting took place. While costly and perhaps a bit overboard for many, less than full documentation is not going to garner a lot of sympathy today either.

6. Have sympathy for those who sold short. Short sellers include very honorable people who did everything they could to help the bank recover as much as possible, as well as less honorable people who strategically forced the banks to take huge losses even though they could have kept their mortgage current. At this point in the recovery, asking short sellers to wait four years to get a federally insured or guaranteed mortgage is not viewed as unreasonable.

7. Offer FHA terms on homes above the FHA limit. There are borrowers who cannot qualify for a FHA loan but want to buy a home above the FHA limit and do not qualify for a conforming loan. They are not going to get a lot of sympathy right now either, as homes above the FHA limit are more expensive than half of the homes being sold in the market.

To the extent that any of these scenarios above can produce good loans, banks or non-banks will start making them and charging the appropriate risk-based return.

We could go on and on with respect to loans that industry executives think banks should be making, but instead we hope to focus people's attention on the paradox in today's lending environment and the current reality that could help buoy sales.

Summary

In conclusion, let's:

1. Get the word out that loans below the FHA limit are readily accessible, with monthly payments that are a great historical value in comparison to gross incomes.

2. Let the bankers use manual underwriting in instances where they can document that the loan has a very low likelihood of losses.