Mortgage applications continue to hover around the same level, while home sales keep rising, according to an article in Business Insider.

The article uses a report from Hui Shan at Goldman Sachs, which cited three factors for why there is a disconnect between mortgage applications and home sales.

1. Things are different

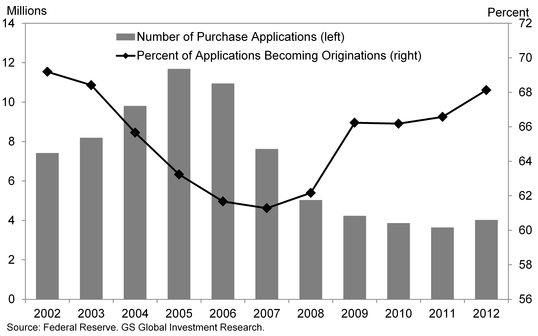

Not every mortgage application is approved and ends in an origination. "The pull-through rate, which is the origination to application ratio, can vary considerably over time," according to Shan.

2. Reliability in question

The market share of the four large banks, Wells Fargo, Chase, Bank of America and Citi has fallen from 50% of all residential mortgages in 2011, to 31% in the first half of the year. This could skew the survey that the MBA index is based on.

3. Cash still remains

Tight lending standards continue to cause the share of cash transactions to stay close to peak levels, even as their share in distressed sales continues to fall.

Business Insider also repurposes a graph from the note to highlight the points, but this one is better at outlining the growing gap between starts and mortgage applications, click to enlarge:

Goldman Sachs economists Jan Hatzius and Jari Stehn also put out a note Monday morning to clients stating three reasons housing is not in a bubble.

“Most economists would agree that preventing another financial crisis should be a central goal of macroeconomic policy,” they wrote. “But identifying a crisis in advance is difficult.”