At 3:20 a.m. on Sunday morning, the largest earthquake in 25 years hit the San Francisco Bay Area. The magnitude-6.0 earthquake was centered in the Napa Valley, home to some of the most expensive homes in the country as well as countless wine vineyards.

After the ground beneath the San Francisco Bay Area finally stopped shaking, the area’s residents began to survey the damage. According to a report from The New York Times, the losses stemming from the earthquake could exceed $1 billion.

But just three years ago, Moody’s Investor Service cautioned investors on the risks that come with investing in RMBS with a concentration in San Francisco.

"If a major earthquake were to strike the San Francisco MSA, the decline in the values of damaged properties, and the likelihood that borrowers could abandon properties whose value has plummeted, will likely result in either losses to senior certificate holders or deterioration of the credit quality of the notes to junk status," Moody's Managing Director Linda Stesney said at the time.

In its report, Moody’s noted a U.S. Geological Survey from April 2008 that stated there was a 63% chance of a magnitude-6.7 or higher earthquake to hit the San Francisco Bay Area before 2038.

Sunday’s magnitude-6.0 earthquake should serve as a reminder that investors need to weigh the inherent risks that come with investing in the San Francisco market. The foundation of those securitizations is literally built on shaky ground. However, these risks are no means isolated to San Fran.

San Francisco has long been home to some of the most expensive real estate in the nation and the prices keep rising. According to the latest data from the National Association of Realtors, the median sales price for a home in the San Francisco-Oakland-Freemont metro area was $769,600 in the second quarter of 2014.

That trailed only nearby San Jose-Sunnyvale-Santa Clara, which was the most expensive market with a medial sales price of $899,500.

According to NAR’s data, prices in San Francisco have risen nearly 60% since 2011, from $483,400 to $769,600.

With prices that high, the San Francisco market is chock full of jumbo mortgage loans, which are loans that exceed the Qualified Mortgage requirements from the Consumer Financial Protection Bureau.

And over the last few months, HousingWire has chronicled the reemergence of residential mortgage-backed securitizations backed by jumbo loans.

Earlier in August, Morgan Stanley (MS) brought its first jumbo RMBS to the market in 2014. Prior to that, Credit Suisse (CS) brought its third prime, jumbo RMBS to market in 2014. CSMC Trust 2014-IVR3 was backed by 526 mortgage loans with a total principal balance of $363.63 million.

A week after that, Two Harbors Investment Corp (TWO) launched its second Agate Bay Mortgage Trust residential mortgage-backed securitization. The $267.67 million deal was backed by 334 mortgage loans with an average unpaid balance of more than $800,000.

Before that, JPMorgan Chase & Co. (JPM) issued two jumbo RMBSs, beginning in February with J.P. Morgan Mortgage Trust 2014-1, which was comprised of 412 first-lien mortgage loans with an aggregate principal balance of $356 million. It was followed by J.P. Morgan Mortgage Trust 2014-2, which was built on a pool of 544 loans with an aggregate loan balance of $303.75 million.

In June, a new player burst onto the scene when WinWater Home Mortgage offered its first securitization, a $250 million jumbo RMBS.

And in July, the once-prolific Redwood Trust (RWT) issued its second jumbo RMBS of the year as well. Redwood’s Sequoia Mortgage Trust 2014-2 was backed by 438 loans with an average loan balance of $698,736.

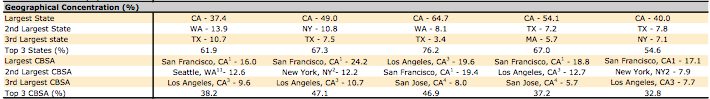

In each of those RMBS offerings, California ranked first with the largest portion of underlying properties. In the Winwater offering for example, California was 64.7% of the underlying properties.

Click the image below to see a breakdown of some of the recent jumbo RMBS offerings broken down by the top states and cities.

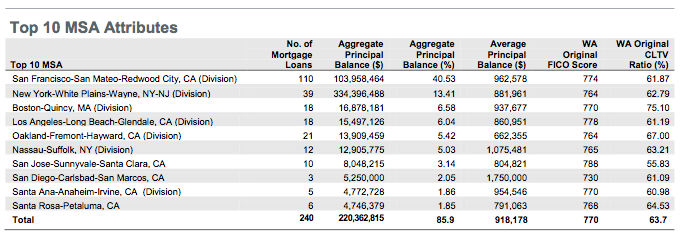

And San Francisco also ranks near the top of every geographic concentration breakdown. In the recent Morgan Stanley offering, properties in the San Francisco area made up 40.53% of the securitization by themselves. The average principal balance on those loans was $962,578.

Click the graphic below to see the breakdown of the securitization's top cities.

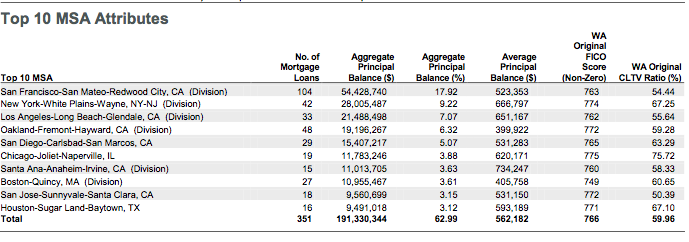

In the Redwood Trust offering, San Francisco also ranked number one with 16% of the total properties coming from that area. In JPMorgan’s JPMT 2014-2, properties in San Francisco represented nearly 18% (17.92%) of the total with an average principal balance of $523,353.'

Click the image below to see a breakdown of the securitization's top cities.

Considering the cost of real estate in San Francisco, those numbers shouldn’t come as a shock, but investors should be weighing the risks that come with investing in RMBSs that are that highly concentrated in California, with a specifically high concentration in San Francisco.

For each of these securitizations, ratings agencies like DBRS, Kroll Bond Rating Agency, Standard & Poor’s, and Fitch Ratings cite the geographic concentration of the underlying properties as a potential concern.

“Pools concentrated in geographic regions may be sensitive to deteriorating regional economic conditions, fluctuations in regional risk factors or other risks like unexpected industry shifts or natural disasters,” Fitch said in its ratings of JPMorgan’s JPMT 2014-2.

Each ratings agency factors in these factors when rating RMBS offerings, and the earthquake risk hasn’t stopped any of the agencies from issuing AAA ratings to the largest tranches of each offering.