Yes, millennials have accrued an absurd amount of student debt, putting a damper on the housing recovery.

And nothing is hurting the housing recovery in such a nuanced way as student loan debt, according to Rohit Chopra, the student loan ombudsman for the Consumer Financial Protection Bureau.

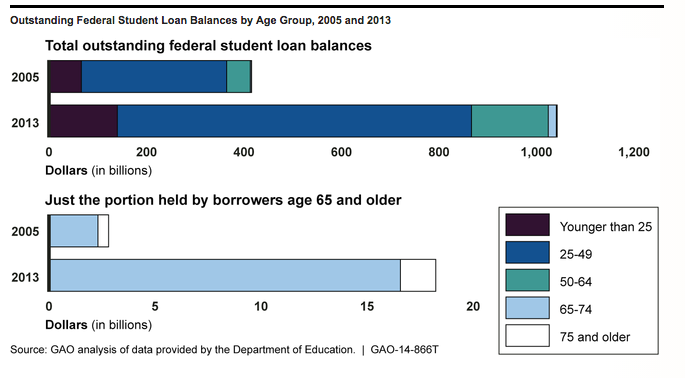

But milennials are not alone in dealing with the burden of student debt. A new study released by the Government Accountability Office found that the outstanding federal student debt for those aged 65 or older is growing.

While older Americans don't carry a significant amount of student debt, the percentage of households headed by those aged 65 to 74 having student debt grew from about 1% in 2004 to about 4% in 2010.

In addition, the small amount of outstanding federal student debt for this age group grew from about $2.8 billion in 2005 to about $18.2 billion in 2013.

(Source GAO, click for larger image)

In the overall picture, about 3% of households headed by those aged 65 or older — about 706,000 households — carry student loan debt. In comparison, about 24% of households headed by those aged 64 or younger — 22 million households — carry student debt.

With the increase in student debt, borrowers 65 and older hold defaulted federal student loans at a much higher rate, which can leave some retirees with income below the poverty threshold.

If left unpaid for over a year, the GAO said a portion of the borrower's Social Security disability, retirement or survivor benefits can be claimed to pay off the loan.

As a result, the report said, “From 2002 through 2013, the number of individuals whose Social Security benefits were offset to pay student loan debt increased about five-fold from about 31,000 to 155,000. Among those 65 and older, the number of individuals whose benefits were offset grew from about 6,000 to about 36,000 over the same period, roughly a 500 percent increase.”

Although additional limits on the amount that monthly benefits can be offset were implemented in 1998, since that time the value of the amount protected and retained by the borrower has fallen below the poverty threshold.

It's important to mention that older Americans are more likely to have other types of debt, with 29% carrying home mortgage debt and 27% carrying credit card debt.