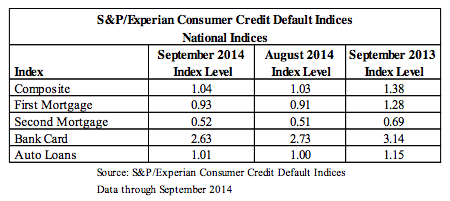

Consumer default rates recorded a slight uptick in September, rising for the second consecutive month, according to the most recent S&P/Experian Consumer Credit Default Indices.

As a whole, the national composite came in at 1.04% in September, up three basis points from July 2014’s historical low.

The indices show a comprehensive measure of changes in consumer credit defaults.

The first mortgage default rate rose again, increasing to 0.93% in September.

Meanwhile, the second mortgage default rate grew one basis point to 0.52%, which was its first increase since April 2014.

The bank card rate decreased for the third consecutive month, declining by 10 basis points to 2.63%.

“Default rates for bank cards reversed an increase seen in the first half of 2014 while defaults on first mortgages and auto loans appear to have bottomed out over the summer. However, none of these movements are very large,” says David Blitzer, managing director and chairman of the index committee for S&P Dow Jones Indices.

“Despite their slight increase, default rates are still near the lows seen before the 2007- 2009 recession and financial crisis,” he continued.

(Source S&P/Experian; Click for larger image)

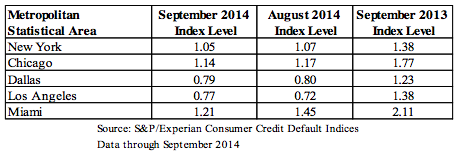

When looking across the nation, Chicago, Dallas, New York and Miami all reported rate decreases.

Miami reported a default rate of 1.21%, its lowest rate since June 2006, compared to New York, which posted a default rate of 1.05%, its lowest since September 2005.

Furthermore, Los Angeles, for the second consecutive month, posted a rate increase of 0.77%, up 11 basis points from its historical low in July 2014.

“All five cities – Chicago, Dallas, Los Angeles, Miami and New York – remain below default rates seen a year ago,” Blitzer said.

(Source S&P/Experian; Click for larger image)