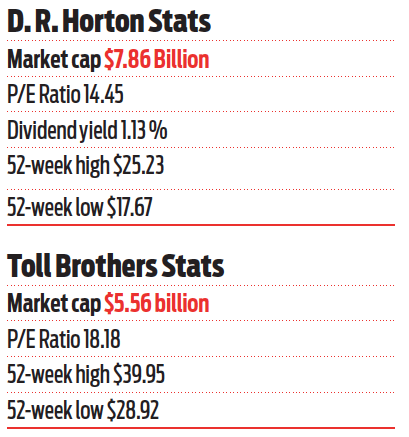

The HW 30 represents the top public companies that make up the core of the nation’s housing economy. Among them are some of the country’s biggest builders, the largest among them D.R. Horton (DHI), though Toll Brothers (TOL) is perhaps the one to watch now. A luxury builder, it has seen a more steady increase in profits than many of its lower-end counterparts. Is it time to invest in home construction? Here’s our take.

The Bear Case

Builder confidence may be on the rise, but confidence does not necessarily translate into dollars. While the NAHB/Wells Fargo Housing Market Index may have reported builder confidence at a nine-year high, banking on that ignores the fact that mortgage applications are at a 14-year low.

Plus, certain segments of the home-buying market aren’t even participating at this point. NAHB Chief Economist David Crowe pointed out in a September news release, “While a firming job market is helping to unleash pent-up demand for new homes and contributing to a gradual, upward trend in builder confidence, we are still not seeing much activity from first-time homebuyers.” He added, “Other factors impeding the pace of housing recovery include persistently tight credit conditions for consumers and rising costs for materials, lots and labor.”

And while new home prices may be rising overall, along with sales, recovery in the market remains uneven, according to a Sept. 24 report to clients from Stern Agee, which points out that even as new homes sales are on the rise, existing home sales are declining. “Following a deep decline at the start of the year — the aftermath of overzealous buyers rushing into the market in mid-2013 to beat the threat of rising rates — housing activity regained momentum during the spring and summer selling season,” the report noted. “However, even with positive activity levels, there has not been enough momentum to recapture the previous 2013 peak in sales, until now.” End of selling season price reductions have boosted sales, but Stern Agee points out, “one data point does not make a trend.”

And while the Bulls may point to housing starts rising 6.3% in September, don’t forget they dropped 14.4% in August. September’s gains are not enough to make up for that plunge. Most of the gain has been centered on multifamily housing, too. September single-family housing starts stood at a rate of 646,000, only 1.1% above August’s 639,000. However, the rate for buildings with five units or more in September was 353,000. That’s 18% above August figures.

And while the Bulls may point to housing starts rising 6.3% in September, don’t forget they dropped 14.4% in August. September’s gains are not enough to make up for that plunge. Most of the gain has been centered on multifamily housing, too. September single-family housing starts stood at a rate of 646,000, only 1.1% above August’s 639,000. However, the rate for buildings with five units or more in September was 353,000. That’s 18% above August figures.

Stern Agee economists said single-family starts are at their lowest point since May.

Could this be a market slowdown? The seasonally adjusted rate for privately owned housing units authorized by building permits were at a seasonally adjusted rate in September of 1,018,000, only 1.5% above August’s rate of 1,003,000 and 2.5% above September 2013. Growth is miniscule…and non-existent when it comes to single-family, where authorizations stood at 624,000 in September, 0.5% below August’s figure of 627,000.

And while the nation’s largest builder, D.R. Horton, may be seeing increased sales, company-wide gross margins declined to 20.7% in the third quarter compared to 22.2% in the second quarter and 21.4% in the third quarter of 2013. D.R. Horton’s net income in the third quarter stood at $113 million (32 cents per share), a decrease of 22.5% from the third quarter of 2013 when income stood at $146 million (42 cents per share).

The building industry remains an uncertain bet right now.

The Bull Case

Builder confidence continues to rise, increasing for the fourth consecutive month in September, according to the National Association of Home Builders/Wells Fargo Housing Market Index, which was released Sept. 17. The index reached 59, the highest level since November 2005.

In a news release, NAHB Chairman Kevin Kelly, a builder and developer from Wilmington, Delaware, said, “Since early summer, builders in many markets across the nation have been reporting that buyer interest and traffic have picked up, which is a positive sign that the housing market is moving in the right direction.”

The NAHB/Wells Fargo Housing Market Index is based on a survey the association has been conducting for the past 30 years and reflects builder perceptions on market conditions for the next six months. Scores over 50 indicate builders view conditions as positive rather than poor. All three HMI measures showed gains in September, including builder forecasts for current single-family homes sales and prospective buyer traffic. In fact, those two indices showed even higher results than builder confidence, coming in at 67 and 63, respectively.

While the market may not be growing quickly, it is growing and poised to grow more, so investing in homebuilding companies will likely offer a promising, if not huge, return.

New home sales in August, for example, rose to an almost six-year high, according to a Sept. 24 report to clients from Stern Agee Chief Economist Lindsey Piegza. That 18% overall increase occurred despite tight credit standards and minimal wage growth. Meanwhile the median price of new homes fell, dropping 1.6% in August. Year-over-year, however the median price rose 8%.

Jay McCanless, an analyst with Sterne Agee, said he recommends investing in the building sector now, highlighting HW30 member D.R. Horton in particular, but urges caution on the part of investors. He says while employment growth is helping drive “a catalyst for demand,” he adds, “mortgage lenders’ risk appetites appear to be growing at a slower rate.”

Toll Brothers may be the best bet for seeing more immediate gains. This luxury builder has a long-term EPS growth forecast around 49% and price-to-earnings ratios greater than the industry average.

But even D.R. Horton, which tends to specialize in first-time and first move-up buyers, has seen noteworthy gains with third-quarter revenue standing at $2.1 billion, a 28% increase year over year. D.R. Horton’s backlog has increased as well, increasing 15% in unit terms and 26% in dollar terms. Given that backlog offers a promise of future revenues, investors should pay attention.

In comments about the quarter, D.R. Horton Chairman of the Board Donald Horton said, “Our position as the largest and most geographically diverse homebuilder provides a strong platform for us to compete for new home sales, evidenced by the 32% increase in the value of our net sales orders, 28% increase in our home sales revenue and the 26% increase in the value of our sales order backlog this quarter as compared to the prior year quarter.”

Horton said he really doesn’t see increasing interest rates having a significant effect on revenue, but rather jobs will be the largest driver of business, particularly given the company’s emphasis on first-time homebuyer clients.

McCanless indicated in a release to investors in mid-October that he expects average closing prices for homes has risen 10% year over year as of September. The homebuilders’ group average gross margin expanded by 50 basis points year over year to 21.7%.

However, McCanless said investors shouldn’t be surprised if things go downhill some in December, though he expects order growth in the third quarter to help mitigate impacts.

An Oct. 17 report to clients from Stern Agee showed building permit demand rose 1.5% in September, and housing starts rose 6.3%. That’s after a decline of 12.8% in August, bringing the annual rate on housing starts from 957k to 1,017k.

Piegza said the new data indicates “stabilization at best in housing.” She added that uneven demand is probably going to keep homebuilders cautious for the immediate future.

However, big homebuilder investment remains a fairly safe option given that most reporting builders have shown double-digit year-over-year price increases from 2013 to 2014. Stern Agee banks particularly on D.R. Horton, though Toll Brothers seems the best bet given its access to higher-end markets, which have fared better since the financial crisis.

D.R. Horton, with its unrestricted cash of over $930 million, will likely look at acquisitions as an avenue to growth in the coming months and years, just as Toll Brothers has with the recent acquisition of Shapell, which gave it access to the L.A. and San Francisco markets. D.R. Horton also plans to target the first-time homebuyers that have been cut out of the market for several years by both tight lending standards and a weak employment market by offering a line of $120,000 to $150,000 homes.

And plenty of analysts say as the labor market improves, pent up first-time homebuyer demand will let loose, resulting in gains for D.R. Horton and other lower-end builders like PulteGroup.

Editor’s note: Bull vs. Bear is a non-positional column designed to present both “bull” and “bwear” cases surrounding a publically traded stock representative of the U.S. housing economy. Analysis focuses primarily on macro economic factors, and the column is designed to allow investors to choose for themselves which case presented makes the most sense for their own investment objectives. HousingWire does not recommend any specific investments