Credit Suisse (CS) is set to bring the year’s second prime, jumbo residential mortgage-backed securitization to market. The $381.59 million offering was assigned mostly AAA ratings by credit ratings agency DBRS.

The offering, CSMC Trust 2015-WIN1, is backed by 525 loans with a total principal balance of $381,595,526. The underlying loans have an average balance of $726,849, larger than the average loan size in the year’s first jumbo RMBS from Two Harbors Investment Corp (TWO), which carries an average loan balance of $688,392.

The loans in CSMC Trust 2015-WIN1 carry a weighted average FICO score of 766, a weighted average collateralized loan-to-value ratio of 71.4%, and a weighted average debt-to-income ratio of 33.2%.

According to DBRS’ presale report, the underlying borrowers also carry clean payment histories.

“The pool is on average four months seasoned, with a maximum age of nine months,” DBRS said in its report. “The payment histories on the loans are substantially clean. Except for 22 loans that had previous servicing transfer-related payment disruptions, no loan has had prior delinquencies since origination.”

According to DBRS’ report, 100% of the loans are fixed-rate, first-lien mortgages and none of the loans carry interest-only features. A composition like that poses the lowest default risk, given the stability in monthly payments, DBRS said.

The underlying borrowers also have substantial cash reserves and significant annual income. “For the entire pool, the WA primary borrower income exceeds $268,000 annually,” DBRS said. “For the entire pool, the WA liquid reserves for the loans are approximately $348,000, which is enough to cover over seven years of monthly mortgage payments. On average, 8.3% of the loans have liquid reserves higher than their current loan balance.”

Also of note in the deal is that approximately 45.2% of the borrowers have more than one mortgaged property.

“Borrowers with three or more mortgages (with a maximum of five) represent 13.8% of the pool and generally show considerable income and liquid reserves,” DBRS said. “The WA DTI ratio for borrowers with multiple properties is 34.7%, slightly above the overall DTI ratio for the entire pool of 33.2%. For borrowers with multiple mortgages, there are no instances where more than one of their mortgages have been included in this securitization.”

Additionally, the CSMC Trust 2015-WIN1 has a “relatively moderate” geographic composition, DBRS said. California represents nearly 50% (49.4%) of the underlying loans, and the top three states represent 59.4%, with Florida ranking second with 5.7% and Massachusetts ranking third with 4.3%.

The originators for the mortgage pool are New Penn Financial (20.2%), Quicken Loans (19.3%), Caliber Home Loans (7.6%) and various other originators, each comprising less than 5%.

The loans will be serviced by Select Portfolio Servicing (68.8%), New Penn doing business as Shellpoint Mortgage Servicing (20.2%), Fifth Third Mortgage Company (4.8%), PHH Mortgage Corporation (3.7%), First Republic Bank (1.5%) and EverBank (0.9%).

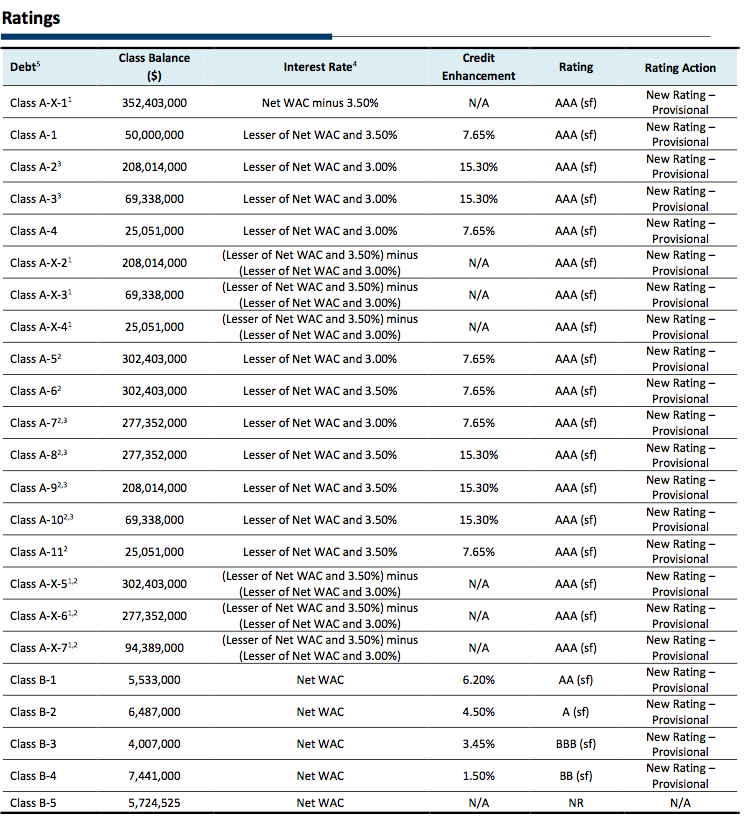

Click the image below to see DBRS’ presale ratings for the offering’s classes.