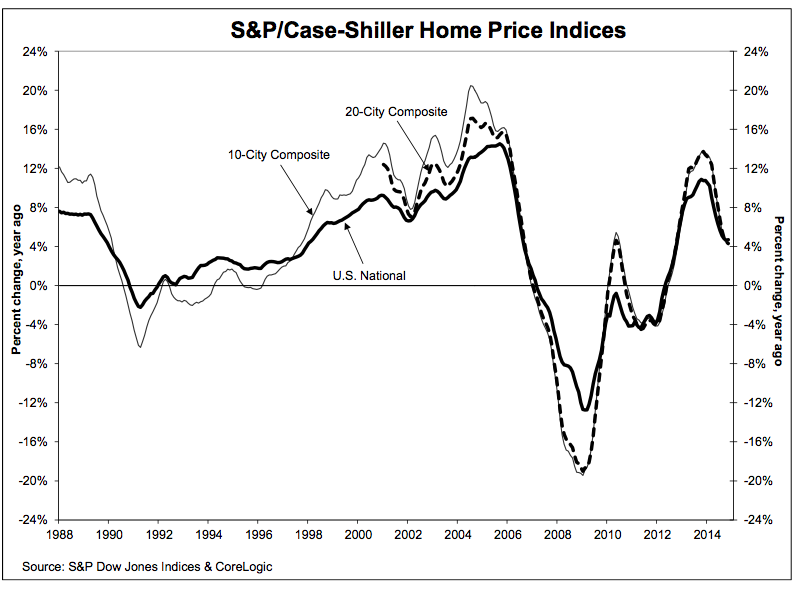

Home price growth continues to slow as both the 10-city and 20-city composites witnessed year-over-year growth rates decline in November compared to October, S&P/Case-Shiller’s Home Price Indices reported.

The 10-city composite gained 4.2% year-over-year, down from 4.4% in October, while the 20-city composite gained 4.3% year-over-year, compared to 4.5% in October.

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, posted a slight increase, with a 4.7% annual gain in November 2014 versus 4.6% in October 2014.

Miami and San Francisco continue to lead all cities, posting gains of 8.6% and 8.9% over the last 12 months.

However, a total of nine cities, including Tampa, Atlanta, Charlotte and Portland, experienced annual growth rates climb more than other cities in November.

On a monthly basis, the national and composite indices were both marginally negative in November. The 10 and 20-city composites posted declines of -0.3% and -0.2%, while the national index posted a decline of -0.1% for the month.

Although Tampa led all cities in November with an increase of 0.8%, Chicago and Detroit offset those gains by reporting decreases of -1.1% and -0.9% respectively.

“With the spring home buying season, and spring training, still a month or two away, the housing recovery is barely on first base,” says David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices.

“Prospects for a home run in 2015 aren’t good. Strong price gains are limited to California, Florida, the Pacific Northwest, Denver, and Dallas. Most of the rest of the country is lagging the national index gains. Moreover, these price patterns have been in place since last spring. Existing home sales were lower in 2014 than 2013, confirming these trends,” he added.

Click to enlarge

Source: S&P Dow Jones Indices & CoreLogic

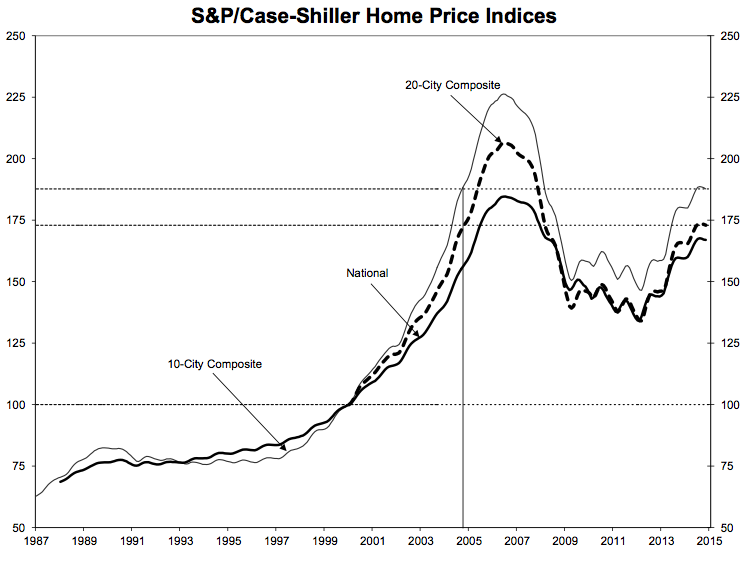

Click to enlarge

Source: S&P Dow Jones Indices & CoreLogic

However, not everyone agrees with Blitzer’s negative forecast for the spring homebuying season.

Zillow (Z) Chief Economist Stan Humphries said that the housing market is heading in the right direction – slowing down, yes, but still making gains, and at a level much more in line with historic norms.

“Lately, we’ve seen stronger home value appreciation at the bottom end of the market, among those homes most likely to be sought by first-time, entry-level buyers. These gains should help lift more lower-end homeowners from negative equity, freeing them to list their homes for sale and contributing to sorely needed inventory gains to meet burgeoning demand from millennials and other first-time buyers,” said Humphries.

“This year ought to be much more friendly for buyers in general, after years in which sellers were in the driver’s seat in most markets. More inventory from both previously sidelined sellers and new construction, slowing price gains and continued low mortgage rates will all contribute to buyers feeling more comfortable this year than in previous years,” he continued.

A recent Zillow report said that Homeowners at the bottom of the housing tier emerged from 2014 in a stronger position than in previous years, with home values up 6.8% year-over-year.

Lower-valued homes were hit hardest by the recession and experienced an unsteady recovery compared to high-end homes, and according to Humphries, those lower-value homes are key to the overall recovery.