California is performing well as it heads into the spring homebuying season, at least in terms of homes under offer.

According to the latest California Association of Realtors report, pending home sales in the state soared in February to record the first doubled-digit annual gain in nearly three-year and the third straight year-to-year increase.

This should hopefully translate into improved market conditions and more closed transactions in the coming months.

As a whole, California pending home sales increased in February, with the Pending Home Sales Index growing 24.8% from a revised 89.9 in January to 112.2, based on signed contracts.

The month-to-month increase easily topped the long-run average increase of 17.9% observed in the last seven years.

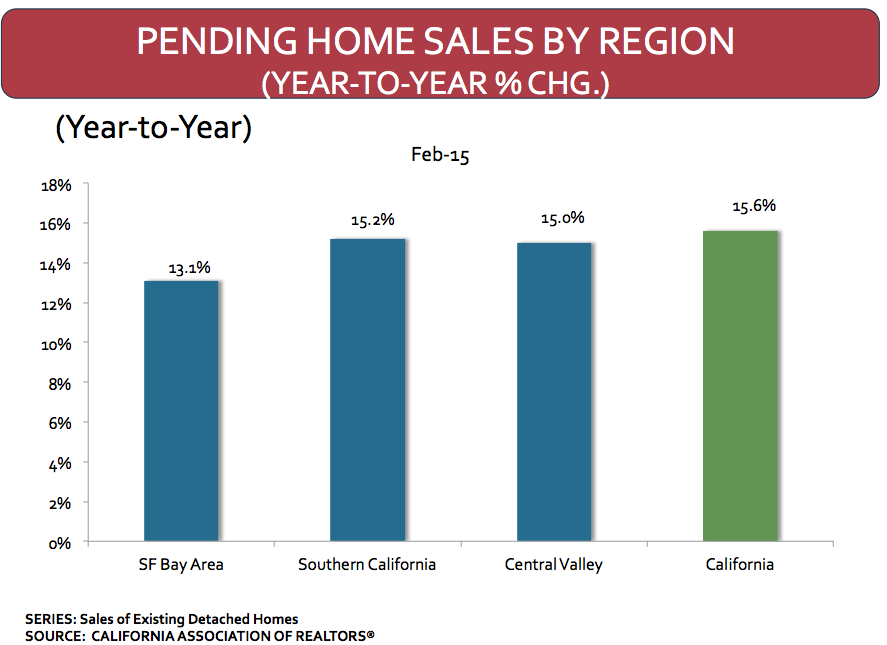

Statewide pending home sales were up 15.6 percent on an annual basis from the 97.1 index recorded in February 2014. The yearly increase was the largest since April 2009 and was the first double-digit gain since April 2012.

Click to enlarge

Source: CAR

This comes as good news for the state since it infamous for having a tough housing market to enter.

Dwight Johnston, chief economist for the California Credit Union League, explained that California is not changing anytime soon. There is no movement to loosen the problem in the states, and if anything, there are people who are restricting changes.

His tip for how to afford living in California: save.

In the old days, people didn’t need to put as great of an emphasis on saving, Johnston explained. However, now it really requires incomes to rise and people to save more.

Saving for a down payment, allows for a better loan-to-value ratio, keeping a borrower safer from risks of defaulting.

And if borrowers are struggling to save, Trulia (TRLA) outlined simple, but feasible, ways people can save over $10,000 in as little as three years if they just cut back in various areas.