With oil prices trending down again, the impact of the oil’s new normal will soon be felt throughout the housing industry, especially in cities whose economy is dependent from oil and gas drilling.

According to a new report from real estate analytics firm HouseCanary, oil price changes are a leading indicator of home values in many markets in the U.S.

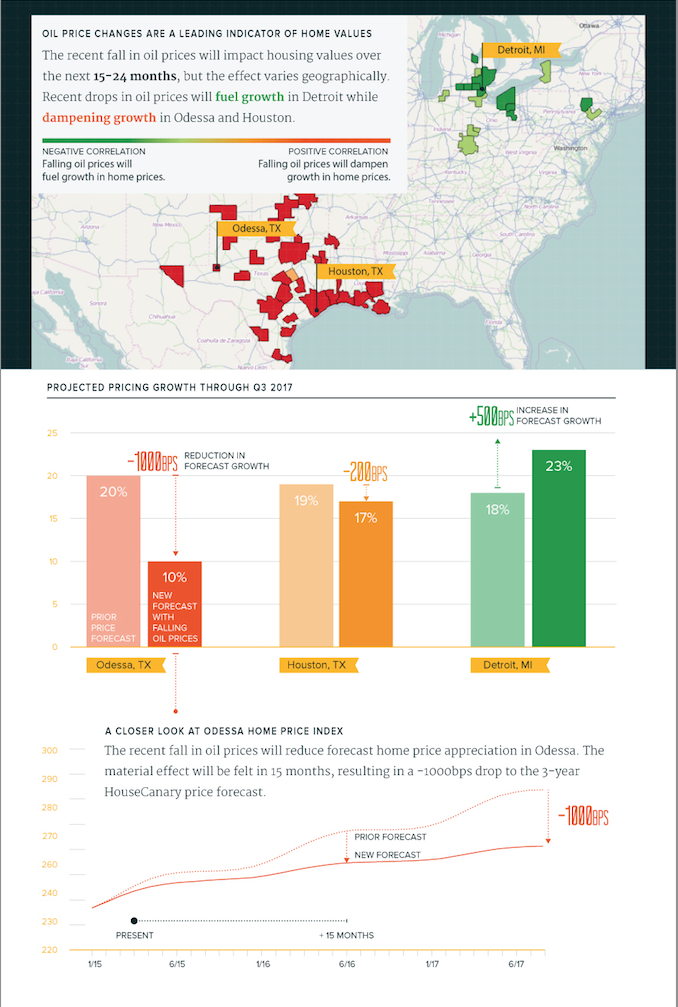

Failing oil prices will dampen growth in areas where the local economies are heavily based on the production of oil, HouseCanary said in the study. On the other hand, there are many areas that will see economic stimulation from low oil prices, which will fuel demand and housing price growth, the study showed.

As a result of failing oil prices, HouseCanary said that it is lowering its forecast for housing prices in two oil-heavy markets. For Odessa, Texas, HouseCanary adjusted its housing price forecast down by 1,000 basis points, lowering the growth target to from 20% cumulative growth to 10% through the third quarter of 2017.

The impact of falling oil prices will be felt less in Houston, but felt nonetheless. HouseCanary said that it is lowering its housing price forecast for Houston by 200 basis points to 17% cumulative growth through the third quarter of 2017.

But, as HouseCanary’s study shows, falling oil prices can also help many areas’ housing markets. One such market is Detroit, which according to HouseCanary’s data has seen its economy repeatedly stimulated over the last 40 years by failing oil prices.

As such, HouseCanary said that is increasing its home price forecast for Detroit by 500 basis points to 23% cumulative growth through the third quarter of 2017.

Click the image below to see an infographic (courtesy of HouseCanary) that shows the impact of falling oil prices in both Texas and Michigan.

According to Chris Stroud, HouseCanary chief of research and company co-founder, “strength in oil prices from 2014 are still fueling market conditions, but if low oil prices persist, the impact to home values will be more material."

While the impact on house prices will be felt in those oil-heavy areas, for the country as a whole, the impact of falling oil prices could prove to a positive for the economy, according to new research from Goldman Sachs (GS).

“We continue to expect that lower energy prices should prove a net benefit for growth and we would expect the negative direct and indirect effects of slowing energy activity on the labor market to be offset by the positive effects on employment in industries that are more closely tied to consumption,” Goldman Sachs analysts said in a new report.

“Overall, we expect monthly payroll growth over the next several months to be roughly in line with the current 3-month average of 197,000,” the analysts continued. “If we are correct that weakness in oil-related employment will spill over into slower job growth in closely-related non-energy sectors, the burden will be on consumer-related sectors to produce a greater share of payroll growth than they have on average over the last several months. While this seems likely over the longer run, it does raise the possibility that the negative effects on job growth from slowing oil production, where the adjustment has been more immediate than expected, could be a bit more front-loaded than the employment boost from consumer spending.”