Ocwen Financial (OCN) properly addressed its noncompliance and independence issues to a satisfactory standard after reports came out in December that the nonbank mortgage servicer inaccurately conducted its internal review.

Ocwen has been under the gun since February of last year, when the New York Department of Financial Services stopped its plans to buy a $2.7 billion MSR portfolio. Since then the NYDFS completely killed that deal with Wells Fargo (WFC) and any other bulk purchases of MSRs. The hits continued through the fall with the firm being accused of backdating letters to borrowers.

Ocwen, though, is having success cleaning up its operations per the unrelated National Mortgage Settlement.

"In May 2014, an Ocwen employee contacted a member of the Monitoring Committee and alleged serious deficiencies in the internal review group (IRG) process, which called into question the IRG’s independence and the integrity of the IRG’s operations," said Joseph Smith, the monitor for 2012's National Mortgage Settlement. "Additionally, after reviewing a letter issued by the New York Superintendent of Financial Services, which indicated that the date on certain correspondence from Ocwen to its consumers was incorrect, I directed Ocwen to scope, correct and remediate this letter dating problem."

On Wednesday, Smith filed a report with the United States District Court for the District of Columbia on his continued review of Ocwen’s compliance with the Settlement, finding that there were in fact errors in Ocwen’s internal review.

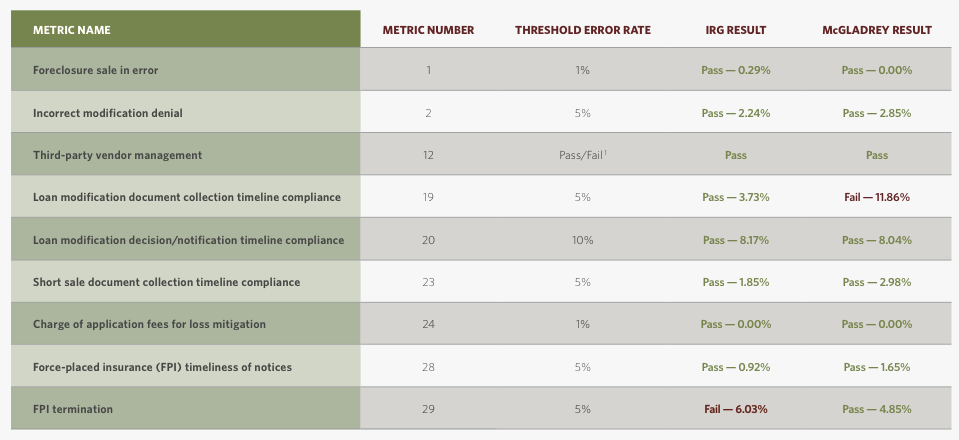

Click to enlarge

Source: NMS Monitor

The report includes results from the monitor’s retesting of work completed during the first quarter of 2014 as a result of his lack of confidence in Ocwen’s internal review group and outlines several actions Ocwen has taken to improve its IRG.

“Our retesting for the first quarter of 2014 of nine metrics that our investigation determined to be ‘at risk’ showed that the servicer failed one metric (Metric 19) that it had previously reported as a pass. Metric 19 tests whether the servicer is complying with the requirement to notify borrowers of any missing or incomplete documents in a loan modification application. Ocwen has proposed a corrective action plan to address the reasons for its failure, and I am reviewing it,” Smith said.

Here are 4 specific actions Ocwen took to address these problems:

- Ocwen replaced the executive who leads the IRG and otherwise reorganized employees.

- Ocwen adopted corporate governance principles.

- Ocwen also enhanced Smith’s access to information.

- In addition, Smith’s office also created a hotline to allow any concerned employees to contact Smith directly and anonymously if they see problems.

“As a result of these actions, I report to the Court that Ocwen internal review group’s independence, competency and capacity have shown measurable improvement,” Smith said. “Throughout my time as Monitor of the NMS, I have made transparency a priority. Although there is still work to be done to ensure Ocwen’s compliance, I felt it was important to report to the Court and to the public as the results of our retesting became available. I will continue to do so until I am satisfied that Ocwen has addressed its noncompliance and independence issues.”