More and more, homeowners are thinking more of their homes than the professionals.

According to the Quicken Loans study of home value perceptions, the trend of a widening gap between appraiser and homeowner opinions continued in April.

It’s been like this for the last three months and it's getting bigger.

Detroit-based Quicken Loans, the nation’s second-largest retail mortgage lender, uses its internally generated Home Price Perception Index to gauge how homeowners currently view the housing market.

In the latest report, the HPPI showed appraiser opinions were 0.69% below homeowner estimates.

The index dipped compared to March when appraiser opinions were 0.4% below homeowner estimates.

“There is nothing more disappointing to a homeowner than learning that the value of their home is less than they expected. This index is an important tool for lenders and homeowners alike as they set reasonable expectations for obtaining a mortgage,” said Quicken Loans Chief Economist Bob Walters.

“While it is not surprising to most appraisers that homeowners are overestimating their home’s value on a national average, we should always make note of the direction the trend is heading to help set expectations for homebuyers and those looking to refinance,” he added.

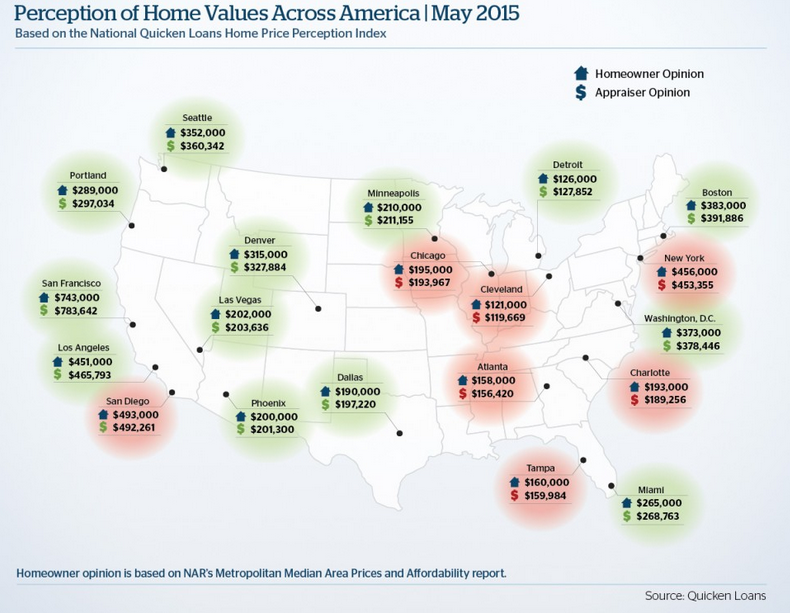

Here’s a chart breaking down some of the findings by major real estate market (click to enlatrge):