Conditions are ripe for more growth in house prices soon, according to the latest housing report from Capital Economics.

Sales of new single-family houses in April 2015 were at a seasonally adjusted annual rate of 517,000, according to estimates released jointly Tuesday by the U.S. Census Bureau and the Department of Housing and Urban Development.

This comes after a big drop in March which saw just 481,000 new home sales, the biggest drop in almost two years and primarily driven by a precipitous drop in sales in the Northeast in March.

This is 6.8% above the revised March rate of 484,000 and is 26.1% above the April 2014 estimate of 410,000.

And according to Capital Economics, the 6.8% m/m rebound in new home sales in April seems to confirm that the drop from the previous month was nothing more than a blip.

“By rising to an annualized rate of 517,000, up from 484,000 in March, new sales beat the consensus estimate of 500,000 but were very close to our own 520,000 forecast," write Ed Stansfield, chief property economist, and Andrew Hunter, assistant economist.

"We expect that continued strong employment growth and looser credit conditions should help sales to make further steady gains over the rest of the year,” they concluded in an email to clients this morning.

Meanwhile, the S&P Case Shiller adjusted 20-city house price index rose a very solid and slightly higher-than-expected 1% in March with gains across all cities and well balanced gains across all regions.

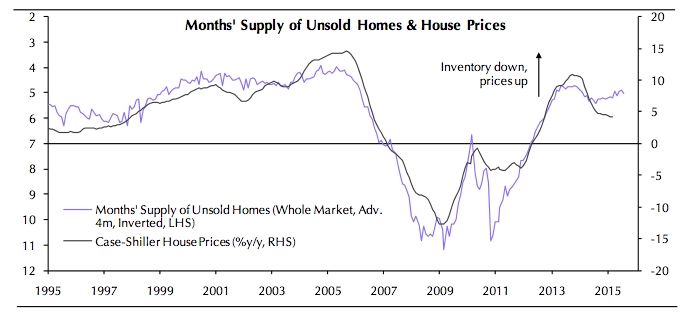

“The current tightness of supply conditions would normally be consistent with much faster price growth. The continued steady growth in home sales that we expect this year will only add to this upward pressure on prices,” the economists said.

“Furthermore, other measures such as the CoreLogic and FHFA indices suggest that house prices are still rising at an annual rate above 5%. All things considered, we expect a gradual acceleration in the Case-Shiller measure of price growth soon,” they continued.

All this feeds into the larger picture of what's really happening in the housing market. That is, as the below chart shows, in recent times, the months of supply remains low and steady while house price appreciation is also flattening out, with nowhere to go but up.

Click to enlarge

Source: Capital Economics