That’s the day that Marty McFly travels to in the seminal ’80s classic “Back to the Future II.” For Marty, that day is 30 years into his future. He’s summoned there by his trusty time-traveling compatriot, “Doc” Brown, to save Marty’s children’s lives.

When he arrives in 2015, he’s greeted with flying cars, hover boards, holographic imagery, digital handheld computers, video conferencing, automatic dog walkers, food hydrators, wearable technology, drones, self-drying clothes and shoes equipped with power shoelaces.

As it turns out, the filmmakers actually got a lot right about the year 2015. We have digital handheld computers, video conferencing and wearable technology. And we certainly have drones.

But we don’t have flying cars, hover boards, automatic dog walkers or self-drying clothes. And we certainly don’t have power shoelaces.

You win some and you lose some.

The filmmakers tried to envision what the future would look like 30 years down the road and they had some hits, but they had some misses, too. Clearly, predicting the future isn’t easy.

Think about how much life changed in the last 30 years, let alone the last 50.

Just 15 years ago, the Internet was still this new amazing thing that many of us could only access using a dial-up modem. And if you told someone in 1965 that one day they’d be able to carry an index card-sized device in their pocket that would allow them to access the totality of human knowledge within seconds, their heads might explode.

What about looking 50 years down the road from now? What will things look like in 2065? The possibilities are endless. And fascinating. What will our financial system look like? What about how we live and where we live?

And how will we get there?

To answer these tough questions and more, HousingWire polled some of the brightest minds in the housing industry to get their predictions for the future. But more than just predictions, they spoke about how we’re going get to where we’re going, and what we all need to do to ready ourselves for what’s coming.

ADAPTING TO THE UNIMAGINABLE

Nearly every person that HousingWire spoke to shared the same advice — be ready to adapt to changes that none of us can imagine.

“Find a way to evolve and innovate,” said Jonathan Smoke, chief economist at realtor.com. “I’m concerned today that the industry is lacking in representation of Millennials, who will define industry trends for at least the next 20 years. Success has a way of narrowing our vision over time as we stick to what we do best. To counter that, we have to intentionally scan the horizon and ideally inject youth, diversity and different perspectives even though that might seem inefficient or unnecessary in the short term.”

Being connected to the customer and being prepared to change are key going forward, according to Frank Nothaft, chief economist at CoreLogic.

“There are two things that come right to mind,” Nothaft said when asked what advice he’d give on how to stay in business for the next 50 years.

“One is that it’s critical to have the connection with the customer. Understand what the customer’s needs are. If you’re a lender, you have to understand what the needs of the borrower are. If you’re more in the secondary market, you have to understand what the needs are of the primary market lenders. Just be really on top of what the trends and developments are in the marketplace to meet the customers’ needs,” he said.

“The second thing is technology. We’ve seen so much evolution in technology over just the last 10-20 years and it’s not going to stop. There’s so much technological development underway right now that are going to have lasting impacts on the housing finance system,” Nothaft said.

“It’s hard to say what those changes are going to be 40-50 years from now,” he added. “But you’re going to have to stay on top of the technological developments and find a way to implement them efficiently; otherwise you’re going to be history.”

Embracing change is key, said Mat Ishbia, president and CEO of United Wholesale Mortgage (and one of our Rising Stars: see page 44).

“It’s imperative that business leaders embrace change – from a compliance and regulatory perspective, but also from a technology and origination perspective. View change as an opportunity to gain a competitive advantage,” Ishbia said. “The mortgage industry is constantly evolving and it’s the wrong mentality to think that the way things have always been done will continue to remain the same. In order to be in business 20 years down the line, companies will have to be great at adapting and modifying their processes. When a new law comes out, embrace it and find a way to make it work, because it will lead to success.”

“It’s imperative that business leaders embrace change – from a compliance and regulatory perspective, but also from a technology and origination perspective. View change as an opportunity to gain a competitive advantage,” Ishbia said. “The mortgage industry is constantly evolving and it’s the wrong mentality to think that the way things have always been done will continue to remain the same. In order to be in business 20 years down the line, companies will have to be great at adapting and modifying their processes. When a new law comes out, embrace it and find a way to make it work, because it will lead to success.”

Staying on top of the never-ending changes and developments in technology is imperative but it’s not the be-all, end-all, according to Ilyce Glink, CEO of Glink Media and a HousingWire 2014 Woman of Influence.

“You really have to become an early adopter of new technology and new apps,” Glink said. “But in the end, technology won’t give you staying power. You have to use technology to provide outstanding customer service. Buying and selling real estate is a highly emotional process.”

One way that many of the people HousingWirespoke to see technology impacting the industry is in the mortgage process itself.

“The entire world is starting to be done with algorithms. Decades from now technology will have the capacity to know everything in seconds,” said Logan Mohtashami, senior loan officer at AMC Lending Group and one of the most prolific housing presences on social media. “Your income, liquid assets amount, your debt-to-income ratio will be known in a nanosecond and technology will know where it is best for you to live and if a property is available. We are far from that day and age, but that is the future.”

RISE OF THE MACHINES

Ed Fay, CEO of Fay Servicing, suggests that the human element will be scaled back in some areas of housing, but it won’t ever disappear permanently.

“Automation will continue to replace real people in certain areas of the mortgage industry; however, the human element is too essential to be fully replaced. Every borrower’s financial situation is unique and evolves over time,” Fay said.

“This dynamic is the reason algorithms and computers could never replace the value that human interaction brings to the business,” Fay continued. “Whether you are servicing a loan or trying to originate one, nothing compares to expertise and the ability to make a connection with a borrower, no matter what the circumstances may be. That will never change.”

But the improvement in utilizing data could lead to a vastly different mortgage process, Glink said.

“I?‘m certain that data will continue to drive most decisions when it comes to housing,” she said. “By then, we’ll probably have kiosks that will do a mortgage for you on the spot. So, loan officers will disappear. On the plus side, because all of the data will be electronic, you might get approved in 60 seconds or less.?”

The way investors conduct their business will change too, according to K.C. Brotherton, senior director of product management at HomeUnion.

“The biggest thing is that you have to embrace technology and you have to keep an eye on what’s going on in the market. You can’t fight technology,” Brotherton said.

“If we look at the investor side, it won’t be 100% online. But you’ll leverage the data to succeed. People will rely more and more on technology and that will take some of the emotional aspects out of it,” Brotherton said. “I think the online marketplace will really drive that and the agent will be become more of the local expert. There’s still going to be that expert with boots on the ground, but investors will be more educated.”

Several people HousingWire spoke to expect a change in the way borrowers are evaluated.

Several people HousingWire spoke to expect a change in the way borrowers are evaluated.

“With all the new-age technology and data that exists about people, I believe the mortgage industry will adopt more of an all-encompassing metric to determine loan qualifications within the next 15 years, and trend away from FICO scores,” Ishbia said. “I think it will change the game and make the process of lending so much easier because you’ll know if borrowers qualify for a mortgage based on this all-encompassing metric.”

Nothaft predicts that the mortgage itself may become smarter, much like the smart houses being built today.

“One innovation we might see is something I’d call a ‘smart mortgage,’ just like how builders today talk about a smart house with the microchips already built in so that even when you’re away from the home you can control the temperature, or you can turn on the stove to start dinner,” Nothaft said.

“You could also have a smart mortgage that alerts you that interest rates are falling and it might be a great time to refinance your loan. Or maybe this is a great time to tap into the home equity that you’ve accumulated and take out a home equity line,” he said.

“So you can envision some type of mortgage or application that follows trends on property values, follows trends on market interest rates, and is smart, in the sense that it tells the borrower, hey, this is a good time to refinance or to take out a HELOC, etc.”

A DIFFERENT KIND OF MORTGAGE

Several industry insiders suggested that the mortgage loan may become more portable in the future, perhaps traveling with the borrower from house to house as they move.

“This has been an idea that’s popped up from time to time — making mortgages portable,” Nothaft said. “So that while it’s secured by a specific property, as you know, people move. And maybe you can design a mortgage that you take with you. And you take it to the next property you go to.”

Glink also believes we could see a portable mortgage in the future. “You might have a mortgage for life that will follow you around from property to property,” she said.

Smoke also believes that mortgages will take different forms in the future.

“We have far more choices today than in 1965 and I would expect that trend to continue as long as we encourage innovation in risk-appropriate lending,” Smoke said. “If so, what do you think mortgages will look like? Shorter? Longer? I expect that limited affordability in high cost areas will drive the most innovation, perhaps in shared equity concepts or longer amortization periods beyond 30 years.”

BIG BROTHER

While the mortgage loan itself will take on different forms in the future, one thing that won’t be leaving the housing finance system is the government and its role in the market.

What role the government will play elicits varying answers.

“What I expect to see in this evolution over the next many years is that the federal government will continue to play an important role but it will be a different role than the one they play now,” Nothaft said.

“I don’t think the government wants to be in the position of managing large institutions in the secondary market, like Fannie Mae and Freddie Mac.”

Nothaft speaks from experience when it comes to the role the

government is currently playing in housing, having spent nearly 30 years with Freddie Mac, including the last 13 years as Freddie Mac’s chief economist.

“I think most policy people would agree that that should be something in the hands of the private sector, in terms of managing and running those companies,” Nothaft said of Fannie and Freddie.

“There will still be a lot of federal oversight in the future, but it could be coupled with an insurance mechanism where the mortgage-backed securities are insured by a federal entity, a little bit like FDIC insures deposits at banks right now,” he said.

“So it could be a structure like that where the government is providing the overarching backdrop or guarantee in case of another huge failing in the financial markets. But the first line of defense and first loss will be private capital not government capital. So that’s where I think we’re going to see the system evolve over time.

“So is that a bigger role or a smaller role for government? That’s hard to say,” Nothaft said with a chuckle. “It’s a different role from the one it has right now.”

Despite all of that, Nothaft believes that Fannie and Freddie or some other company (or companies) functioning in similar capacity will still be around in 2065.

“I think there’s going to be an ongoing role for the secondary mortgage market long-term in the U.S. I think the housing finance market will continue to evolve going forward. I think there’s a critical need to link the primary market in the U.S. with global capital markets,” Nothaft said.

“And for that, you need some type of efficient viable secondary market at play. So whether it’s Fannie Mae and Freddie Mac as constituted today or some different institutions playing that same role, I think that function is still critical.

“And for that, you need some type of efficient viable secondary market at play. So whether it’s Fannie Mae and Freddie Mac as constituted today or some different institutions playing that same role, I think that function is still critical.

“So when we look out 50 years from now, I think we still see that there’s a viable secondary mortgage market that’s going to be a lynchpin for pumping credit from global capital markets into the primary market in the U.S.,” Nothaft said. “What those institutions look like, I don’t know. But we know, or I believe, that function is still going to be critical. So they’ll be somebody playing that role in the future.”

Glink shares Nothaft’s view that the secondary market is key.

“I don’t think we can let private lenders control the housing market,” Glink said, adding that the housing market would be “more dangerous” if Fannie and Freddie disappear.

Mohtashami believes that the governmental involvement may take a different form in the future.

“Massive, affordable housing just isn’t being constructed,” Mohtashami said. “With globalization, technology, debt and demographics showing their ‘Four Horsemen’ capacity this century, the government will step in and do what the builders don’t want nor can’t do, build affordable housing.”

Much of the government’s current involvement in housing was necessitated by the recent economic crisis. Asked how to avoid the next economic crisis, whatever the cause may be, the answers varied.

“If we’ve learned anything from the last 15 years, I hope it’s a dose of humility that we cannot create a ‘new economy’ immune from crises. But the problem with crises is that they emerge in ways that we’ve not seen before,” Smoke said. “It’s tough to be prepared for the next problem when we tend to focus myopically on the last crisis—much like today! My eyes are wide open and I’m committed to trying to make sense of what is happening in housing. I will be looking for new insights and new data to help us understand the complex dynamics that influence the market.”

Glink agreed that we will not be able to avoid severe economic downturns in the future. “There will be many more economic crisis between now and 2065,” Glink said. “If you look at the last 200 years, there has been a financial crisis about once every 10 to 20 years. Nothing about that timeline will change except the swings may get a lot bigger.?”

Glink agreed that we will not be able to avoid severe economic downturns in the future. “There will be many more economic crisis between now and 2065,” Glink said. “If you look at the last 200 years, there has been a financial crisis about once every 10 to 20 years. Nothing about that timeline will change except the swings may get a lot bigger.?”

Mohtashami suggested that there will always be a looming economic crisis, in some form or another.

“There will always be a crisis in history. Just look at the U.S economic history since 1790,” Mohtashami said.

“There was the panic of real estate in 1796, the economic crisis of 1819 after the War of 1812, the depression of 1837-1843, the bank and railroad collapse in 1861, the railroad strike of 1877, the fear of 1907 and the run on the banks, the Great Depression of 1929-1941, the oil shock and the massive inflation of the late 1970s Misery Index peak, the stock market bubble and collapse of the late 1990s and finally the housing bubble and collapse in the last decade,” he said.

“History has shown us two things. First, there will always be someone to fight,” he said. “Second, there will always be an economic crisis at some point. Right now, the global central bank intervention around the world and yields are very low everywhere. If yields spike out of control for some reason, that could the cause of the next crisis.”

MEET GEORGE JETSON

No matter what happens with the economy, one common thing that all our sources were sure of is that the houses themselves won’t look the same in 2065 as they do now.

“?I think we’ll have more tech-heavy homes, and more homes that are truly green,” Glink said. “I think most homes will have some sort of mini-greenhouse attached, and will be growing some sort of produce. I also think we’ll have reached the point where most houses will be carbon neutral, using very little water — it’ll all be reused — and energy.?”

Nothaft agrees that construction will be even “greener” in the future.

“I think there will be a bigger push for houses that are green,” he said. “In the future, it might be that in your roofing tile, there’s a built-in solar panel, so that when you cover your roof, you’re also covering it with solar panels that can be used to power your house and then sell the access to the grid.”

Nothaft and Glink aren’t alone in thinking the way we’ll actually live will be different in the future.

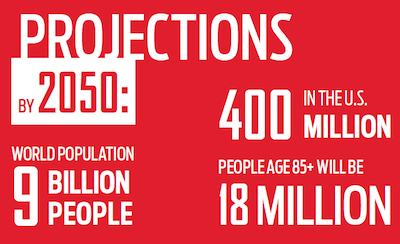

“Housing fulfills a fundamental human need, so I’m positive housing will remain a central focus of consumers and leaders,” Smoke said. “Population trends would suggest that we will need much more housing. We’re likely to see more vertical construction in ‘mega cities’ where land scarcity is already acute and drives up the cost of both rental and ownership housing. We could see technology breakthroughs that change the work-home dynamic or extend the boundaries or even eliminate the need for commutes.”

Another big change to prepare for is the country’s shifting demographics, Nothaft said.

“One challenge we seem to have in delivering credit in the housing finance system is the adequate access to credit for all types of borrowers across all ethnic and racial groups. There’s a significant homeownership gap or difference between white, non-Hispanic households and minority households,” Nothaft said

“There’s still some sand in the gears in terms of this housing finance machine that provides credit that is not making access as uniform across all groups as it could. I think that’s a challenge longer term,” Nothaft added.

“Because when you look at the demographic drivers, looking 50 years out, beyond just the Millennials that are coming into the housing market in the next decade. But when you look out in the future, all the projections show a substantial change in the racial and ethnic composition of America,” he said.

“Because when you look at the demographic drivers, looking 50 years out, beyond just the Millennials that are coming into the housing market in the next decade. But when you look out in the future, all the projections show a substantial change in the racial and ethnic composition of America,” he said.

“Now, 70% of households are white, non-Hispanic, but when you get out 50 years from now, white, non-Hispanic households are less than half of all the households in the United States,” Nothaft said.

“So it’s a gradual but steady shift over a long period of time and I think it’s incumbent on the machine that delivers housing finance here in the U.S. to figure out how to ensure fair and equal access to all applicants.”

Smoke agreed that the makeup of the house-buying population is absolutely going to change, and the industry needs to focus on Millennials.

“Twenty-five to 34-year-old households represented the largest share of home buyers last year. Their home-owning numbers are not far from what we would expect controlling for their age and the recent economic cycle,” Smoke said. “Given their sheer numbers, they will be a dominant force for the next 20-40 years.”

But the industry needs to focus on the generation beyond Millennials, Smoke said.

“Some call them ‘Generation Z’ since they follow ‘X’ and ‘Y.’ They are still being made, but they are on pace to be even larger than the Millennials,” Smoke said. “Looking at population trends, we have nothing to worry about with regard to the future demand for housing in the U.S., thanks to the Y’s and the Z’s and immigration.”

Looking ahead 50 years, life will be vastly different. But perhaps not as different as we once thought.

“I remember a line from a song in the early ’80s that said something like ‘It’s the ’80s, so where’s my rocket pack?’ The safest bet is that 2065 will look more like today than the picture we see on the Jetsons,” Smoke said.

We may not have flying cars or hoverboards or even power shoelaces in 2065, but our world will be different in ways we can’t even imagine. Time to start thinking ahead.