A new study from RealtyTrac and Down Payment Resource shows the top 10 and bottom 10 markets in the U.S. in terms of affordability and accessibility for low down payment borrowers.

According to RealtyTrac and Down Payment Resource, the study reviewed 370 counties, and ranked each based on how it scored in five metrics: affordability of house payment in April 2015 relative to its historical average; maximum income allowed for homeownership programs relative to median income; maximum home price allowed for down payment help relative to median home prices; average down payment program benefit relative to median home prices; and number of homeownership programs available relative to total housing units.

On a whole, for the 370 counties that the study covered, 334 (90%) were more affordable for low down payment buyers in April 2015 than their historic averages.

In many major counties, homes are still more affordable than their historic averages, the study found. Major counties still more affordable than their historic averages included Cook County, Illinois (Chicago), Maricopa County, Arizona (Phoenix), San Diego County, California, Miami-Dade County, Florida, and Riverside County in Southern California.

There were 36 counties of the 370 analyzed (10%) that were less affordable for low down payment buyers in April 2015 than their historic averages.

Counties least affordable relative to their historic averages were San Francisco and San Mateo counties in the San Francisco metro area, Kings County (Brooklyn), New York, Santa Clara County, California in the San Jose metro area, and Denver County, Colorado.

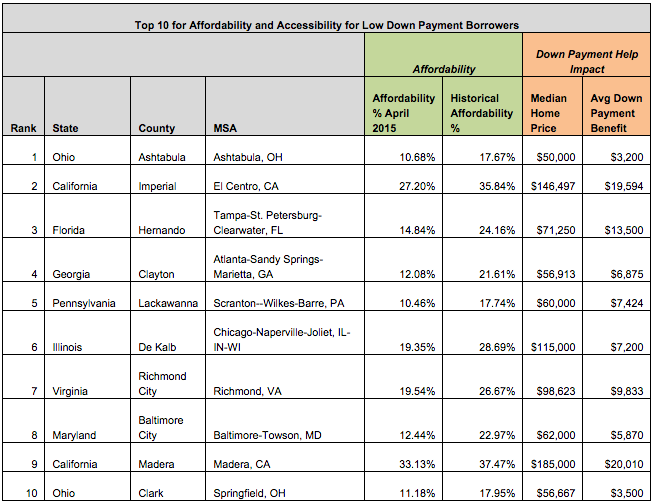

After reviewing all 370 counties, RealtyTrac and Down Payment Resource found the top ten most affordable markets for low down payment borrowers.

Of the counties analyzed the top five highest for affordability and accessibility for low down payment buyers included Ashtabula, Ohio, Imperial, California in the El Centro metro area, Hernando, Florida in the Tampa metro area, Clayton, Georgia in the Atlanta metro area and Lackawanna, Pennsylvania in the Scranton metro area, the study showed.

Click the image below to see the top 10 most affordable markets for low down payment borrowers.

(Image courtesy of RealtyTrac and Down Payment Resource)

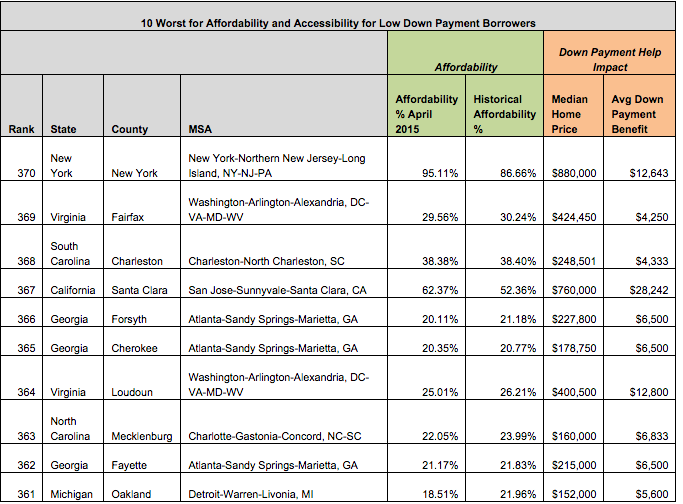

On the other end of the scale were the bottom 10 markets in terms of affordability and accessibility for low down payment buyers. That list includes New York, New York, Fairfax, Virginia in the DC metro area, Charleston, South Carolina, Santa Clara, California in the San Jose metro area and Forsyth, Georgia in the Atlanta metro area.

Click the image below to see the bottom 10 least affordable markets for low down payment borrowers.

(Image courtesy of RealtyTrac and Down Payment Resource)

Other markets in the bottom 25 score for affordability and accessibility for low down payment buyers included counties in Seattle, San Francisco, , Chicago, Philadelphia, Des Moines, Iowa, Minneapolis and Reno, Nevada.

“This analysis demonstrates that low down payment borrowers can find affordable housing and good accessibility to down payment help in a wide variety of markets nationwide,” said Daren Blomquist, vice president at RealtyTrac. “However, within many major metro areas the most affordable and accessible markets for low down payment buyers are often those furthest from jobs and other amenities that many buyers want.”

On average, across all 370 counties analyzed the average amount of down payment help was $10,443 and that was on average 6.84% of the median home sales price in April, the study found.

Counties with the highest average down payment program benefit as a percentage of the median home sales price in April 2015 were Volusia County, Florida in the Deltona-Daytona Beach-Ormond Beach metro area (24.73%), Pasco County, Florida in the Tampa metro area (24.16%), Kern County, California in the Bakersfield metro area (21.62%), Sullivan County, Tennessee in the Kingsport-Bristol metro area, and Broward County, Florida in the Miami metro area.

Counties with the highest average down payment assistance in dollars were San Francisco, California ($51,713), Orange County, California ($43,121), Los Angeles County, California ($40,004), Placer County, California in the Sacramento metro area ($35,475) and King County, Washington in the Seattle metro area ($33,735).

“Housing affordability is a critical issue for all buyers today. This report underscores the fact that there are significant missed opportunities for down payment help, even in the areas ranked worst in affordability,” said Rob Chrane, CEO of Down Payment Resource.

“There are programs in every community that could increase housing affordability for buyers, especially first time and boomerang buyers,” Chrane continued. “The entry cost for homeownership is the greatest challenge for all buyers. This report highlights how homebuyers can save on their home loan when they access available programs.”