The mortgage industry breathed a palpable sigh of relief on June 3 when the Consumer Financial Protection Bureau announced that it would grant a good-faith enforcement period for complying with the TILA-RESPA Integrated Disclosure rule.

After a frantic 21-month implementation period, and then two quick changes by the CFPB, the TRID rule will become effective Oct. 3. Lenders and third-party vendors will now have a few months to work out the implications of the rule during an enforcement grace period before being slapped with steep fines for noncompliance. The CFPB decided on the grace period after heavy lobbying by industry leaders and a bipartisan group of congressmen, who held hearings on the matter in March and again in May.

The enforcement reprieve is the only bright spot in the otherwise catastrophic decision by the CFPB — as directed by Dodd-Frank — to reform consumer disclosures.

JUST A FEW CHANGES?

A summary of the TRID changes seems straightforward on the surface: Give consumers a Loan Estimate within three days of their mortgage application, and give them a combined disclosure three days before closing. The CFPB released the final TRID rule in 2013 to help potential borrowers understand the true costs of a mortgage loan and give them the freedom to shop around for better rates.

But the help to consumers comes at a high cost to lenders.

First of all, it’s hard to see how lenders will be able to comply unless their mortgage process is mostly automated. The rule requires lenders to coordinate the timing of dynamic communications among all the parties involved — title and settlement services companies, Realtors and consumers themselves — something that is immeasurably harder with a paper process.

Indeed, the TRID rule is just part of the CFPB’s larger mission to push the industry to adopt a wholly electronic process to help consumers.

Law firm Morrison Foerster, in an Executive Perspective of TRID presentation, concluded that:

- “CFPB is driving overall, end-to-end electronic workflow for residential mortgage loans, not just e-signatures, but entirely electronic processes.

- CFPB has (too much) faith in the inerrability of computer systems, particularly systems that collect and manage data.

- CFPB believes long timeline to implementation justifies the effort, expenditure.”

In a hearing before the House Financial Services Committee’s Housing and Insurance Subcommittee in May, industry leaders testified to the difficulty and cost of adhering to the new rule. A note from the subcommittee said retrofitting forms and information technology systems so they comply with the new rule will cost an estimated $100 million, which will be passed on to consumers trying to buy a home.

The CFPB’s director, Richard Cordray, hasn’t seemed to understand the complexity of working the new timing and communications into lenders’ processes. In remarks at a conference of the National Association of Realtors in May, Cordray expressed optimism about the industry’s ability to make the changes by the deadline.

“We learned from that (QM) experience, and so from the time this rule was finalized in November 2013, we have focused on supporting industry implementation so the market will be ready when the rule takes effect in August. We also heard extensive input from all parties and opted to provide a 21-month implementation period. All of our hard work with industry is reflected in what we are now hearing, which is that most market players have put themselves in position to be ready by August, and others are getting ready as well.”

But lenders and the third-party vendors who have been trying to deliver TRID-compliant systems take issue with that rosy view. Everything from the definition of an application to what comprises a day had to be dissected and decided on, then worked around other regulations.

The Mortgage Bankers Association, as part of the appeal to the subcommittee for an enforcement grace period, had this to say:

“The final rule, comprising 1,888 pages, is far more than a new set of forms — it is a wide-reaching new regulatory regime that changes the timing and requirements for the entire real estate settlement process, not just the mortgage transaction.

“Following the issuance of this rule, it has taken virtually all of the implementation period to discern the countless implementation questions it has raised and it has also taken most of that time for the CFPB to provide answers to some but not all of these questions,” the MBA stated.

That translated to a compressed timeline, leaving vendors scrambling to develop compliant new programs, and lenders scrambling to figure out how to pay for those programs.

“The rules that lenders must follow are still confusing and difficult to apply. Given the scope and complexity of these new rules, the implementation of this regulation will impose high costs on all lenders and consumers,” said Cindy Lowman, president of United Bank Mortgage Corporation, at the House hearing.

Diane Evans, president of the American Land Title Association, submitted this testimony for the hearing: “This regulation is more than just two new disclosure forms. It represents a paradigm shift in the way real estate settlements occur in this country.”

That hearing was just one part of the appeal by industry leaders and their Congressional representatives to get an enforcement grace period from the CFPB. In March a group of 17 trade organizations formally requested the grace period, and in May, 225 members of Congress from both parties sent a letter to the CFPB asking for temporary safe harbor from enforcement of the TRID rule.

From the May 20 letter to the CFPB: “Nevertheless, this complicated and extensive rule is likely to cause challenges during implementation, which is currently scheduled for August 1, 2015, that could negatively impact consumers. As you know, the housing market is highly seasonal, with August, September, and October consistently being some of the busiest months of the year for home sales and settlements.

“By contrast, January and February are consistently the slowest months of the year for real estate activity. We therefore encourage the Bureau to announce and implement a ‘grace period’ for those seeking to comply in good faith from August 1st through the end of 2015.”

The CFPB left the grace period open-ended and most in the industry interpreted that to mean that it will last throughout the rest of 2015, at least. Unfortunately, as welcome as that grace period is, TRID remains a costly and complicated fix that has enormous implications for the whole industry.

The CFPB left the grace period open-ended and most in the industry interpreted that to mean that it will last throughout the rest of 2015, at least. Unfortunately, as welcome as that grace period is, TRID remains a costly and complicated fix that has enormous implications for the whole industry.

“In many respects, the grace period doesn’t change anything,” said Jonathan Kunkle, president of LenderLive’s Guardian Docs division. “Every lender in America has been marching toward Aug. 1 and it’s going to be a cataclysmic event for our industry. The grace period just allows lenders to get their gear oiled and ready for the post-enforcement period.”

The consequences of complying with the rule are magnified for small and medium-sized lenders, who lack the resources to absorb the higher costs.

A GAME-CHANGER FOR SMALL LENDERS

A post on respalawyer.com this spring reported that some big banks were completely ready for TRID at the end of February — months before the deadline. These banks “went in-house and designed their LOS systems due to concerns about meeting the implementation rule deadline.”

Megabanks, which have already invested millions in automated systems for other regulations and which can dedicate large amounts of money and staff to TRID regulations, will be compliant by the deadline. But what about smaller lenders?

For small lenders, the cost of compliance with TRID, on top of previous Dodd-Frank rules, can be a game-changer.

Despite the significant role they play in small towns and rural areas, community banks — those with less than $10 billion in assets — have seen some of the most negative consequences of regulation. A working paper on community banking released by the Harvard Kennedy School of Government in February details the repercussions of increased legislation on these banks.

The research revealed that community banks lost 6% of their share of U.S. banking assets between the second quarter of 2006 and mid-2010, presumably from the financial crisis. But their share has shrunk even more drastically — 12% — since the second quarter of 2010, around the time of the Dodd-Frank reforms.

“Our findings appear to validate concerns that an increasingly complex and uncoordinated regulatory system has created an uneven regulatory playing field that is accelerating consolidation for the wrong reasons…The rapid rate of consolidation away from community banks that has occurred since Dodd-Frank’s passage is striking given that this regulatory overhaul was billed as an effort to end ‘too-big-to-fail,’” the working paper reported.

Part of the Harvard study asked what regulatory concerns drove community banks to seek the most guidance. The first two concerns on the list? TILA and RESPA.

At the American Bankers Association conference in April, Richard Andreano, partner at Ballard Spahr, went even further, saying that the new rule could be the “nail in the coffin for smaller mortgage lenders.”

WORTH IT IN THE END?

The CFPB introduced TRID so that consumers could understand more about the mortgage closing process and make informed choices when borrowing. No one disputes the fact that the process of getting a mortgage can be frustrating and confusing for consumers. But when it comes to regulation, sometimes the remedy is worse than the disease.

In the process of defining the rule, the CFPB conducted a large-scale quantitative validation study of the new forms, and concluded that the new integrated disclosures had on average “statistically significant better performance” than the previous disclosures under TILA and RESPA.

And according to the CFPB’s website, the new Loan Estimate and Closing Disclosure “use clear language and design to make it easier for consumers to locate key information, such as interest rate, monthly payments, and costs to close the loan. The forms also provide more information to help consumers decide whether they can afford the loan and to facilitate comparison of the cost of different loan offers, including the cost of loans over time.”

And according to the CFPB’s website, the new Loan Estimate and Closing Disclosure “use clear language and design to make it easier for consumers to locate key information, such as interest rate, monthly payments, and costs to close the loan. The forms also provide more information to help consumers decide whether they can afford the loan and to facilitate comparison of the cost of different loan offers, including the cost of loans over time.”

But whether the benefits to consumers will outweigh the cost to lenders is an open question.

“The new forms remain lengthy and intimidating to average consumers,” Lowman said at the House subcommittee hearing.

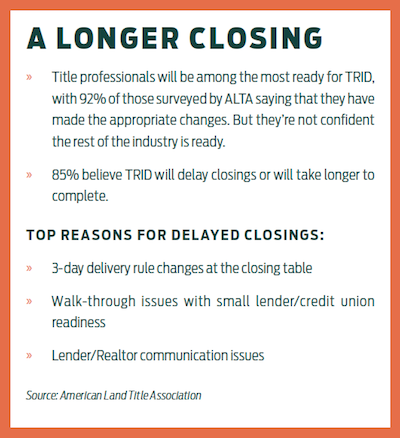

According to a survey by the American Land Title Association in 2015, “more than two-thirds of the respondents believe the TILA-RESPA forms will not help the CFPB meet its objective of helping consumers understand or be better prepared to understand the costs of buying a home.”

Even supporters wonder if borrowers will actually read the new forms. “Some do believe the new Closing Disclosure will help consumers understand the costs associated with purchasing a home,” ALTA stated on its website. “According to one person, ‘The contents of the Closing Disclosure Form are great and I love the first page details. However, I believe the average consumer will choose to ignore the remainder. It is all about how much is my payment and how much do I bring to closing. Beyond that, most simply do not care.’”

A note from the House subcommittee said, “It’s unclear whether the proposed changes will actually simplify the mortgage closing process and provide a meaningful benefit to consumers, or at least a benefit that outweighs the higher costs.”

And the rule is far from clear on some points. “To date, the CFPB has provided guidance only orally, which many industry members consider to be lacking. The industry has found numerous issues that are not clearly addressed by the rule and will require CFPB guidance, which appears to have been a factor in the trade groups’ request to the CFPB,” Ballard Spahr’s CFPB Monitor blog reported in March.

One glaring example of the clarity needed is the price of title insurance.

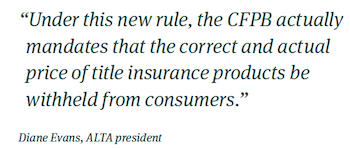

“For the majority of real estate transactions, the rule requires a complicated formula that will disclose to consumers an inaccurate price for title insurance. Under this new rule, the CFPB actually mandates that the correct and actual price title insurance products be withheld from consumers,” Evans testified before the subcommittee.

Unfortunately, these concerns won’t be factored into the CFPB’s strict enforcement standard or the fines that lenders will face for noncompliance. Under Dodd-Frank, the CFPB can fine lenders $5,000 per day per violation, $25,000 per day for reckless violations and $1 million per day for knowing violations. And turning to vendors for the answers doesn’t solve the whole problem for lenders.

“Vendors delivering workflow-based solutions will provide only PART of what is need for compliance with TRID,” according to Morrison Foerster. “Just getting the process right will not be enough, according to the regulators.”

“CFPB and banking regulators still will be looking for compliance with all aspects of the rule and Exam Guidelines. Specific, documented policies, procedures and controls, in particular QC tailored to TRID. In the end, risk falls to originating lender under TRID Rule,” they concluded.

Mitigating that risk means investing in more compliance personnel, QC systems and automation, which means the cost of originating loans has just gotten higher. Passing that cost on to consumers will be tolerable as long as interest rates remain artificially low because of Fed policy. The minute the Fed starts raising interest rates, these compliance costs will start pricing out large swaths of would-be borrowers.

The awful truth about TRID? In the end it hurts not only the industry, but the very people it was supposed to help.

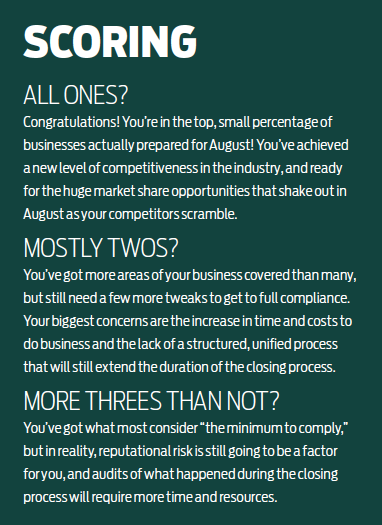

Is your organization ready for Oct. 3? We asked technology company Pavaso to break down the categories that will separate the truly compliant from the rest of the pack on judgment day. Compare your company’s progress against the criteria below to determine where you are today and what it will take to be fully prepared for the TRID deadline.

Production

1. You’ve got the fees and tolerances covered with adequate tools and processes that work for you and your business partners. Information changing after delivery is highly unlikely, but in case something changes, you’ve got the plan and process to handle it.

2. You’ve laid out a fairly decent process with your business partners and may be facing too many tools with most of them, creating an expensive, and time-intensive maintenance headache. But hey, you’ve got a plan to stay out of trouble on the fees and tolerance rules.

3. You have a general process, maybe even a “band-aid” tool for you and one or two of your business partners to handle the fees. Quite a bit of manual checking will still be required to ensure tolerance rules aren’t violated.

Delivery

1. You and your business partners use a common tool to deliver the LE, CDF and entire closing package for the three-day rule, prove consumer receipt and acknowledgment, and even capture the intent to sign documents at the closing table.

2. You’ve heard about delivery tools and likely started to explore some of them, but they’re focused on the LE and/or CDF and ignore the fact that the three-day rule applies to the ENTIRE closing package.

3. You’ve decided that “going postal” is actually OK, even if it means the overall time of the closing process will be significantly longer than it already is.

Consumer experience

1. You’re at a whole new level with an engaging, transparent and unified process for the consumer and every stakeholder involved. Educating consumers is consistent and measurable, and they’ve been able to compare services for selection. Not only are closings smooth and enjoyable for all involved, but you’ve got confirmation on the consistency and completion of how they were executed.

2. You’ve invested in some capability to deliver better customer service and information on multiple devices, but it’s still a separate process from your business partners (who may not be at your level yet) to the consumer. You’re planning to provide some educational material, but not looking forward to how much time and attention that will place on your resources.

3. You plan to keep doing business as you always have, because only two forms are changing, right?

Secure Communication

1. Documents are securely delivered, and a unified communication channel with smart notifications helps you be proactive with the consumer and business partners. Best of all, the status, documents, actions and communication of the transaction are easy to package up for auditing in addition to being secure.

2. Maybe you’ve dished out the dough for an encrypted email system or have found tools that you’re trying to get your business partners on. Most likely, you’re wondering if there’s a cheaper way to pull this off, that doesn’t involve debates with business partners over which one will be adopted.

3. For some reason, you’ve got a stubbornly vested interest in unstructured phone calls, emails, faxes and couriers, all of which are communication methods that really aren’t that secure and definitely not centralized.

Audit tracking

1. You’ve got proof that you delivered the documents to the consumer on time, provided a high-quality level of service consistent with every other consumer you’ve served, and executed the closing properly. Oh, and many of these details are automatically shared with the secondary market to speed up their sales and dramatically reduce buy backs.

2. Most information will be available, even if it’s still in multiple systems requiring some time to aggregate. The main concern now is how to ensure that the closing is executed properly since you’ve never had control of that before.

3. You have disparate systems so communications and paper are delivered all over the place. At some point in the future you will collate all of the information into one spot and try to prove what happened during the closing.