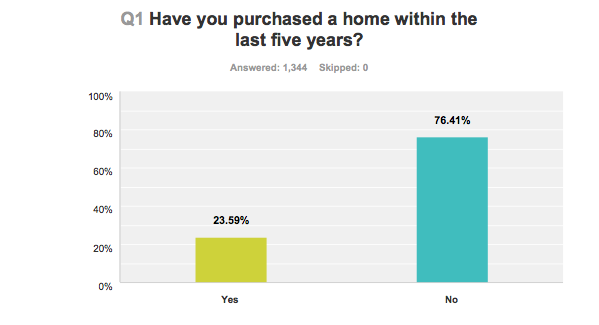

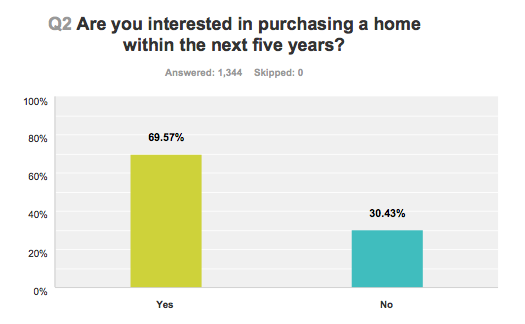

Seventy percent of Millennials want to buy a home in the next five years, but how and why they will buy a home widely varies depending on the individual.

Digital Risk recently conducted a housing survey on Millennials in the housing market, surveying 1,344 millennials, who are between the ages of 18 and 34, distributed nationally by their age, gender and census geography.

After reviewing the survey’s results, Digital Risk managing partner Jeff Taylor said, “The findings suggest that the absence of first-time buyers in the market is more a matter of facing up to economic headwinds than to a reluctance to buy a home.”

The survey was broken up into the following charts. Note: The actual survey contains many more.

Click to enlarge

(Source: Digital Risk)

Click to enlarge

(Source: Digital Risk)

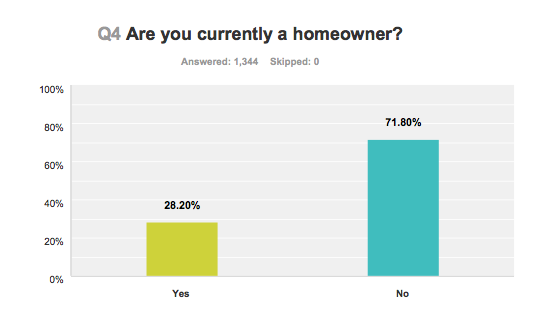

Of the Millennials surveyed 72% said they do not own a home.

Click to enlarge

(Source: Digital Risk)

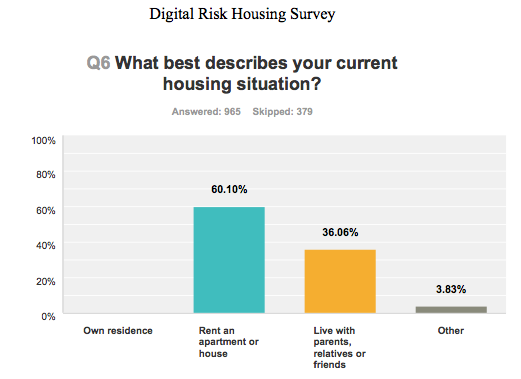

And 94% said they have owned a home (note that 379 chose to not respond to this).

Click to enlarge

(Source: Digital Risk)

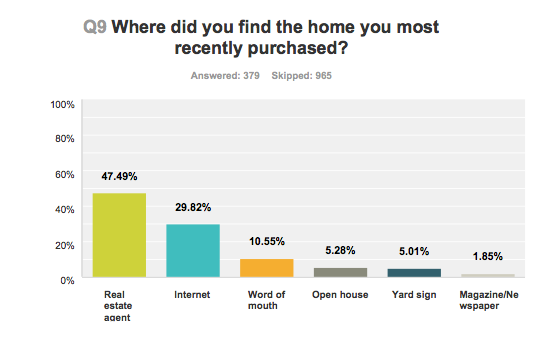

So where do they choose to go to answer their homeownership questions?

Click to enlarge

(Source: Digital Risk)

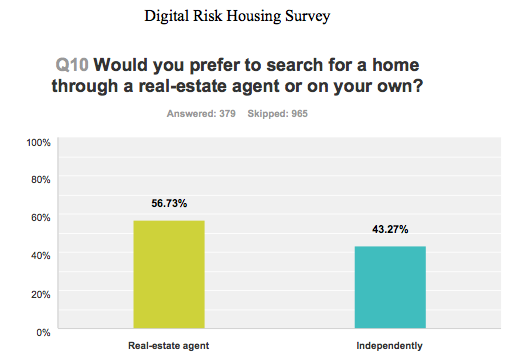

More and more, first time homebuyers are preferring to search alone.

Click to enlarge

(Source: Digital Risk)

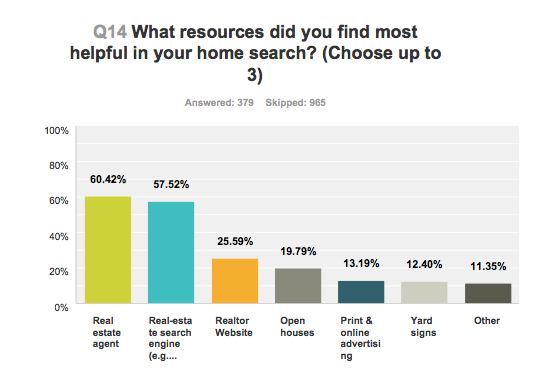

Click to enlarge

(Source: Digital Risk)

Click the next page to see how Millennials fare with downpayment options.

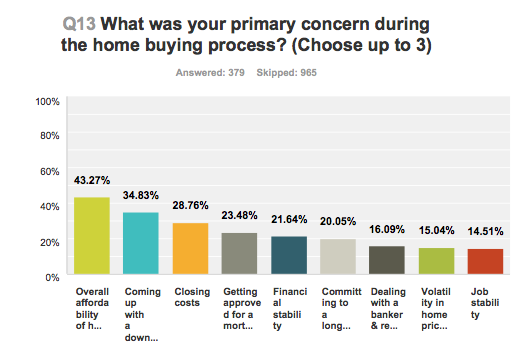

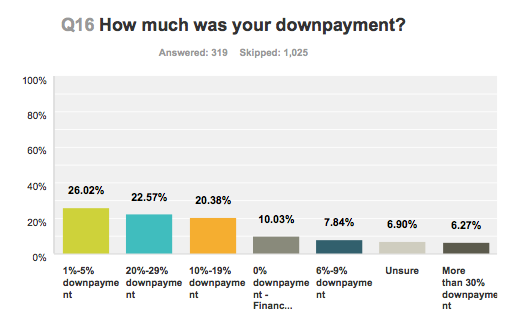

Downpayment and costs options were a common concern among Millennials looking for a mortgage, the survey found.

Click to enlarge

(Source: Digital Risk)

In the end, most millennials end up putting something down, despite the availability of home buyer assistance programs.

Click to enlarge

(Source: Digital Risk)

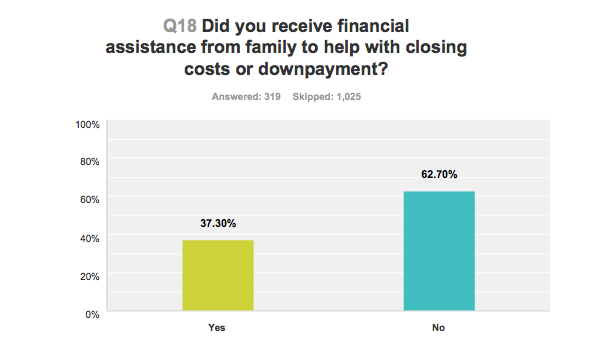

One thing that hasn't changed much; a huge percentage of homebuyers look to the Bank of Mom and Dad to help get that first home loan.

Click to enlarge

(Source: Digital Risk)