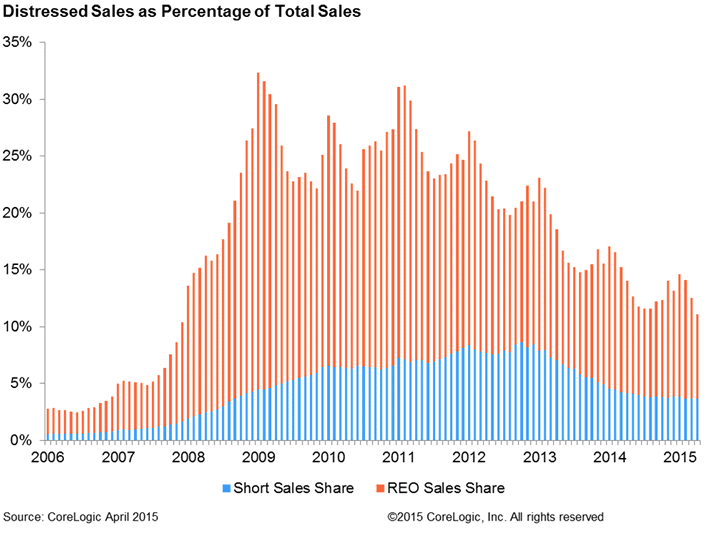

Distressed sales—real estate-owned (REO) and short sales—made up 11.1% of total home sales in April, down 3 percentage points from April 2014 and down 1.5 percentage points from March, the most recent housing report from CoreLogic (CLGX) said.

While distressed sales typically decrease month over month in April due to seasonal factors, this distressed sales share was the lowest from the month of April since 2007.

Broken up, REO sales accounted for 7.4% and short sales made up 3.7% of total home sales in April. Additionally, the short sales percentage fell below 4% in mid-2014 and has remained stable since then.

At its peak in January 2009, distressed sales totaled 32.4% of all sales, with REO sales representing 27.9% of that share.

Click to enlarge

Source: CoreLogic

“The ongoing shift away from REO sales is a driver of improving home prices since bank-owned properties typically sell at a larger discount than short sales. There will always be some level of distress in the housing market, and by comparison, the pre-crisis share of distressed sales was traditionally about 2%,” the CoreLogic report said.

“If the current year-over-year decrease in distressed sales share continues, the distressed sales share would reach that ‘normal’ 2-percent mark in mid-2017,” it continued.