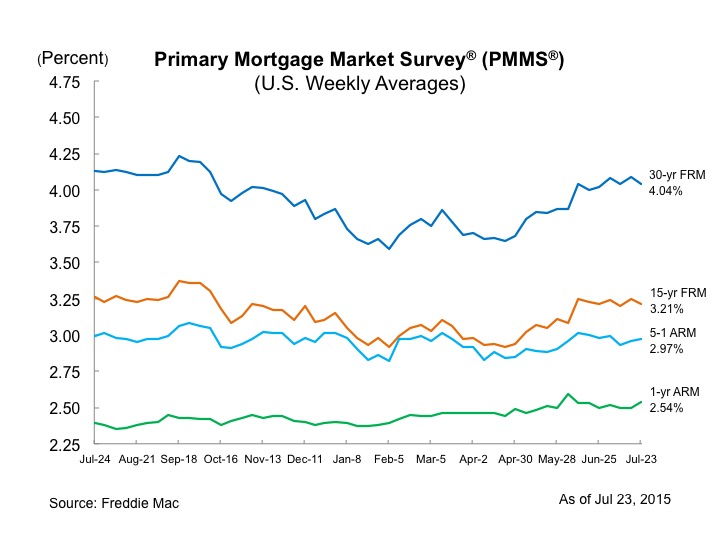

After moving to the highest level of 2015 one week ago, mortgage rates retreated slightly, according to Freddie Mac’s latest Primary Mortgage Market Survey.

Freddie Mac’s latest report, released Thursday morning, showed that the 30-year fixed-rate mortgage average 4.04% with an average 0.6 point for the week ending July 23, 2015, down from last week when it averaged 4.09%.

Last year at this time, the 30-year fixed-rate mortgage averaged 4.13%.

According to Sean Becketti, Freddie Mac’s chief economist, the slight decline was driven by mixed economic and housing data.

“U.S. Treasury yields dropped following announcements that many blue chip companies’ earnings failed to meet expectations,” Becketti said.

Becketti said that the Treasure yield decline helped to drive down mortgage rates by 5 basis points.

“Existing home sales beat market expectations coming in at a seasonally adjusted annual rate of 5.49 million homes,” Beckettii added.

“This is up 9.6% from a year ago and the fastest pace since 2007,” he continued. “Also, housing starts jumped 9.8% responding to strong demand in the multifamily market.”

According to Freddie’s report, the 15-year fixed-rate mortgage this week averaged 3.21% with an average 0.6 point, down from last week when it averaged 3.25%.

A year ago at this time, the 15-year fixed-rate mortgage averaged 3.26%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.97% this week with an average 0.5 point, up from last week when it averaged 2.96%.

A year ago, the 5-year ARM averaged 2.99%.

And the 1-year Treasury-indexed ARM averaged 2.54% this week with an average 0.3 point, up from last week when it averaged 2.50%.

At this time last year, the 1-year ARM averaged 2.39%.

Click the image below for a look at mortgage rates over the last year.

(Image courtesy of Freddie Mac)