Three years ago, Dallas resident Lilly Neubauer and her husband, Marcus,refinanced their mortgage through Costco’s program. The Neubauers were eager to take advantage of lower interest rates. Lilly reported to HousingWire at the time that she and her husband were extremely happy working with Costco.

Lilly even went so far as to say, “Yay, yay, yay! I love Costco!”

Here is how she came to Costco in the first place:

“I subscribe to Costco’s Facebook page and my husband received their emails so we both heard about refinancing with them. Costco took us from a 5.5% (which was low when we bought) to 3.875% interest. Closing costs were around $1,000 and could be applied to the principal. Overall we’re saving $200 a month on our mortgage, which we can use as an overpayment or put into savings or use for an unexpected cost. That freedom has been really great for us!”

HousingWire covered the introduction of Costco into the mortgage lending space and it made the industry nervous. If a big-box retailer could achieve such a digital product reach, where did the traditional lenders stand?

Lenders openly asked each other at conferences, “Who will be next? Google, Apple?”

Well, that never happened. But why not? Three years on, and the interest rate environment remains low, yet more people have jobs and the economy is improving.

The primary reason is because the amount of people who can actually qualify for a mortgage, post-QM, is not getting larger. The demand is there, the supply is there. But something is still broken in mortgage lending.

Therefore, it’s time to think outside of the box — the credit scoring box, that is.

Scoring metrics used by the GSEs today are antiquated and keep a significant number of potential buyers off the housing ladder. And both Fannie Mae and Freddie Mac seem to realize that, as they explore alternatives to traditional credit-scoring models.

New scoring models and lending platforms could offer a solution that keeps current underwriting standards intact and doesn’t reintroduce risky loan products.

The FHFA, Fannie Mae and Freddie Mac’s regulator, has included as part of its 2015 scorecard the goal to have the GSEs look at alternative and updated scoring models.

The FHFA, Fannie Mae and Freddie Mac’s regulator, has included as part of its 2015 scorecard the goal to have the GSEs look at alternative and updated scoring models.

At the moment, the Fair Isaac Corp. (FICO) score remains the sole determination of whether or not a potential homeowner should even be considered for a loan in the first place. But the model, originated in 2004, includes data from 1995 to 2000.

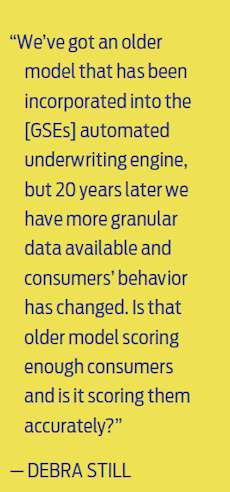

“We’ve got an older model that has been incorporated into the [GSEs] automated underwriting engine, but 20 years later we have more granular data available and consumers’ behavior has changed,” said Debra Still, president and chief executive of Pulte Financial Services.

Still then pauses for a moment, and asks, “Is that older model scoring enough consumers and is it scoring them accurately?”

Figures reported by the Urban Institute in April indicate that it’s not. The data showed that 4 million more loans would have been made between 2009 and 2013 if credit standards had been similar to 2001 levels.

The Urban Institute data shows that mortgage lending to high-credit borrowers (those with a 720 FICO score or higher) is down only 8.9% from 2001. However, lending for moderate credit borrowers has dropped 37% and lending to low-credit borrowers (those with a FICO score below 660) has dropped an astonishing 75.8%.

As a result of this tightening, high-credit borrowers now make up the majority of new purchase loans, while low-credit borrowers comprise only a tiny share relative to 2001.

“Mortgage credit today is much tighter than it was at the peak of the housing bubble in 2005 and 2006, which is expected and appropriate,” stated Laurie Goodman, Jun Zhu and Taz George, authors of the April Urban Institute report. “But it is also significantly tighter than it was in 2001, prior to the housing crisis.”

But broadening access to credit doesn’t necessarily mean loosening credit underwriting or reintroducing risky loan products.

“The current underwriting guidelines would service more borrowers if we could reach more borrowers,” Still said.

That is what the FHFA has commissioned under its 2015 scorecard: a look at qualified borrowers who aren’t being scored or are being scored artificially low, to access lending without changing credit underwriting guidelines.

Credit Box Opening Up

VantageScore and FICO, the two largest developers of credit-scoring models, are moving the needle forward in the right direction.

In August 2014, FICO announced that it would recalibrate its credit scoring methodology by softening the score impact of delinquent bills if they were ultimately settled and reducing the impact of unpaid medical bills.

FICO’s new scoring model, FICO 9, diminishes the effects of medical collection debts. As long as the debts are paid (whether or not they went to collection), they would have little influence on an individual’s credit score.

Millennials are likely to be most affected by this scoring adjustment. And remember, Millennials are America’s largest generation.

What’s more, this segment of consumers prefers online banking and automated payments. Because medical bills do not arrive electronically, they frequently go unnoticed until they have already hurt consumers’ credit. FICO 9 does not penalize consumers when these previously unknown debts are paid.

“FICO changing its methodology to clean up how they report medical debt — that is a meaningful thing, when you consider that the Consumer Financial Protection Bureau has said that over half of all identifiable collectives relate to medical debt,” said Isaac Boltansky, an analyst at Compass Point Research and Trading.

According to a CFPB report published last December, an estimated 220 million consumers have a credit report at one or more of the nationwide consumer reporting agencies (NCRAs). Roughly half of all collections that appear on credit reports are reported by debt collectors seeking to collect on medical bills owed to hospitals and other medical providers.

These medical debt collections affect the credit reports of nearly one-fifth of all consumers in the credit reporting system.

However, most medical collections are for small amounts. According to the CFPB, medical unpaid collections had a median amount of $207 and average $579.

This contrasts with the much larger amounts that are due on delinquent credit cards or student loans, which average several thousand dollars.

This contrasts with the much larger amounts that are due on delinquent credit cards or student loans, which average several thousand dollars.

While FICO indicates a slight increase in credit scores (a median increase of 25 points) for consumers with medical debts, the real impact of FICO 9 is its evaluation of borrowers with a limited credit history.

The model uses other types of payments like utilities and rent to score borrowers with “thin file” credit reports. These are consumers that don’t actively use credit or haven’t used credit in the last six months.

However, the current FICO model used by the GSEs can’t score these consumers.

VantageScore, which released its recalibrated scoring model in March 2013, also scores thin-file borrowers. All VantageScore models, including VantageScore 3.0, leverage rent, utility and telecom payment data.

The model recognizes the value of data up to and greater than 24 months old. The data sample used to build the model was developed on consumer behavior from two different, two-year time frames: 2009-2011 (during the economic crisis) and 2010-2012.

Each performance time frame contributed 50% of the model’s development. This reduces the model’s sensitivity to consumer behavioral shifts over different volatile periods. The model also sets negative information to neutral if it is coded as occurring during a natural disaster but allows positive information to retain its positive impact.

The number of so-called “credit-invisible” consumers impacted by the new scoring model is significant.

In a June 2015 presentation, VantageScore stated that the new model generates scores for 30 to 35 million consumers and 7.6 million meet the GSE credit score cut-off of 620. That means 7.6 million potential, first-time homebuyers would meet the cut-off for conforming mortgages.

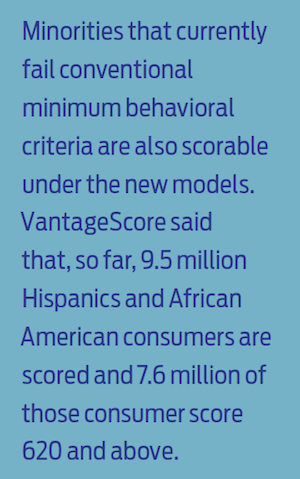

Minorities that currently fail conventional minimum behavioral criteria are also scorable under the new models. VantageScore said that, so far, 9.5 million Hispanics and African-American consumers are scored and 7.6 million of those consumer score 620 and above.

“The future of the housing market will be the Millennials, which are a bit late to enter the market, but they will enter at some point,” said Still. “We need to make sure that we are reaching these more diverse borrowers that have different debt patterns and maybe don’t use debt as much”.

Now it’s up to the FHFA to validate the new scoring models. Vantage Score believes it would take up to $544 million in increased annual net revenues to the GSEs to pay for implantation costs. But the costs would be more than worth it, considering that up to 144,570 potentially new homeowners could be reached annually and lending to African American and Hispanic households would increase annually by 32% over 2013 levels.

“Until the GSEs allow for the newer models to be incorporated into their automated underwriting engines, the lenders have to use the current modeling,” said Still.

Credit Scoring for Marketplace Lending

Real estate marketplace lending grew 156% in 2014, just breaking the $1 billion mark, with campaigns ranging in size from less than $100,000 to over $25 million, according to analyst and research firm Massolution’s 2015 Crowdfunding Report.

In 2014, North America stood as the largest region by funding volume at 56% market share, compared with Europe at 42%. This year, U.S. commercial and industrial property marketplace lending expects to see a 250% increase.

Boltansky said that credit scoring can get tricky with marketplace lenders, because “each and every one has their own proprietary model where they are collecting data from less commonly used scoring sources,” he said.

“That’s lovely, except it becomes very dangerous because it can come uncomfortably close to crossing the line for fair lending. It is also completely untested.”

CompassPoint covers Lending Club and OnDeck and has done considerable analysis on the policy side. Last year, Lending Club Chief Executive Renaud Laplanche told CNet Magazine that the platform would expand into home mortgages, student loans, and other areas.

Social Finance, another marketplace lender currently offering mortgages and mortgage refinancing through its platform, focuses on traditional scoring metrics such as debt-to-income, FICO and LTV.

The lender also considers other factors like work experience to offer low-down payment home loans.

In addition to secondary marketing factors that influence rates, other variables that impact rates include, but are not limited to, product, LTV and credit score, including the borrower’s free cash flow after all debts are considered.

“The DTI becomes secondary to the analysis and, as such, DTI limits will vary by loan and are dependent upon our holistic analysis of the borrower and their financial profile,” said a SoFi company spokesperson.

“Keep in mind though, that we keep in accordance with applicable state and federal rules.”

On June 25, the Supreme Court ruled in favor of the legal doctrine of “disparate impact,” which holds that a law or practice can have a discriminatory effect, even if it wasn’t based on a discriminatory purpose . While that decision itself was huge, it won’t change some traditional regulations for lending. Despite the the Supreme Court’s ruling, “the idea here is that you can’t use certain input into making a credit decision,” Boltansky explain.

On June 25, the Supreme Court ruled in favor of the legal doctrine of “disparate impact,” which holds that a law or practice can have a discriminatory effect, even if it wasn’t based on a discriminatory purpose . While that decision itself was huge, it won’t change some traditional regulations for lending. Despite the the Supreme Court’s ruling, “the idea here is that you can’t use certain input into making a credit decision,” Boltansky explain.

Boltansky believes that market-place lenders, “scraping borrower information off of social media, looking at what people are tweeting, putting on Facebook or what their LinkedIn status has been over a period,” probably face a higher likelihood of tripping state and federal rules, like ECOA.

Still, Boltansky believes that lenders in this space are challenging and impacting every part of the lending chain — including the credit metrics.

“It may only be a peripheral impact on the changes in thinking how to assess credit worthy borrowers, but it’s surely an impact,” he said.

And while a peer-review credit scorings model will likely never become the norm in mortgage lending, the hope is one day it can help the underwriting process get a better focus on the borrower.

By looking through a stronger mortgage-lending microscope, maybe then we will see the credit invisible as potential homeowners.