Millennials are not as savvy as their predecessors when it comes to their finances and credit management, a new report from Experian revealed.

However, this same generation also has a lot of potential to improve their credit for the future.

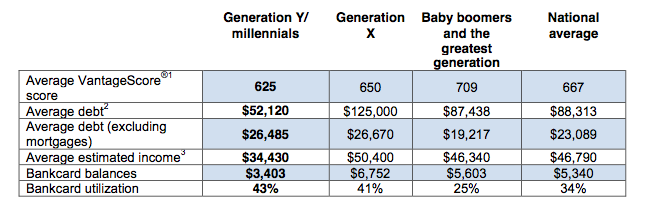

The analysis highlights the credit characteristics of an average Millennial as well as looking at how other generations are faring. The groups studied included Generation Y/Millennials (ages 19–34), Generation X (ages 35–49), and a combination of Baby Boomers and the greatest generation (ages 50–87).

Here’s a snapshot of credit characteristics by generation.

Click to enlarge

(Source: Experian)

“Given the significance Millennials play in financial services and the credit marketplace, it is crucial to understand this influential consumer segment and how they use credit as a tool,” said Michele Raneri, vice president of analytics and business development.

“While this generation may not look like they are on the right track financially, it’s important to keep in mind that credit scores are built on credit experiences, and while this generation has been slower to use credit, they have plenty of opportunities to build a positive credit history. The best way to do that is to understand credit before using it,” added Raneri.

This infographic from Experian should break it down better.

Click to enlarge

(Source: Experian)