Lenders witnessed an easing in lending standards across all loan types over the third quarter, according to Fannie Mae’s third quarter 2015 Mortgage Lender Sentiment Survey.

The Mortgage Lender Sentiment Survey is a quarterly online attitudinal survey among senior executives, such as CEOs and chief financial officers, of Fannie Mae’s lending institution partners to track insights into lending activities and market expectations.

What’s most noteworthy in the latest survey is a clear easing of credit standards by lenders.

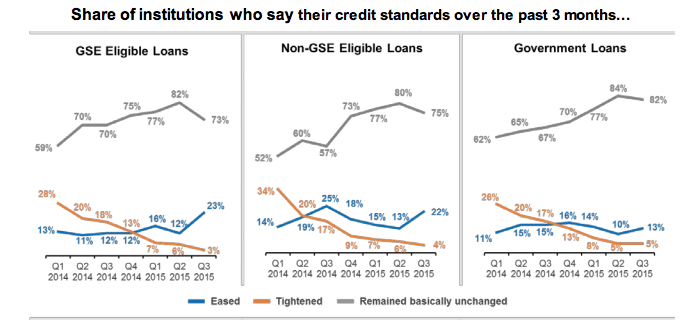

The survey asked senior mortgage executives whether their lending organization’s credit standards have eased, tightened or remained essentially unchanged for GSE eligible, non-GSE eligible and government loans during the prior three months.

Looking at the results, the gap between lenders reporting easing as opposed to tightening over the last three months grew to 20 percentage points and 18 percentage points for GSE eligible and non-GSE eligible loans, respectively — reaching new survey highs of “net easing.”

Click to enlarge

(Source: Fannie Mae)

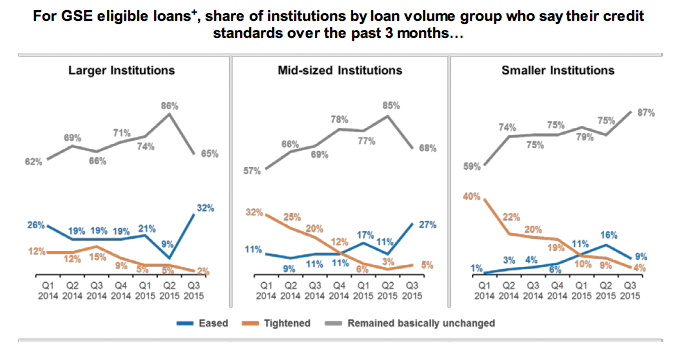

Here are the responses broken up by institution size.

Click to enlarge

(Source: Fannie Mae)

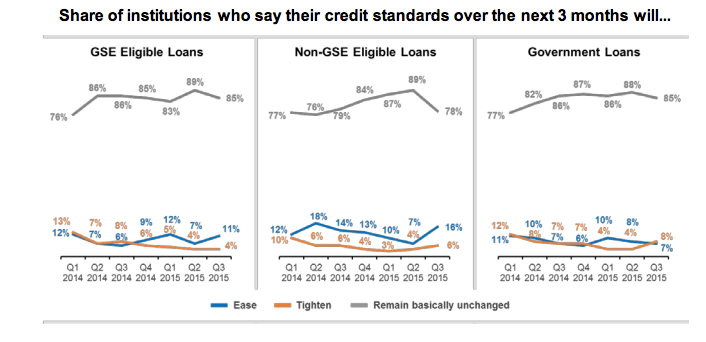

And the next three months look similar, with further easing of credit standards.

Click to enlarge

(Source: Fannie Mae)

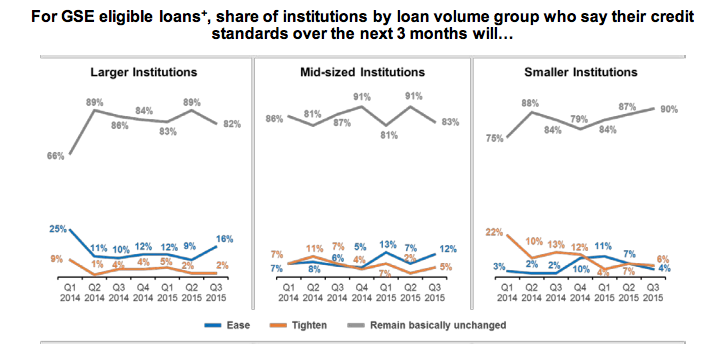

Here are the responses broken up by institution size.

Click to enlarge

(Source: Fannie Mae)

“For the first time in seven quarters, we see a pronounced increase in the share of lenders, particularly medium- and larger-sized lenders, reporting on net an easing of credit standards in both the GSE eligible and non-GSE eligible loan categories,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. "This is a significant result in light of public discourse on credit availability and standards."

Duncan explained that one reason behind the easing could be that lenders are becoming more comfortable with the GSEs’ updated guidelines intended to provide them greater certainty regarding representations and warranties. Lenders also might be more accustomed to the regulatory and compliance environment, Duncan said.

“Finally, lenders may be removing credit overlays,” Duncan concluded. "Overall, we expect that lenders’ tendency toward easing credit standards, together with relatively low mortgage rates and a strengthening labor market, will continue to support the housing market expansion."