Mortgage rates remained fairly stagnant despite ongoing global growth concerns putting downward pressure on Treasury yields, the latest Freddie Mac Primary Mortgage Market Survey said.

“This marks the tenth consecutive week of a sub-4-percent mortgage rate,” said Sean Becketti, chief economist with Freddie Mac.

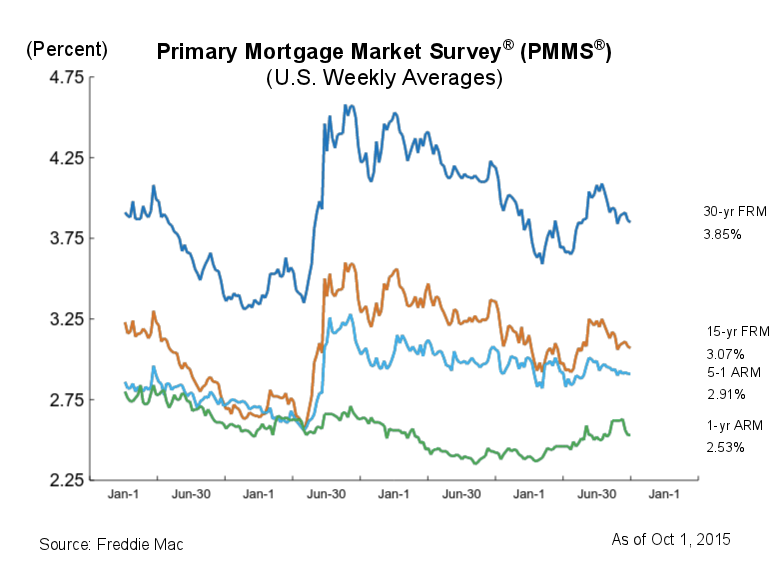

Click to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage averaged 3.85% for the week ending Oct. 1, down from last week when it averaged 3.86%. A year ago at this time, the 30-year FRM averaged 4.19%.

Similarly, the 15-year FRM this week averaged 3.07%, falling from 3.08% last week. A year ago at this time, the 15-year FRM averaged 3.36%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.91% this week, unchanged from last week. However, it is down from 3.06% a year ago.

The 1-year Treasury-indexed ARM averaged 2.53% this week, unchanged from last week. At this time last year, the 1-year ARM averaged 2.42%.

“In contrast to the volatility in equity markets, the 10-year Treasury rate—a key driver of mortgage rates—varied just a little more than 10 basis points over the last week. As a result, the 30-year mortgage rate remained virtually unchanged, dropping 1 basis point to 3.85%,” said Becketti.