Both New York and California on average require more than a 20% down payment for the average 30-year, fixed-rate conventional loan, a new report from Lending Tree found.

Overall, the report found that average down payment percentages for conventional 30-year, fixed rate purchase mortgage offers increased to an average of 17.63% in the third quarter, slightly up from 17.34% in the previous quarter and 16.29% a year ago.

Similarly, the average down payment amount also grew to $48,924 quarter-over-quarter, surging from $44,204 last quarter.

On the other side, the report said the average down payment on an Federal Housing Administration mortgage in the second quarter was 7.99%, or $15,391, which is marginally up from the previous quarter.

"During the third quarter, the housing market thrived in certain markets as consumer demand outweighed supply," said Doug Lebda, founder and CEO of LendingTree.

“In competitive housing markets, homebuyers will often bolster their buying credentials by offering a larger down payment. Not only could this improve a buyer's chances of securing the home, but could also help avoid delays in closing, create built-in equity and generate lower monthly payments,” added Lebda.

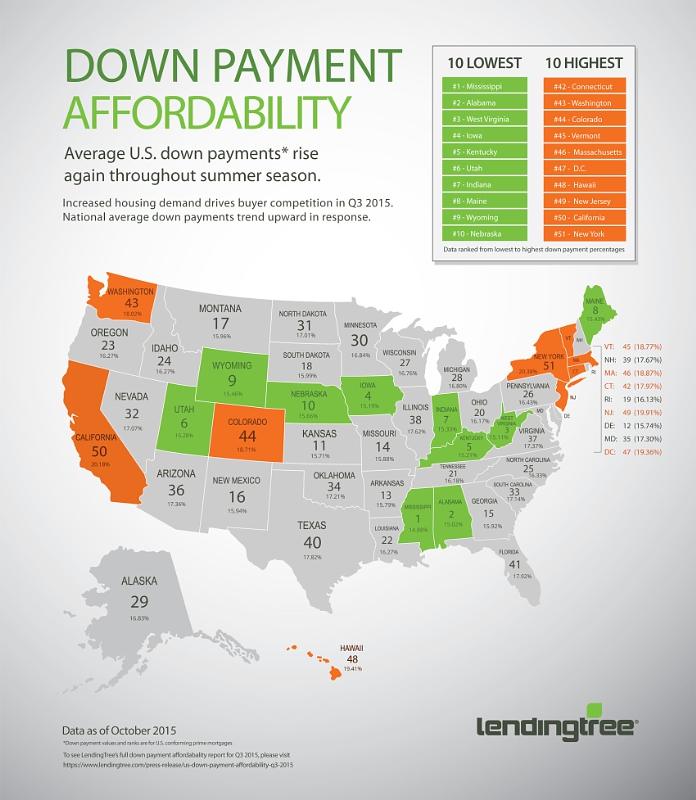

This infographic shows the ten states with the lowest and highest average down payment percentage for a 30-year fixed rate conventional loan.

Click to enlarge

(Source: LendingTree)

Check here to see the 5 common down payment misconceptions, with one of them being that homebuyers don’t need to put 20% down. There options for borrowers.