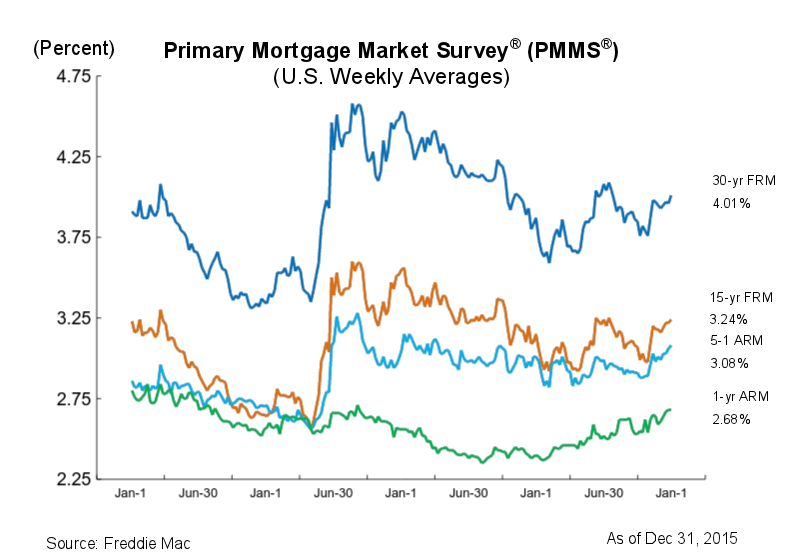

Mortgage rates surpassed the 4% threshold for the first time in five months, the latest Primary Mortgage Market Survey from Freddie Mac said.

“In the final week of 2015, Treasury yields jumped reacting in part to strong consumer confidence in December,” said Sean Becketti, chief economist with Freddie Mac.

“In response, the 30-year mortgage rate rose 5 basis points to 4.01%, ending a 5-month span below 4%. After averaging 3.9% in the fourth quarter of 2015, we expect the 30-year mortgage rate to average 4.7% for the fourth quarter of 2016,” said Becketti.

As a result, Freddie Mac came said after the announcement that it expected an increase in mortgage rates, which have hovered near or below 4% for much of this year.

Click to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage averaged 4.01% for the week ending Dec. 31, up from last week when it averaged 3.96%. A year ago at this time, the 30-year FRM averaged 3.87%.

Also rising, the 15-year FRM this week averaged 3.24%, slightly up from 3.22% last week. In 2014, the 15-year FRM averaged 3.15%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.08% this week, up from last week when it averaged 3.06%. A year ago, the 5-year ARM averaged 3.01%.

The 1-year Treasury-indexed ARM remained unchanged at 2.68% this week. At this time last year, the 1-year ARM averaged 2.40%.