Sometimes, “offshoring” sounds like a bad word. It’s often confused with overseas outsourcing, where companies utilize third-party vendors instead of employees, or it’s misinterpreted as corporate inversion, where American companies buy or merge with foreign companies and then move their operations — and their tax base — overseas. Add the volatile mix of emotions associated with mortgage servicing and offshoring can sound downright sinister.

In reality, offshore mortgage servicing simply means using remote staff, usually to take advantage of lower labor and overhead costs and round-the-clock staffing availability.

But legitimate questions remain. In the midst of increasing compliance pressures, is offshoring a sound strategy for mortgage servicers looking to stay competitive, or a fast track to dissatisfied customers and trouble with the CFPB?

BIG PLAYERS

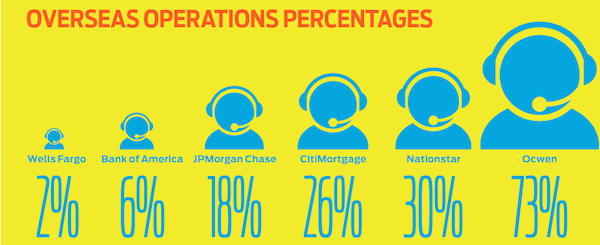

Many of the biggest banks utilize offshore employees: CitiMortgage has 26% of its staff overseas and JPMorgan Chase has 18%. However, Bank of America has just 6% of its operations offshore and Wells Fargo maintains only 2% of its operations outside the U.S., none of which are customer facing, according to a company spokesperson.

While CitiMortgage declined to answer direct questions about its offshore employee base, Mark Rodgers, director of Citi Public Affairs, told HousingWire, “As a global company, we leverage resources in multiple locations in the U.S. and abroad to best address business and client needs and provide consistent, around-the-clock customer service. For portions of our operations and technology work, we utilize vendors, including some overseas.” He maintained, however, that CitiMortage maintains “a rigorous vendor selection process” and sets “high standards to monitor their performance to meet our customers’ expectations.”

Mike Weinbach, CEO of mortgage banking at JPMorgan Chase, championed the bank’s employment of offshore human resources in the Philippines, telling HousingWire, “Our employees in Manila bring years of knowledge and expertise to their jobs and a passion for the customer. Our operations there provide process enhancements that allow for a faster, more efficient customer experience.”

And big banks aren’t the only ones taking advantage of the benefits of overseas operations. Two servicers with the biggest offshore presence are nonbanks Ocwen and Nationstar.

According to a company spokesperson, Ocwen had approximately 11,000 employees as of Dec. 31, 2014, with 73% of its workforce overseas. Its largest offshore base is India, with 7,600 employees, followed by the Philippines at 600 and smaller numbers in Uruguay and other countries.

“Ocwen has a long-standing presence in India and also maintains operations in the U.S., U.S. Virgin Islands and the Philippines,” the spokesperson added, confirming that more than 80% of the company’s foreign-based employees work in servicing operations.

“It is important to note that Ocwen’s offshore customer service operations are conducted by employees of the company, in facilities leased and managed by the company, rather than outsourced to third parties,” the Ocwen spokesperson said. “Our employees undergo the same rigorous hiring and training processes and are subject to the same company policies and procedures that apply to our U.S. based employees.”

Dallas-based Nationstar has more than 30% of its staff located offshore in India and the Philippines, according to an article in National Mortgage News in December. CEO Jay Bray explained the importance of the company’s overseas presence. “If we can transform the customer’s experience, we can conquer the world in this space,” he said in the piece.

The offshore operations of Ocwen, Nationstar, JPMorgan Chase, and CitiMortgage include customer-facing services, including basic customer service, collections, loan administration and default support, according to Fitch Ratings.

FOLLOWING THE SCRIPT

Nationstar and Ocwen are among a handful of key players in the mortgage servicing sector, which took off two years ago as banks looked to offload mortgage servicing rights (MSRs) in preparation for implementation of Basel III requirements in 2019.

But with regulatory scrutiny of nonbank servicers increasing, their growth in 2016 could be muted, according to Fitch Ratings’ 2016 Outlook: Finance and Leasing Companies. As a result, Fitch predicts servicers will increase focus on retention efforts like refinancings to help keep current customers — no small feat in light of widely publicized customer service issues among key players.

However, as interest rates rise, so will the values of mortgage servicers’ portfolios, as prepayments decrease, default risk drops and revenue prospects increase. That being said, the Federal Housing Finance Agency released new guidelines in 2015 requiring nonbank mortgage servicers to maintain a minimum net worth of $2.5 million plus a dollar amount representing 25 basis points of the servicer’s total portfolio of unpaid principal on loans it services.

While nonbank servicers have moved substantial amounts of operations offshore in an effort to save on costs, the practice can result in servicing disruptions.

While nonbank servicers have moved substantial amounts of operations offshore in an effort to save on costs, the practice can result in servicing disruptions.

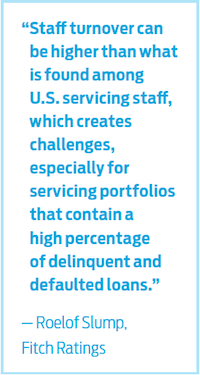

Fitch Ratings’ Managing Director, RMBS Group, Roelof Slump says, “Staff turnover can be higher than what is found among U.S. servicing staff, which creates challenges, especially for servicing portfolios that contain a high percentage of delinquent and defaulted loans.”

Slump points out that offshore customer service agents often rely on a high degree of “scripting” to handle calls. That can be frustrating for a borrower who calls with a complex issue. “In a natural flowing discussion with an experienced U.S.-based serviceperson, a one-stop call may be all that’s necessary,” he notes. But if that borrower calls an agent in India, for example, where employee turnover rates are high, “he or she is not going to benefit from the knowledge base of staff.”

Many offshore employees have not received the training necessary to deviate from scripts when complex issues, like late stage collection or loss mitigation efforts, come up. Fitch Ratings said in a recent report that if servicers want to improve customer service, they need to set up procedures that will quickly move customers from contact with offshore employees back to U.S. representatives when challenging issues arise.

And while offshoring some operations can significantly reduce cost for servicers, there are, as Slump points out, “natural challenges,” even in a place like India with its highly educated workforce.

“Offshoring requires oversight from the U.S. and the challenge of managing from a long distance,” he explains. That means a lot of travel on the part of management as well as a lot of dependence on information technology.

So what kind of bottom-line benefits are servicers seeing from their offshoring efforts? Nationstar’s servicing portfolio has grown 50% since the third quarter of 2012, and at the close of the third quarter of 2013, it stood at $408 billion. As of the end of November, Nationstar’s shares had dropped 54% for the year and 78% since their peak share price of $58 at the end of 2013, but at least some of the company’s troubles can be traced to its investments in online home-buying portal Xome and not as a result of offshoring.

Ocwen has been hammered by New York regulators, who kicked out founder William Erbey and denied the servicer the ability to take on any more servicing contracts or move any more operations offshore until consent orders are met, backing the firm into a $150 million settlement.

Keeping customer service operations in the U.S., however, doesn’t necessarily reduce customer complaints. While Wells Fargo Home Mortgage remains the largest mortgage servicer and has no customer-facing staff located offshore, the company registered more complaints than any other servicer between Jan. 1 and Dec. 7, 2015: a total of 4,739. Most of them, over 4,400, have been noted by the CFPB as “closed with explanation.”

According to Fitch Ratings, Wells Fargo operates seven servicing/customer centers and four specialized loss-mitigation centers throughout the U.S., servicing more than 8.9 million loans worth over $1.5 trillion, so certainly the volume of loans it handles has a lot to do with the number of complaints it received, too.

THE CFPB WEIGHS IN

While the Consumer Financial Protection Bureau declined to make direct comment on any specific servicers, spokesperson Sam Guilford told HousingWire, “The Bureau expects mortgage servicers to provide good customer service, and to comply with the law, regardless of where they choose to locate their operations.”

That good customer service includes “providing accurate information to borrowers, as well as retrieving complete records of the borrower’s payment history and information in connection with a loss-mitigation application,” Guilford added.

He also noted that the CFPB is aware of the increased risk of consumer injury presented when companies outsource or off-shore operations, explaining the bureau has identified three key factors that could increase the risk of harm to borrowers:

- Significant direct contact with consumers

- Performance of multiple services related to a single mortgage loan account

- Increased potential for violation of federal consumer financial law or customer injury due to failure to comply with contractual or regulatory obligations.

JPMorgan, with 18% of its employees overseas, received fewer complaints about customer service in 2015 than Nationstar and Ocwen. Of 2,905 JPMorgan complaints registered with the CFPB between Jan. 1 and Dec. 7, 2015, 2,604 had been marked as “closed with explanation.” The bulk of those complaints (nearly half, in fact) related to loan modification, collection and foreclosure.

And it’s those types of complex issues that have agencies like the CFPB watchful. Guilford noted, “The risk of harm to consumers will usually be significant when a servicer engages a service provider to subservice a large number of delinquent mortgage loans.”

The CFPB received nearly double the complaint load for nonbank servicer Ocwen when compared to JPMorgan Chase. Of 4,414 complaints registered between Jan. 1 and Dec. 7, 2015, for Ocwen, 1,812 involved loan modification, collection and foreclosure, and 2,085 involved loan servicing, payments and escrow accounts.

To Ocwen’s credit, the CFPB has marked more than 4,000 of those complaints as “closed with explanation.” And the CFPB noted in the third quarter that complaints against Ocwen were down 16% year-over-year.

And while offshore servicing tends to get a bad rap overall in the media, it offers critical benefits beyond the obvious one of providing cost savings. Ocwen’s spokesperson told HousingWire that the offshore servicing model of using call centers in many locations around the world has been tested and validated and “allows Ocwen to employ a highly educated and skilled global workforce, while offering customers 24-hours-a-day access to the company’s servicing team to efficiently and effectively meet their needs and the needs of other stakeholders.” Ocwen has provided offshore loan serving for 12 years, starting in India.

Nationstar received 3,617 complaints through the CFPB between Jan. 1 and Dec. 7, 2015, more than 3,000 of them in the same area as the bulk of Ocwen complaints — in loan modification, collection, foreclosure, servicing, payments and escrow accounts. But nearly all (3,413) were “closed with explanation.”

MOVING AHEAD: IS CUSTOMER SERVICE IMPROVING?

The ideal scenario, of course, would be no complaints to start with, and nonbank servicers tend to lead when complaint volume is compared to loan servicing numbers on customer service issues. But avoiding complaints completely? That’s not likely to happen in any scenario, and the cost savings that nonbank servicers see through hiring offshore employees is something they very much need.

In the fall 2015 issue of the CFPB’s Supervisory Highlights, the bureau recognized the efforts that mortgage servicers are making to improve compliance, including their allocations of more resources. However, the bureau reported it’s still seeing numerous violations of Regulation X, including failing to properly identify and notify successor interests upon the death of a borrower, failing to specifically identify all loss-mitigation options for which troubled borrowers may be eligible, and failing to share adequate and up-to-date information with borrowers on the status of loss-mitigation applications or foreclosure proceedings.

In the face of regulatory action, Ocwen has bumped up its commitment to customer service. “One example of these enhancements is our recently launched Service Excellence Initiative,” the company spokesperson told HousingWire. “Through this initiative, Ocwen is enhancing its service accountability premised on measurements including call-abandonment rates, call resolutions and call-handle times.”

Ocwen said it maintains its commitment to helping families avoid foreclosure and has helped more borrowers with loan modifications than any other servicer.

Ocwen said it maintains its commitment to helping families avoid foreclosure and has helped more borrowers with loan modifications than any other servicer.

“We do everything within our power to assist struggling homeowners, including modifications and principal write-downs when permitted under applicable agreements,” the Ocwen spokesperson said. “Ocwen has helped more than 627,000 families avoid foreclosure.”

Slump says neither investors nor consumers should anticipate the offshoring business model to change. And he gives credit to servicers like Ocwen for making improvements to customer service. “If you talk about Ocwen specifically, their portfolio has been declining steadily,” Slump notes, “so they have more capacity in the U.S. to help with escalated calls.” He believes the company is working to put more solid escalation protocols in place “to get the borrower to the right place more quickly.”

Slump is quick to point out as well that the challenges and setbacks servicers like Ocwen and Nationstar have faced the last couple of years aren’t all related to offshoring. “The genesis of these issues is not offshore. It’s been rapid growth and the integration of multiple systems,” he said.

Ultimately, increased regulatory requirements may decrease the benefits of offshoring, as servicers have to invest in more training, a more educated and stable employee base, and better protocol adherence in order to main regulatory compliance. Ocwen’s spokesperson confirmed the company’s expectation that the road isn’t going to get any easier for mortgage servicers: “We, and all other servicers, have faced, and expect to continue to face, increased regulatory and public oversight as well as stricter and more comprehensive regulation of the mortgage servicing business.”

But servicers aren’t the only ones who benefit from offshoring. Consumers, who are used to on-demand interactions in many other parts of their lives, increasingly expect that kind of round-the-clock availability from their financial institutions. Tangible benefits to both consumers and servicers means offshoring is here to stay.

“I don’t see any major shifts happening in the future in terms of this business model,” Slump said.

Whether the reward will continue to make the risk worth it for U.S.-based servicers is still an open question.