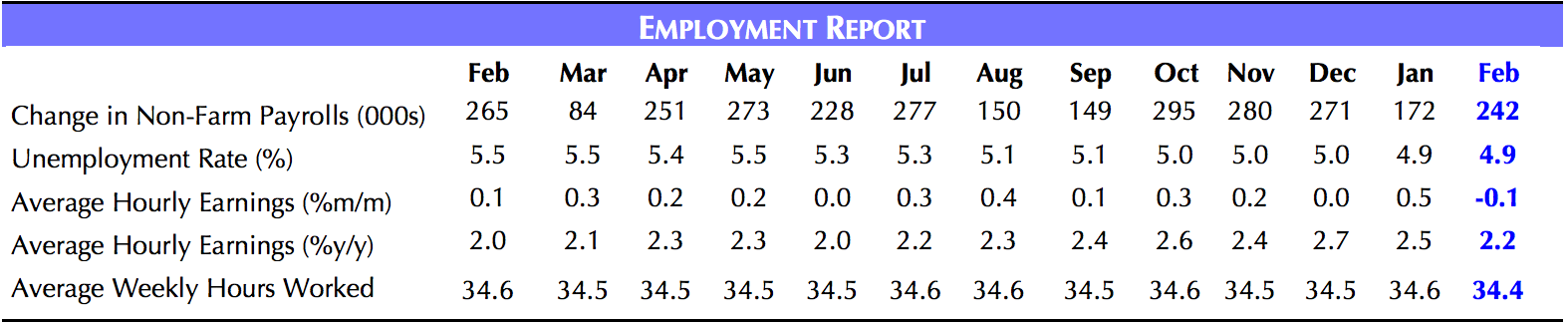

While the U.S. employment rate soared in February, the unemployment rate stayed the same at 4.9%.

According to the Bureau of Labor Statistics’ February report, for the month of February, employers added 242,000 workers and the gains in the preceding two months were revised up by 30,000. The bad news is that most of the new jobs are focused on nonfarm payrolls and not in mining and manufacturing sectors.

Employment gains occurred in health care and social assistance, retail trade, food services, and private educational services.

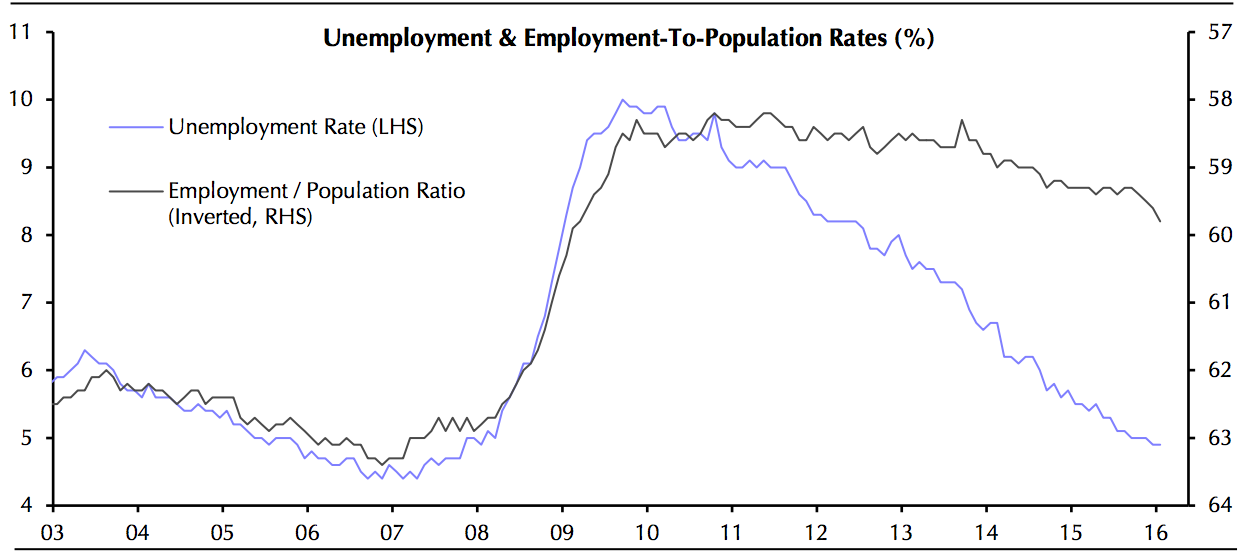

See chart below for the Unemployment & Employment-To-Population Rates.

Click to enlarge:

Source – Bureau of Labor Statistics

Health care and social assistance jobs did really well as it brought in (+57,000) jobs in February increasing employment by 38,000 over the month, with job gains in ambulatory health care services (+24,000) and hospitals (+11,000).

In retail 339,000 jobs were added over the past 12 months. Retail trade jobs increased to (+55,000), while in food and beverage stores added 40,000 jobs increasing it to (+15,000) and general merchandise stores to (+13,000). Employment in private educational services as well as construction continued to rise.

Employment in other major industries, including manufacturing, wholesale trade, transportation and warehousing, financial activities, professional and business services, and government, showed little change over the month.

Per the report, among the major worker groups, the unemployment rates for adult men (4.5%, adult women (4.5%), teenagers (15.6%), Whites (4.3%), Blacks (8.8%), Asians (3.8%), and Hispanics (5.4%) showed little or no change in February.

The weakness was in average hourly earnings, which fell by 0.1% m/m taking the annual growth rate back down to 2.2%, from 2.5%, and average weekly hours worked, which fell sharply to 34.4, from 34.6. The other disappointment was the 10,000 decline in temporary employment last month, which follows an even bigger contraction in January.

Source – Bureau of Labor Statistics

Per CNBC, the jobs report comes at a delicate time for Wall Street, as volatility in the markets calls into question nascent improvements in the economy at large. A trend of solid monthly job gains could convince the Federal Reserve to raise interest rates further in 2016.

It doesn’t matter whether it is demand pull or cost push, inflation is inflation. Job creation increased by 151,000 in January, slightly lower than market expectations, the Bureau of Labor Statistics said.

The employment report for March is scheduled to be released April 1, 2016.