California seems to be a popular topic when it comes to housing, and not in a good way especially when it comes to not having the sufficient income to keep living there.

It’s even worse when Los Angeles property owners start to get rid of low income housing in order to build McMansions, condos and and new rentals, an article in the Los Angeles Times by Ben Poston and Andrew Khouri reported.

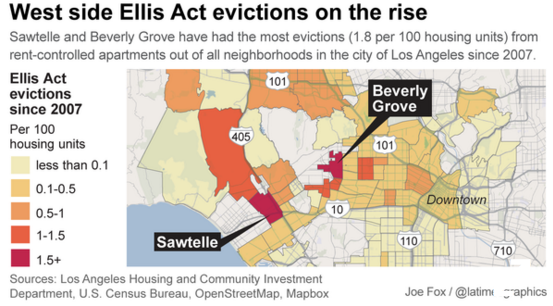

The article stated that more than 1,000 rent-controlled apartments were taken off the market last year.

Worse, evictions have doubled over the same time.

From the article:

Across L.A., more than 20,000 rent-controlled units have been taken off the market since 2001, city records show. The removals peaked during the housing bubble and then bottomed out in the recession, but they have risen significantly since then.

The number of lost units is a fraction of the roughly 641,000 rent-controlled apartments in the city, but in a tight market the removals have had an outsized effect, tenant advocates say, eating away at the supply of affordable housing at a time when L.A. has become one of the least affordable cities in the country.

"Our housing situation is beyond crisis," said Larry Gross, executive director of the Coalition for Economic Survival, a tenant advocacy group. "It's a catastrophe and it's getting worse."

Since the demand for high-end housing is strong, developers like Wiseman Residential buy properties and evict multiple residents.

More from the article:

Michael Cohanzad, senior vice president of development and business affairs for Wiseman, said his company has built five times as many new apartments in place of rent-controlled units it removed, a benefit to a city facing a serious housing shortage.

"The story that gets lost in all of this is that the buildings … are past their useful life," Cohanzad said. "Many of these homes are asbestos-filled, termite-infested, and are not compliant with today's retrofit regulations. So it's a matter of time that these buildings will be torn down."

Michael Cohanzad, senior vice president of development and business affairs for Wiseman, said his company has built five times as many new apartments in place of rent-controlled units it removed, a benefit to a city facing a serious housing shortage.

"The story that gets lost in all of this is that the buildings … are past their useful life," Cohanzad said. "Many of these homes are asbestos-filled, termite-infested, and are not compliant with today's retrofit regulations. So it's a matter of time that these buildings will be torn down."

Residents living in L.A. in rent controlled multifamily buildings built before October 1978, have strong protections against landlords that want to kick them out so that they can increase higher market rents. However, under the 1985 Ellis Act, it allows landlords to evict tenants if they intend to either take the housing off the market or demolish the building to put up new apartments.

The article said, at least 51% of the L.A. properties removed under the Ellis Act in 2013 had been purchased within the previous year, according to a Times analysis.

Click to enlarge

Since the Ellis Act triggers criticism in cities like L.A. and San Francisco, government officials tried to amend the law.

Along with California’s housing crisis, San Mateo County lawmaker Kevin Mullin assembled two bills to figure out what is going on. One of his bills would restore the authority of cities to require new rental developments include a certain percentage of below-market rate housing.

Los Angeles officials recently were in hot water as they started taking tiny homes from the homeless because the structures were a “safety hazard.”