As the housing market improved and prices rose over the last few years, the number of borrowers that owe more on their home than it’s worth fell dramatically, but there are still a number of borrowers that are underwater on their home.

According to recent analysis by RealtyTrac, the number of underwater homes dropped from nearly 13 million in 2012 to 6.7 million in the first quarter of 2016, a reduction of nearly 50%.

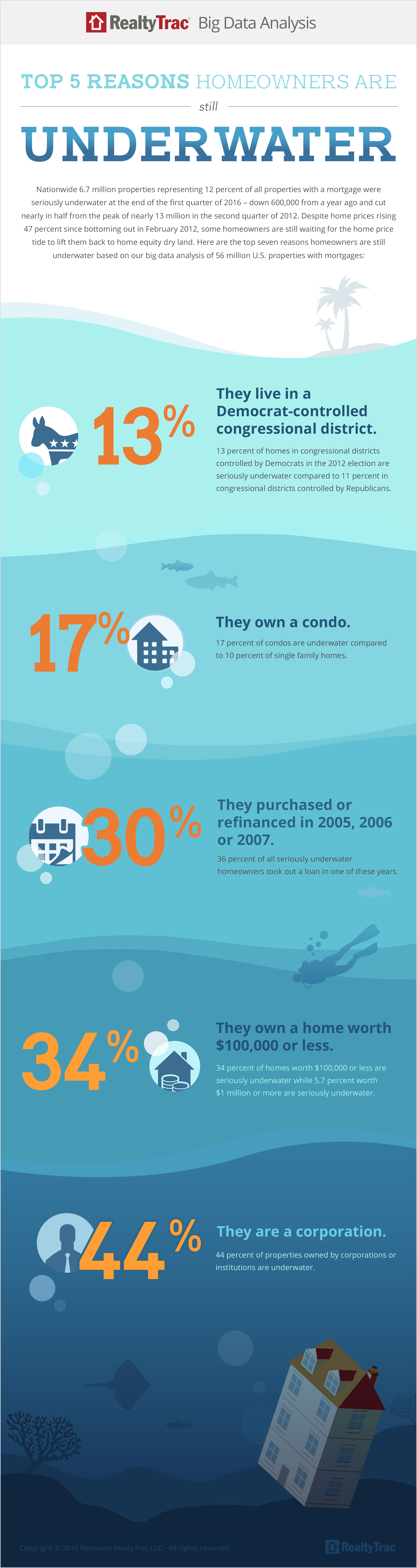

But RealtyTrac notes that 12% of homes with a mortgage are still underwater, but with nationwide home prices rising 47% since bottoming out in February 2012, why are there still so many underwater borrowers?

To find the answer, RealtyTrac looked at the 6.7 million homes that are still underwater to determine the top defining characteristics of these homes, with factors varying from political districts to property type to purchase date to home value to ownership type.

RealtyTrac found several commonalities among the underwater homes, and below is an infographic from RealtyTrac with the top five reasons why some borrowers are still underwater.

Notable among the top seven reasons are whether the homeowner lives in a Democrat- or Republican-controlled Congressional district. According to RealtyTrac’s analysis, 13% of homes in Democratic districts are seriously underwater, while 11% are underwater in Republican districts.

Also notable is the fact that 36% of all seriously underwater homeowners took out a loan on their home in 2005, 2006, or 2007, suggesting that some of the most serious damage of the housing crisis is far from cured.

Click the infographic below for the rest of RealtyTrac’s top five reasons why some homeowners are still underwater.

(Image courtesy of RealtyTrac)