Erasing an upward trend witnessed for the past several weeks, average fixed mortgage rates dropped due to the May employment report coming in well below expectations, Freddie Mac’s Primary Mortgage Market Survey showed.

May’s nonfarm payroll employment only increased 38,000, which was much lower than the anticipated 160,000, according to the U.S. Bureau of Labor Statistics.

“Growing optimism about the state of the economy was quickly erased with May’s employment report,” said Sean Becketti, chief economist, Freddie Mac. “The disappointing release caused an immediate flight to quality resulting in the 10-year Treasury yield dropping 10 basis points on Friday.”

Click to enlarge

(Source: Freddie Mac)

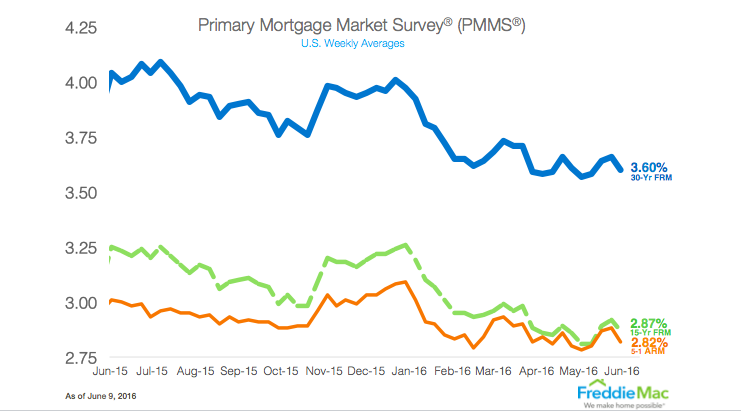

The 30-year fixed-rate mortgage averaged 3.60% for the week ending June 9, 2016, down from last week when it averaged 3.66%. This is well below a year ago at this time when the 30-year FRM averaged 4.04%.

Becketti added, “This week marks the 10th consecutive week the 30-year rate has averaged under 3.7%, allowing an extended window for homebuyers to take advantage of these historically-low borrowing costs.”

Similarly, the 15-year FRM this week averaged 2.87%, down from last week when it averaged 2.92%. A year ago at this time, the 15-year FRM averaged 3.25%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.82% this week, falling from last week’s average of 2.88%. A year ago, the 5-year ARM averaged 3.01%.