Last month, the U.S. Census Bureau released its second-quarter estimate of the homeownership rate. The news? “Homeownership rate falls to 62.9%, half a percent lower than a year ago and reaching lows not seen in half a century!”

This is bad, right?

The economy and the usual homeownership hurdles – student loan debt burdens, access to credit and affordability – must be holding back first-time home buyers. Well, as Mark Twain once said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

The economy expanded for 28 straight quarters, added over 13 million new jobs since the end of the recession, and reduced the unemployment rate to below 5%. That the economy is not expanding fast enough, that newly created jobs are not paying well enough, or that wages aren’t growing quickly enough is important to debate, as we should always strive to do better and increase our collective prosperity.

However, the lingering effect of the economic crisis on homeownership seven years after the end of the recession is hard to see.

So, the common theory is that impediments to homeownership are causing the decline. First-time homebuyers are burdened by student debt and can’t afford the homes that are for sale.

Again, the data doesn’t support that argument. Don’t believe me? Jason Furman, chairman of the Council of Economic Advisors, in a recent report summarized here, argues that despite there being collectively a lot more student loan debt, there are also many more borrowers. In fact, more than 40% of student loan borrowers owe less than $10,000.

The real burden on homeownership? The Federal Reserve Bank of Cleveland determined recently that the monthly debt burden for borrowers between the ages of 20 and 30 in the second quarter of 2015 was $351 a month. The research also points out that three quarters of all 20- to 30-year-old borrowers have student loan payments of $400 or less. If the extra earnings per month that comes with having a college degree ($750) is higher than borrowers’ student loan payments, then they are materially better off. College is still worth it and, if you finish, you will be better able to pay a mortgage than if you had no debt and no degree.

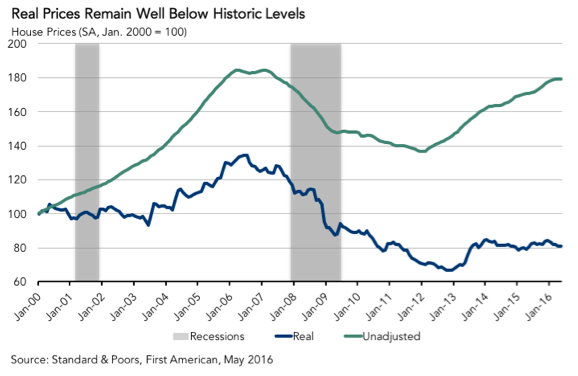

Affordability must be to blame then? Our Real House Price Index measures the price changes of houses adjusted for the impact of income and interest rate changes on consumer house-buying power.Based on this view, houses are 40% less expensive than they were at the housing peak and even 19%` less expensive than they were in January 2000. The purchasing power of record low mortgage rates is more than offsetting the high nominal price levels. Thank you Federal Reserve and Brexit.

Click to enlarge

So why is the homeownership rate at a half-century low?

Two words: Millennial renters.

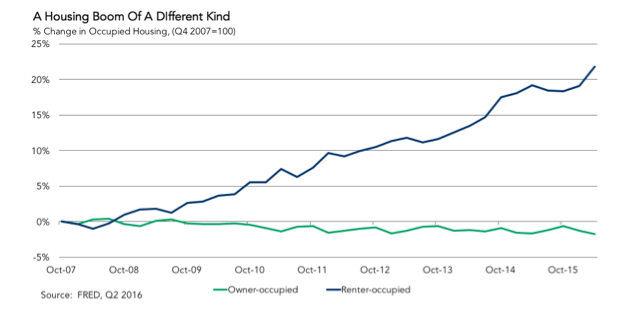

Since the beginning of the recession, the amount of rental households has increased by 22%. That’s 8.4 million new rental households. In contrast, there are 2% fewer owner-occupied households today. That’s 1.5 million fewer owner-occupied households. A challenge to be sure, but not the reason that the homeownership rate is at a half-century low.

The homeownership rate is so low because there are so many more renters – not because we have lost millions of homeowners.

Click to enlarge

And why so many new rental households? As the biggest demographic group in American history finishes their education and gets jobs, they are naturally doing what so many generations before them have done – renting a place to live. Will they stay renters forever? Doubtful. Surveys suggest that the dream of homeownership is far from tarnished, just possibly delayed.

In the meantime, the homeownership rate may yet decline further. But make no mistake, once Millennial renters decide to become homeowners it will be a housing boom of a different kind.