Mortgage originations boomed this fall as volume surged higher from August to October compared to last year, according to the first-ever Consumer Credit Trend report from the Consumer Financial Protection Bureau.

The bureau recently unveiled Consumer Credit Trends, a web-based tool, to help the public monitor developments in consumer lending and forecast potential future risks. The tool draws from a nationally representative sample of credit records maintained by one of the top three U.S. credit repositories.

The new tool joins a list of data reports already in the industry including: the Mortgage Bankers Association’s mortgage application report, the MBA’s independent mortgage bank profit report, Freddie Mac’s mortgage rate report and more.

While the beta version of the tool only covers the mortgage, credit card, auto loan and student loan markets, the CFPB plans to include other consumer credit products and information on credit applications, delinquency rates and consumer debt levels.

For starters, the tool gives a current snapshot of the mortgage industry. The report showed that in October:

- 916,958 mortgages were originated

- There was $242.8 billion in volume of new mortgages

- There was a 69.7% increase in year-over-year originations

However, it’s the charts that are most informative. Check here to see all the featured options.

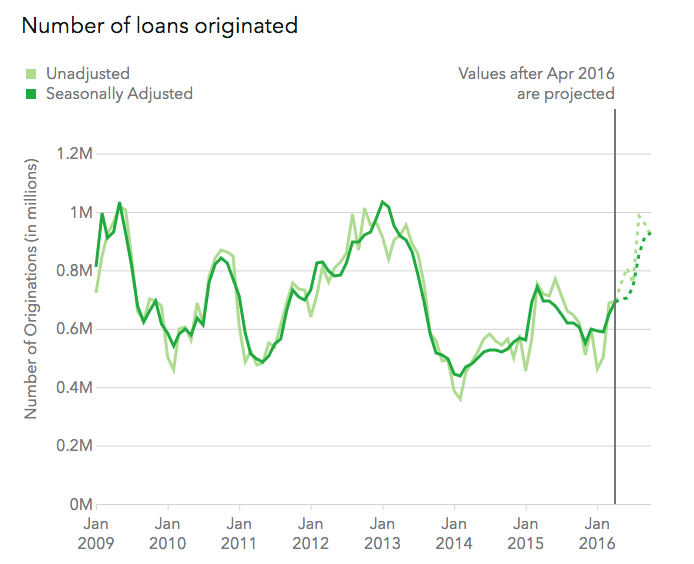

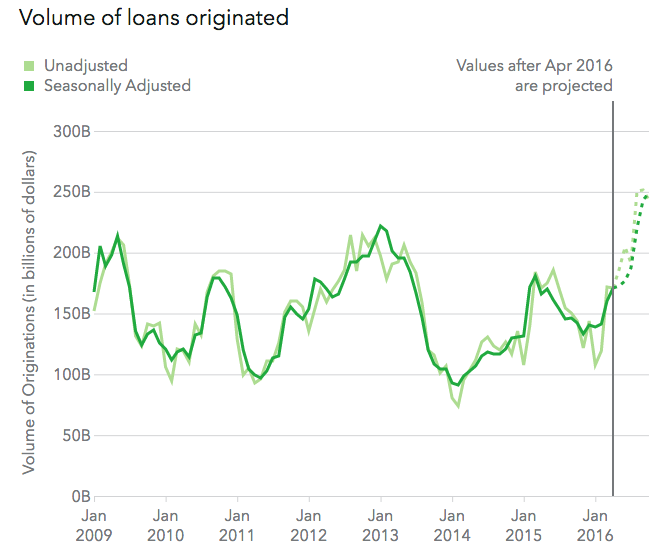

The following two charts show the number and aggregate dollar volume of new mortgage loans opened each month.

Click to enlarge

(Source: CFPB)

Click to enlarge

(Source: CFPB)

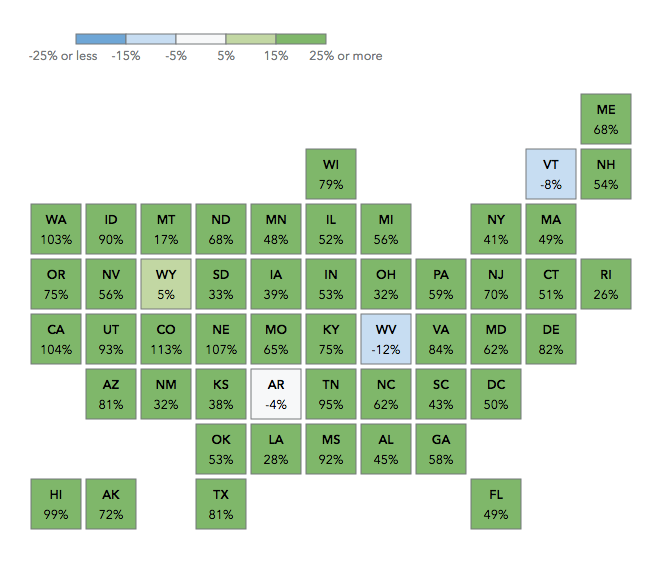

The chart below shows the percentage change in the volume of new mortgages originated in each state, compared to lending activity from one year ago. Positive changes mean that the volume of mortgages originated in the state during the month are higher than they were one year ago and negative values indicate that the volume of mortgages has declined.

Click to enlarge

(Source: CFPB)

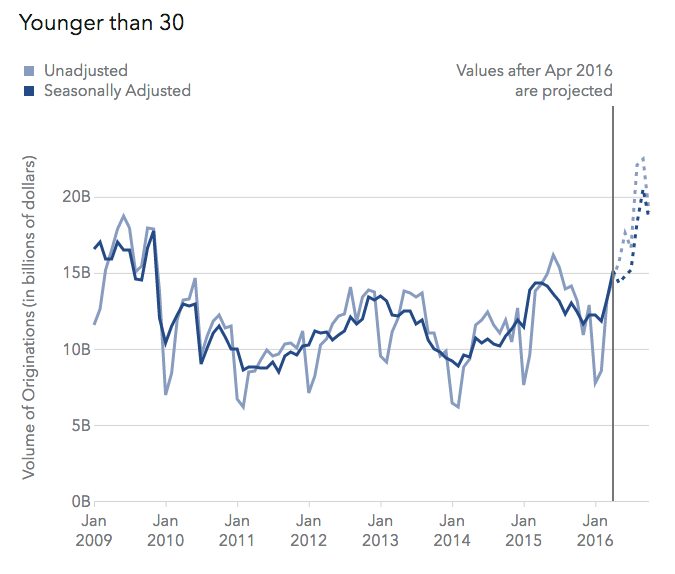

The charts go even deeper into credit scores, income levels and lending age group. For now, here are a couple of examples.

The chart below shows the number and aggregate dollar volume of new mortgage loans opened each month for a specific age group.

Click to enlarge

(Source: CFPB)

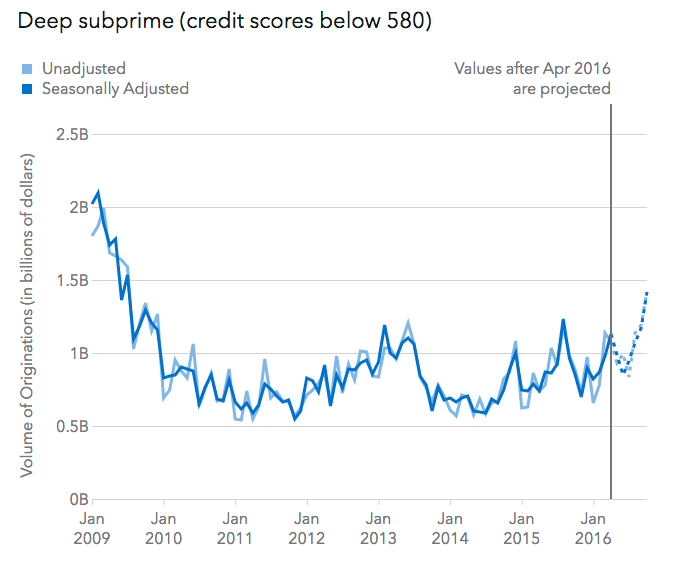

The chart below shows the number and aggregate dollar volume of new mortgage loans opened each month for a specific credit score group.

Click to enlarge

(Source: CFPB)

The bureau designed the tool to better track trends over time to help warn of potential problems lurking in a given market.

“Our Consumer Credit Trends tool can chart the state of consumer markets,” said CFPB Director Richard Cordray. “This critical information will help us identify and act on trends that warn of another crisis or that show credit is too constricted.”

From here, the CFPB plans to update the information regularly and offer analyses on notable findings as warranted.